Reset Form

Print Form

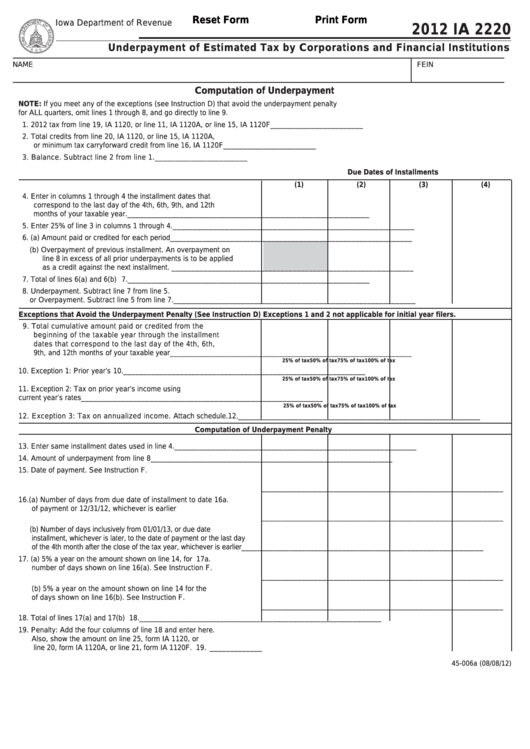

Iowa Department of Revenue

2012 IA 2220

Underpayment of Estimated Tax by Corporations and Financial Institutions

NAME

FEIN

Computation of Underpayment

NOTE: If you meet any of the exceptions (see Instruction D) that avoid the underpayment penalty

for ALL quarters, omit lines 1 through 8, and go directly to line 9.

1. 2012 tax from line 19, IA 1120, or line 11, IA 1120A, or line 15, IA 1120F ............................................................. 1. _______________________

2. Total credits from line 20, IA 1120, or line 15, IA 1120A,

or minimum tax carryforward credit from line 16, IA 1120F .................................................................................... 2. _______________________

3. Balance. Subtract line 2 from line 1. ........................................................................................................................ 3. _______________________

Due Dates of Installments

(1)

(2)

(3)

(4)

4. Enter in columns 1 through 4 the installment dates that

correspond to the last day of the 4th, 6th, 9th, and 12th

months of your taxable year. .......................................................... 4. ____________________________________________________________

5. Enter 25% of line 3 in columns 1 through 4. .................................... 5. ____________________________________________________________

6. (a) Amount paid or credited for each period ................................. 6a. ____________________________________________________________

(b) Overpayment of previous installment. An overpayment on

line 8 in excess of all prior underpayments is to be applied

as a credit against the next installment. .................................... 6b. ____________________________________________________________

7. Total of lines 6(a) and 6(b) .............................................................. 7. ____________________________________________________________

8. Underpayment. Subtract line 7 from line 5.

or Overpayment. Subtract line 5 from line 7. ................................... 8. ____________________________________________________________

Exceptions that Avoid the Underpayment Penalty (See Instruction D) Exceptions 1 and 2 not applicable for initial year filers.

9. Total cumulative amount paid or credited from the

beginning of the taxable year through the installment

dates that correspond to the last day of the 4th, 6th,

9th, and 12th months of your taxable year .................................... 9. ____________________________________________________________

25% of tax

50% of tax

75% of tax

100% of tax

10. Exception 1: Prior year’s tax ........................................................... 10. ____________________________________________________________

25% of tax

50% of tax

75% of tax

100% of tax

11. Exception 2: Tax on prior year’s income using

current year’s rates ................................................................................ 11. ____________________________________________________________

25% of tax

50% of tax

75% of tax

100% of tax

12. Exception 3: Tax on annualized income. Attach schedule. .......... 12. ____________________________________________________________

Computation of Underpayment Penalty

13. Enter same installment dates used in line 4. .................................. 13. ____________________________________________________________

14. Amount of underpayment from line 8 ............................................ 14. ____________________________________________________________

15. Date of payment. See Instruction F. ................................................ 15. ........................................................................................................................

........................................................................................................................

____________________________________________________________

16.(a) Number of days from due date of installment to date .............. 16a. ........................................................................................................................

of payment or 12/31/12, whichever is earlier

........................................................................................................................

____________________________________________________________

(b) Number of days inclusively from 01/01/13, or due date of .......... 16b. ........................................................................................................................

installment, whichever is later, to the date of payment or the last day

........................................................................................................................

of the 4th month after the close of the tax year, whichever is earlier

____________________________________________________________

17. (a) 5% a year on the amount shown on line 14, for the ................ 17a. ........................................................................................................................

number of days shown on line 16(a). See Instruction F.

........................................................................................................................

____________________________________________________________

(b) 5% a year on the amount shown on line 14 for the number ... 17b. ........................................................................................................................

of days shown on line 16(b). See Instruction F.

........................................................................................................................

____________________________________________________________

18. Total of lines 17(a) and 17(b) .......................................................... 18. ____________________________________________________________

19. Penalty: Add the four columns of line 18 and enter here.

Also, show the amount on line 25, form IA 1120, or

line 20, form IA 1120A, or line 21, form IA 1120F. ...................................................................................................................... 19. _____________

45-006a (08/08/12)

1

1 2

2