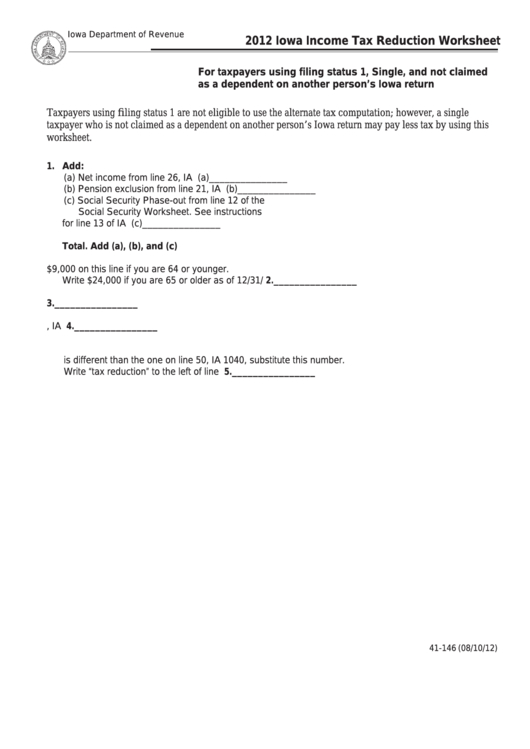

Form 41-146 - Iowa Income Tax Reduction Worksheet - 2012

ADVERTISEMENT

Iowa Department of Revenue

2012 Iowa Income Tax Reduction Worksheet

For taxpayers using filing status 1, Single, and not claimed

as a dependent on another person’s Iowa return

Taxpayers using filing status 1 are not eligible to use the alternate tax computation; however, a single

taxpayer who is not claimed as a dependent on another person’s Iowa return may pay less tax by using this

worksheet.

1. Add:

(a) Net income from line 26, IA 1040 .......................... (a) _______________

(b) Pension exclusion from line 21, IA 1040 ............... (b) _______________

(c) Social Security Phase-out from line 12 of the

Social Security Worksheet. See instructions

for line 13 of IA 1040. ........................................... (c) _______________

Total. Add (a), (b), and (c). .............................................................................1. ________________

2. Write $9,000 on this line if you are 64 or younger.

Write $24,000 if you are 65 or older as of 12/31/12 .........................................2. ________________

3. Subtract line 2 from line 1. ...............................................................................3. ________________

4. Enter the amount from line 50, IA 1040. ..........................................................4. ________________

5. Compare lines 3 and 4. Enter the smaller number here. If this number

is different than the one on line 50, IA 1040, substitute this number.

Write “tax reduction” to the left of line 50. ........................................................5. ________________

41-146 (08/10/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1