F

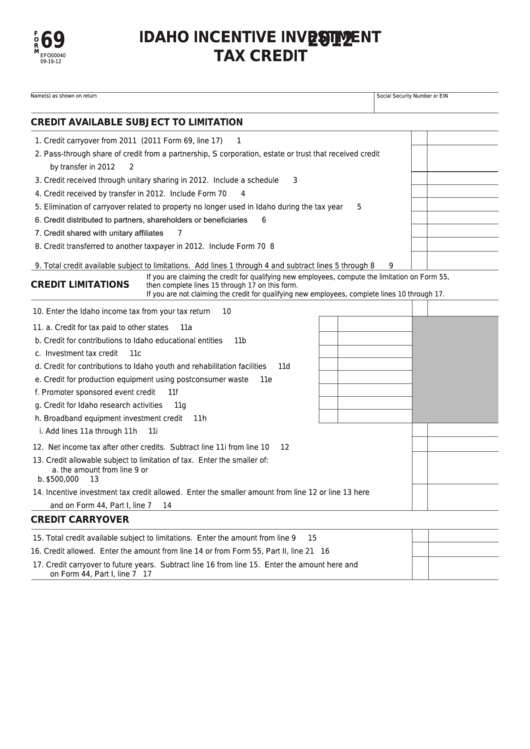

IDAHO INCENTIVE INVESTMENT

2012

69

O

R

M

TAX CREDIT

EFO00040

09-19-12

Name(s) as shown on return

Social Security Number or EIN

CREDIT AVAILABLE SUBJECT TO LIMITATION

1. Credit carryover from 2011 (2011 Form 69, line 17) ................................................................................

1

2. Pass-through share of credit from a partnership, S corporation, estate or trust that received credit

by transfer in 2012 ....................................................................................................................................

2

3. Credit received through unitary sharing in 2012. Include a schedule ......................................................

3

4. Credit received by transfer in 2012. Include Form 70 ..............................................................................

4

5. Elimination of carryover related to property no longer used in Idaho during the tax year ........................

5

6. Credit distributed to partners, shareholders or beneficiaries ....................................................................

6

7. Credit shared with unitary affiliates ...........................................................................................................

7

8. Credit transferred to another taxpayer in 2012. Include Form 70 ............................................................

8

9. Total credit available subject to limitations. Add lines 1 through 4 and subtract lines 5 through 8 ..........

9

If you are claiming the credit for qualifying new employees, compute the limitation on Form 55,

CREDIT LIMITATIONS

then complete lines 15 through 17 on this form.

If you are not claiming the credit for qualifying new employees, complete lines 10 through 17.

10. Enter the Idaho income tax from your tax return ......................................................................................

10

11.

a. Credit for tax paid to other states ...............................................................

11a

b. Credit for contributions to Idaho educational entities .................................

11b

c. Investment tax credit ..................................................................................

11c

d. Credit for contributions to Idaho youth and rehabilitation facilities .............

11d

e. Credit for production equipment using postconsumer waste .....................

11e

f. Promoter sponsored event credit ...............................................................

11f

g. Credit for Idaho research activities ............................................................

11g

h. Broadband equipment investment credit ...................................................

11h

i. Add lines 11a through 11h ....................................................................................................................

11i

12. Net income tax after other credits. Subtract line 11i from line 10 ..............................................................

12

13. Credit allowable subject to limitation of tax. Enter the smaller of:

a. the amount from line 9 or

b. $500,000...............................................................................................................................................

13

14. Incentive investment tax credit allowed. Enter the smaller amount from line 12 or line 13 here

and on Form 44, Part I, line 7 ....................................................................................................................

14

CREDIT CARRYOVER

15. Total credit available subject to limitations. Enter the amount from line 9 ...............................................

15

16. Credit allowed. Enter the amount from line 14 or from Form 55, Part II, line 21 .....................................

16

17. Credit carryover to future years. Subtract line 16 from line 15. Enter the amount here and

on Form 44, Part I, line 7 ..........................................................................................................................

17

1

1 2

2 3

3