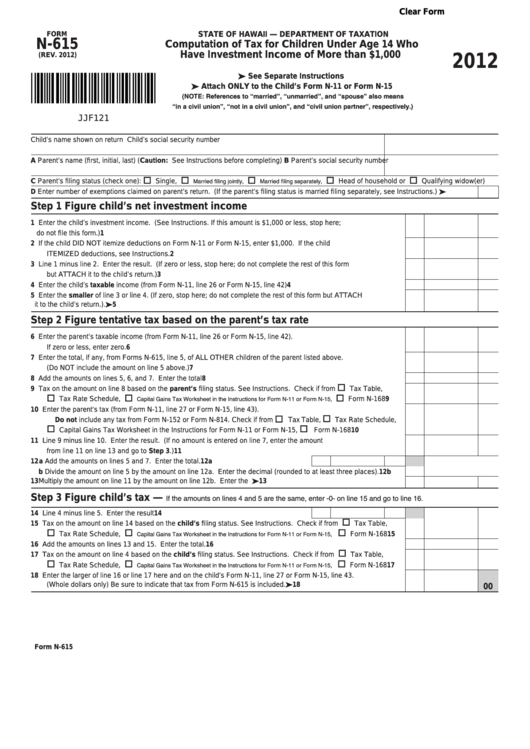

Clear Form

FORM

STATE OF HAWAII — DEPARTMENT OF TAXATION

N-615

Computation of Tax for Children Under Age 14 Who

Have Investment Income of More than $1,000

(REV. 2012)

2012

See Separate Instructions

Attach ONLY to the Child’s Form N-11 or Form N-15

(NOTE: References to “married”, “unmarried”, and “spouse” also means

“in a civil union”, “not in a civil union”, and “civil union partner”, respectively.)

JJF121

Child’s name shown on return

Child’s social security number

A Parent’s name (first, initial, last) (Caution: See Instructions before completing)

B Parent’s social security number

Married filing jointly,

Married filing separately,

C Parent’s filing status (check one):

Single,

Head of household or

Qualifying widow(er)

D Enter number of exemptions claimed on parent’s return. (If the parent’s filing status is married filing separately, see Instructions.)

Step 1

Figure child’s net investment income

1

Enter the child’s investment income. (See Instructions. If this amount is $1,000 or less, stop here;

do not file this form.) .....................................................................................................................................................

1

2

If the child DID NOT itemize deductions on Form N-11 or Form N-15, enter $1,000. If the child

ITEMIZED deductions, see Instructions. .......................................................................................................................

2

3

Line 1 minus line 2. Enter the result. (If zero or less, stop here; do not complete the rest of this form

but ATTACH it to the child’s return.) ...............................................................................................................................

3

4

Enter the child’s taxable income (from Form N-11, line 26 or Form N-15, line 42) .......................................................

4

5

Enter the smaller of line 3 or line 4. (If zero, stop here; do not complete the rest of this form but ATTACH

it to the child’s return.). ..............................................................................................................................................

5

Step 2

Figure tentative tax based on the parent’s tax rate

6

Enter the parent’s taxable income (from Form N-11, line 26 or Form N-15, line 42).

If zero or less, enter zero. ..............................................................................................................................................

6

7

Enter the total, if any, from Forms N-615, line 5, of ALL OTHER children of the parent listed above.

(Do NOT include the amount on line 5 above.) .............................................................................................................

7

8

Add the amounts on lines 5, 6, and 7. Enter the total ...................................................................................................

8

9

Tax on the amount on line 8 based on the parent’s filing status. See Instructions. Check if from

Tax Table,

Capital Gains Tax Worksheet in the Instructions for Form N-11 or Form N-15,

Tax Rate Schedule,

Form N-168 .........

9

10

Enter the parent’s tax (from Form N-11, line 27 or Form N-15, line 43).

Do not include any tax from Form N-152 or Form N-814. Check if from

Tax Table,

Tax Rate Schedule,

Capital Gains Tax Worksheet in the Instructions for Form N-11 or Form N-15,

Form N-168 ..........................

10

11

Line 9 minus line 10. Enter the result. (If no amount is entered on line 7, enter the amount

from line 11 on line 13 and go to Step 3.) .....................................................................................................................

11

12 a Add the amounts on lines 5 and 7. Enter the total. .......................................................

12a

b Divide the amount on line 5 by the amount on line 12a. Enter the decimal (rounded to at least three places). ...........

12b

Multiply the amount on line 11 by the amount on line 12b. Enter the result..............................................................

13

13

If the amounts on lines 4 and 5 are the same, enter -0- on line 15 and go to line 16.

Step 3

Figure child’s tax —

14

Line 4 minus line 5. Enter the result .............................................................................

14

15

Tax on the amount on line 14 based on the child’s filing status. See Instructions. Check if from

Tax Table,

Capital Gains Tax Worksheet in the Instructions for Form N-11 or Form N-15,

Tax Rate Schedule,

Form N-168 ........

15

16

Add the amounts on lines 13 and 15. Enter the total. ...................................................................................................

16

17

Tax on the amount on line 4 based on the child’s filing status. See Instructions. Check if from

Tax Table,

Capital Gains Tax Worksheet in the Instructions for Form N-11 or Form N-15,

Tax Rate Schedule,

Form N-168 ......

17

18

Enter the larger of line 16 or line 17 here and on the child’s Form N-11, line 27 or Form N-15, line 43.

00

(Whole dollars only) Be sure to indicate that tax from Form N-615 is included. ........................................................

18

Form N-615

1

1