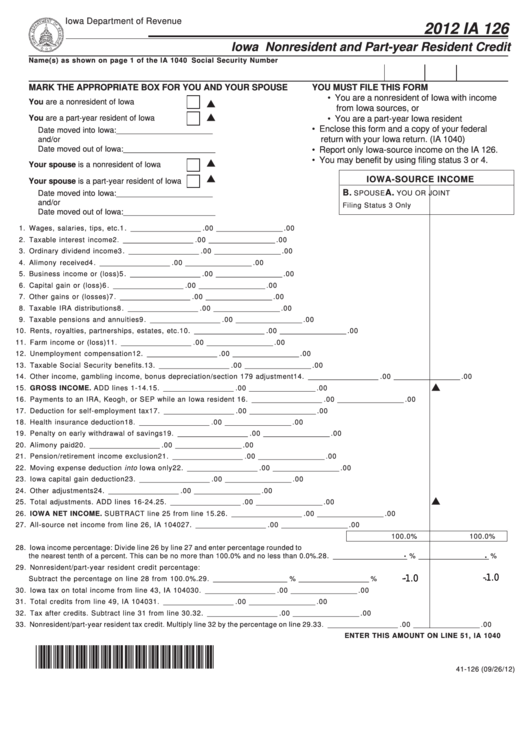

Iowa Department of Revenue

2012 IA 126

Iowa Nonresident and Part-year Resident Credit

Name(s) as shown on page 1 of the IA 1040

Social Security Number

YOU MUST FILE THIS FORM IF...

MARK THE APPROPRIATE BOX FOR YOU AND YOUR SPOUSE

• You are a nonresident of Iowa with income

You are a nonresident of Iowa

L

from Iowa sources, or

L

You are a part-year resident of Iowa

• You are a part-year Iowa resident

• Enclose this form and a copy of your federal

Date moved into Iowa: ______________________

return with your Iowa return. (IA 1040)

and/or

Date moved out of Iowa: _____________________

• Report only Iowa-source income on the IA 126.

• You may benefit by using filing status 3 or 4.

L

Your spouse is a nonresident of Iowa

L

IOWA-SOURCE INCOME

Your spouse is a part-year resident of Iowa

B.

A.

Date moved into Iowa: ______________________

SPOUSE

YOU OR JOINT

and/or

Filing Status 3 Only

Date moved out of Iowa: _____________________

1. Wages, salaries, tips, etc. ............................................................................................................... 1 . __________________ .00 _________________ .00

2. Taxable interest income .................................................................................................................... 2. __________________ .00 _________________ .00

3. Ordinary dividend income ................................................................................................................ 3 . __________________ .00 _________________ .00

4. Alimony received ............................................................................................................................... 4 . __________________ .00 _________________ .00

5. Business income or (loss) ............................................................................................................... 5 . __________________ .00 _________________ .00

6. Capital gain or (loss) ........................................................................................................................ 6 . __________________ .00 _________________ .00

7. Other gains or (losses) .................................................................................................................... 7 . __________________ .00 _________________ .00

8. Taxable IRA distributions ................................................................................................................ 8 . __________________ .00 _________________ .00

9. Taxable pensions and annuities .................................................................................................... 9 . __________________ .00 _________________ .00

10. Rents, royalties, partnerships, estates, etc. .............................................................................. 10. __________________ .00 _________________ .00

11. Farm income or (loss) ..................................................................................................................... 11. __________________ .00 _________________ .00

12. Unemployment compensation ....................................................................................................... 12. __________________ .00 _________________ .00

13. Taxable Social Security benefits. ................................................................................................. 13. __________________ .00 _________________ .00

14. Other income, gambling income, bonus depreciation/section 179 adjustment ................... 14. __________________ .00 _________________ .00

L

15. GROSS INCOME. ADD lines 1-14. .............................................................................................. 15. __________________ .00 _________________ .00

16. Payments to an IRA, Keogh, or SEP while an Iowa resident ................................................. 16. __________________ .00 _________________ .00

17. Deduction for self-employment tax ............................................................................................... 17. __________________ .00 _________________ .00

18. Health insurance deduction ........................................................................................................... 18. __________________ .00 _________________ .00

19. Penalty on early withdrawal of savings ....................................................................................... 19. __________________ .00 _________________ .00

20. Alimony paid ..................................................................................................................................... 20. __________________ .00 _________________ .00

21. Pension/retirement income exclusion .......................................................................................... 21. __________________ .00 _________________ .00

22. Moving expense deduction into Iowa only .................................................................................. 22. __________________ .00 _________________ .00

23. Iowa capital gain deduction ........................................................................................................... 23. __________________ .00 _________________ .00

24. Other adjustments ........................................................................................................................... 24. __________________ .00 _________________ .00

L

25. Total adjustments. ADD lines 16-24. ........................................................................................... 25. __________________ .00 _________________ .00

26. IOWA NET INCOME. SUBTRACT line 25 from line 15. ........................................................... 26. __________________ .00 _________________ .00

27. All-source net income from line 26, IA 1040 .............................................................................. 27. __________________ .00 _________________ .00

100.0%

100.0%

28. Iowa income percentage: Divide line 26 by line 27 and enter percentage rounded to

the nearest tenth of a percent. This can be no more than 100.0% and no less than 0.0%. ..... 28. ___________________ % __________________ %

.

.

29. Nonresident/part-year resident credit percentage:

-1.0

-1.0

Subtract the percentage on line 28 from 100.0%. .................................................................... 29. ___________________ % __________________ %

.

.

30. Iowa tax on total income from line 43, IA 1040 ......................................................................... 30. __________________ .00 _________________ .00

31. Total credits from line 49, IA 1040 ............................................................................................... 31. __________________ .00 _________________ .00

32. Tax after credits. Subtract line 31 from line 30. ........................................................................ 32. __________________ .00 _________________ .00

33. Nonresident/part-year resident tax credit. Multiply line 32 by the percentage on line 29. ........ 33. __________________ .00 _________________ .00

ENTER THIS AMOUNT ON LINE 51, IA 1040

*1241126019999*

41-126 (09/26/12)

1

1