Reset Form

Print Form

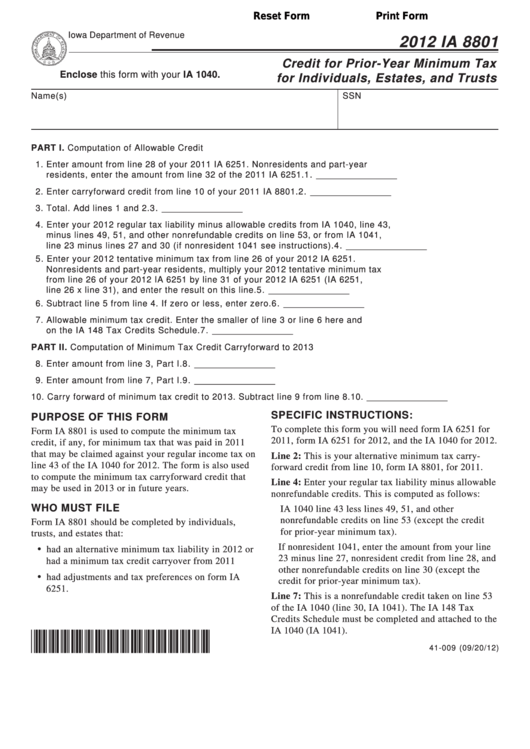

Iowa Department of Revenue

2012 IA 8801

Credit for Prior-Year Minimum Tax

Enclose this form with your IA 1040.

for Individuals, Estates, and Trusts

Name(s)

SSN

PART I. Computation of Allowable Credit

1. Enter amount from line 28 of your 2011 IA 6251. Nonresidents and part-year

residents, enter the amount from line 32 of the 2011 IA 6251. ................................. 1. _________________

2. Enter carryforward credit from line 10 of your 2011 IA 8801. .................................... 2. _________________

3. Total. Add lines 1 and 2. ................................................................................................. 3. _________________

4. Enter your 2012 regular tax liability minus allowable credits from IA 1040, line 43,

minus lines 49, 51, and other nonrefundable credits on line 53, or from IA 1041,

line 23 minus lines 27 and 30 (if nonresident 1041 see instructions). ..................... 4. _________________

5. Enter your 2012 tentative minimum tax from line 26 of your 2012 IA 6251.

Nonresidents and part-year residents, multiply your 2012 tentative minimum tax

from line 26 of your 2012 IA 6251 by line 31 of your 2012 IA 6251 (IA 6251,

line 26 x line 31), and enter the result on this line. ..................................................... 5. _________________

6. Subtract line 5 from line 4. If zero or less, enter zero. ............................................... 6. _________________

7. Allowable minimum tax credit. Enter the smaller of line 3 or line 6 here and

on the IA 148 Tax Credits Schedule. ............................................................................ 7. _________________

PART II. Computation of Minimum Tax Credit Carryforward to 2013

8. Enter amount from line 3, Part I. .................................................................................... 8. _________________

9. Enter amount from line 7, Part I. .................................................................................... 9. _________________

10. Carry forward of minimum tax credit to 2013. Subtract line 9 from line 8. .............. 10. _________________

SPECIFIC INSTRUCTIONS:

PURPOSE OF THIS FORM

To complete this form you will need form IA 6251 for

Form IA 8801 is used to compute the minimum tax

2011, form IA 6251 for 2012, and the IA 1040 for 2012.

credit, if any, for minimum tax that was paid in 2011

that may be claimed against your regular income tax on

Line 2: This is your alternative minimum tax carry-

line 43 of the IA 1040 for 2012. The form is also used

forward credit from line 10, form IA 8801, for 2011.

to compute the minimum tax carryforward credit that

Line 4: Enter your regular tax liability minus allowable

may be used in 2013 or in future years.

nonrefundable credits. This is computed as follows:

WHO MUST FILE

IA 1040 line 43 less lines 49, 51, and other

nonrefundable credits on line 53 (except the credit

Form IA 8801 should be completed by individuals,

for prior-year minimum tax).

trusts, and estates that:

If nonresident 1041, enter the amount from your line

•

had an alternative minimum tax liability in 2012 or

23 minus line 27, nonresident credit from line 28, and

had a minimum tax credit carryover from 2011

other nonrefundable credits on line 30 (except the

•

had adjustments and tax preferences on form IA

credit for prior-year minimum tax).

6251.

Line 7: This is a nonrefundable credit taken on line 53

of the IA 1040 (line 30, IA 1041). The IA 148 Tax

Credits Schedule must be completed and attached to the

IA 1040 (IA 1041).

*1241009019999*

41-009 (09/20/12)

1

1