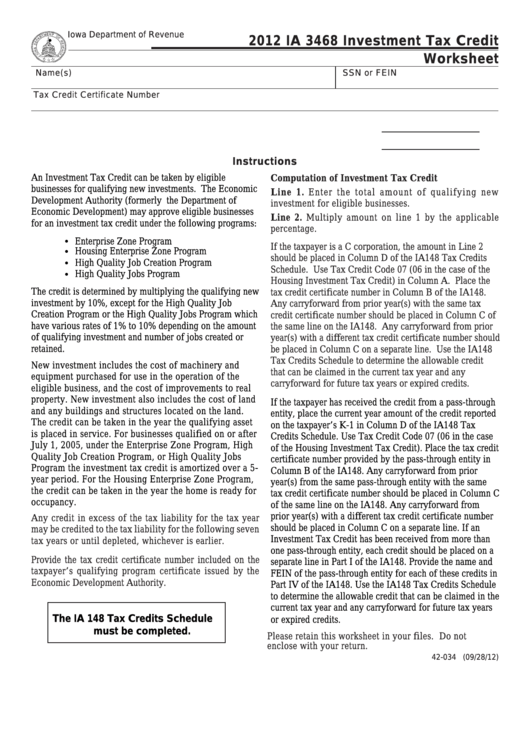

Form Ia 3468 - Investment Tax Credit Worksheet - 2012

ADVERTISEMENT

Iowa Department of Revenue

·

2012 IA 3468 Investment Tax Credit

Worksheet

Name(s)

SSN or FEIN

Tax Credit Certificate Number

1. Qualifying new investment for eligible businesses...............................1.

2. Calculated credit. Multiply line 1 by the applicable percentage.............2.

Instructions

An Investment Tax Credit can be taken by eligible

Computation of Investment Tax Credit

businesses for qualifying new investments. The Economic

Line 1. Enter the total amount of qualifying new

Development Authority (formerly the Department of

investment for eligible businesses.

Economic Development) may approve eligible businesses

Line 2. Multiply amount on line 1 by the applicable

for an investment tax credit under the following programs:

percentage.

· ·

Enterprise Zone Program

If the taxpayer is a C corporation, the amount in Line 2

Housing Enterprise Zone Program

should be placed in Column D of the IA148 Tax Credits

·

High Quality Job Creation Program

Schedule. Use Tax Credit Code 07 (06 in the case of the

·

High Quality Jobs Program

Housing Investment Tax Credit) in Column A. Place the

The credit is determined by multiplying the qualifying new

tax credit certificate number in Column B of the IA148.

investment by 10%, except for the High Quality Job

Any carryforward from prior year(s) with the same tax

Creation Program or the High Quality Jobs Program which

credit certificate number should be placed in Column C of

have various rates of 1% to 10% depending on the amount

the same line on the IA148. Any carryforward from prior

of qualifying investment and number of jobs created or

year(s) with a different tax credit certificate number should

retained.

be placed in Column C on a separate line. Use the IA148

Tax Credits Schedule to determine the allowable credit

New investment includes the cost of machinery and

that can be claimed in the current tax year and any

equipment purchased for use in the operation of the

carryforward for future tax years or expired credits.

eligible business, and the cost of improvements to real

property. New investment also includes the cost of land

If the taxpayer has received the credit from a pass-through

and any buildings and structures located on the land.

entity, place the current year amount of the credit reported

The credit can be taken in the year the qualifying asset

on the taxpayer’s K-1 in Column D of the IA148 Tax

is placed in service. For businesses qualified on or after

Credits Schedule. Use Tax Credit Code 07 (06 in the case

July 1, 2005, under the Enterprise Zone Program, High

of the Housing Investment Tax Credit). Place the tax credit

Quality Job Creation Program, or High Quality Jobs

certificate number provided by the pass-through entity in

Program the investment tax credit is amortized over a 5-

Column B of the IA148. Any carryforward from prior

year period. For the Housing Enterprise Zone Program,

year(s) from the same pass-through entity with the same

the credit can be taken in the year the home is ready for

tax credit certificate number should be placed in Column C

occupancy.

of the same line on the IA148. Any carryforward from

prior year(s) with a different tax credit certificate number

Any credit in excess of the tax liability for the tax year

should be placed in Column C on a separate line. If an

may be credited to the tax liability for the following seven

Investment Tax Credit has been received from more than

tax years or until depleted, whichever is earlier.

one pass-through entity, each credit should be placed on a

Provide the tax credit certificate number included on the

separate line in Part I of the IA148. Provide the name and

taxpayer’s qualifying program certificate issued by the

FEIN of the pass-through entity for each of these credits in

Economic Development Authority.

Part IV of the IA148. Use the IA148 Tax Credits Schedule

to determine the allowable credit that can be claimed in the

current tax year and any carryforward for future tax years

The IA 148 Tax Credits Schedule

or expired credits.

must be completed.

Please retain this worksheet in your files. Do not

enclose with your return.

42-034 (09/28/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1