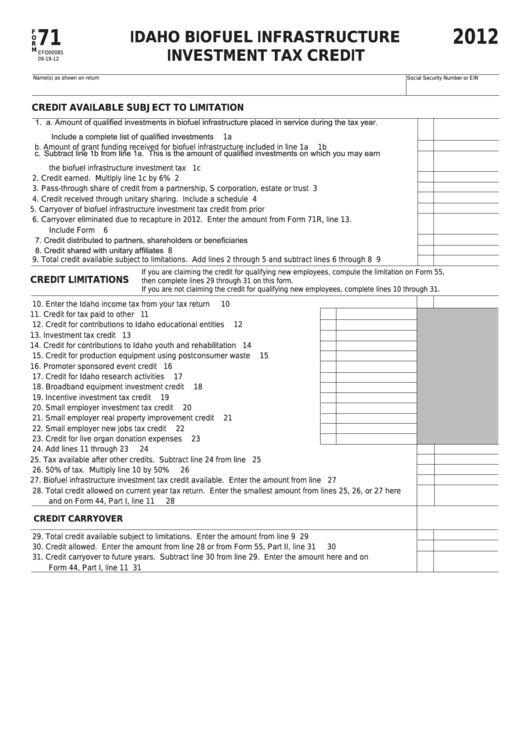

2012

F

71

IDAHO BIOFUEL INFRASTRUCTURE

O

R

M

INVESTMENT TAX CREDIT

EFO00085

09-19-12

Name(s) as shown on return

Social Security Number or EIN

CREDIT AVAILABLE SUBJECT TO LIMITATION

1. a . Amount of qualified investments in biofuel infrastructure placed in service during the tax year.

I nclude a complete list of qualified investments .............................................................................................

1a

b. Amount of grant funding received for biofuel infrastructure included in line 1a .........................................

1b

c. Subtract line 1b from line 1a. This is the amount of qualified investments on which you may earn

the biofuel infrastructure investment tax credit...............................................................................................

1c

2. Credit earned. Multiply line 1c by 6% ............................................................................................................

2

3. Pass-through share of credit from a partnership, S corporation, estate or trust ............................................

3

4. Credit received through unitary sharing. Include a schedule ........................................................................

4

5. Carryover of biofuel infrastructure investment tax credit from prior years......................................................

5

6. Carryover eliminated due to recapture in 2012. Enter the amount from Form 71R, line 13.

Include Form 71R...........................................................................................................................................

6

7. Credit distributed to partners, shareholders or beneficiaries..........................................................................

7

8. Credit shared with unitary affiliates ................................................................................................................

8

9. Total credit available subject to limitations. Add lines 2 through 5 and subtract lines 6 through 8 ................

9

If you are claiming the credit for qualifying new employees, compute the limitation on Form 55,

CREDIT LIMITATIONS

then complete lines 29 through 31 on this form.

If you are not claiming the credit for qualifying new employees, complete lines 10 through 31.

10. Enter the Idaho income tax from your tax return ............................................................................................

10

11. Credit for tax paid to other states......................................................................

11

12. Credit for contributions to Idaho educational entities ........................................

12

13. Investment tax credit ........................................................................................

13

14. Credit for contributions to Idaho youth and rehabilitation facilities....................

14

15. Credit for production equipment using postconsumer waste ............................

15

16. Promoter sponsored event credit .....................................................................

16

17. Credit for Idaho research activities ...................................................................

17

18. Broadband equipment investment credit ..........................................................

18

19. Incentive investment tax credit .........................................................................

19

20. Small employer investment tax credit ...............................................................

20

21. Small employer real property improvement credit ............................................

21

22. Small employer new jobs tax credit ..................................................................

22

23. Credit for live organ donation expenses ...........................................................

23

24. Add lines 11 through 23 .................................................................................................................................

24

25. Tax available after other credits. Subtract line 24 from line 10......................................................................

25

26. 50% of tax. Multiply line 10 by 50% ..............................................................................................................

26

27. Biofuel infrastructure investment tax credit available. Enter the amount from line 9.....................................

27

28. Total credit allowed on current year tax return. Enter the smallest amount from lines 25, 26, or 27 here

and on Form 44, Part I, line 11 .......................................................................................................................

28

CREDIT CARRYOVER

29. Total credit available subject to limitations. Enter the amount from line 9 .....................................................

29

30. Credit allowed. Enter the amount from line 28 or from Form 55, Part II, line 31 ...........................................

30

31. Credit carryover to future years. Subtract line 30 from line 29. Enter the amount here and on

Form 44, Part I, line 11 ...................................................................................................................................

31

1

1 2

2 3

3