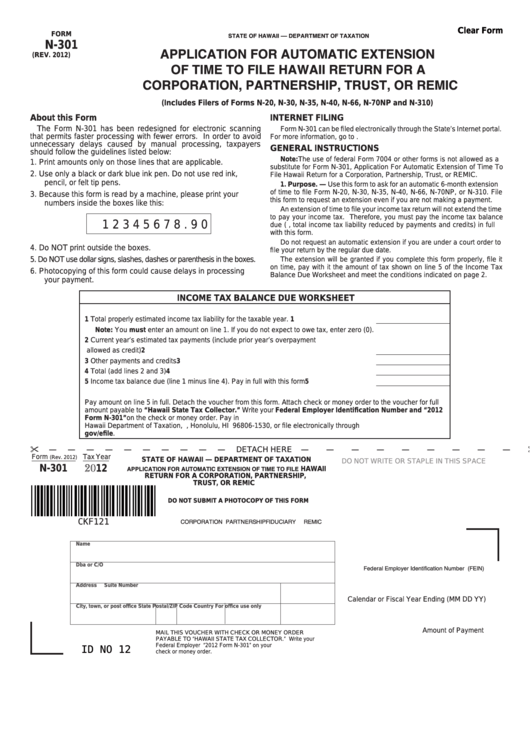

Clear Form

FORM

STATE OF HAWAII –– DEPARTMENT OF TAXATION

N-301

APPLICATION FOR AUTOMATIC EXTENSION

(REV. 2012)

OF TIME TO FILE HAWAII RETURN FOR A

CORPORATION, PARTNERSHIP, TRUST, OR REMIC

(Includes Filers of Forms N-20, N-30, N-35, N-40, N-66, N-70NP and N-310)

About this Form

INTERNET FILING

The Form N-301 has been redesigned for electronic scanning

Form N-301 can be filed electronically through the State’s Internet portal.

that permits faster processing with fewer errors. In order to avoid

For more information, go to

unnecessary delays caused by manual processing, taxpayers

GENERAL INSTRUCTIONS

should follow the guidelines listed below:

Note: The use of federal Form 7004 or other forms is not allowed as a

1. Print amounts only on those lines that are applicable.

substitute for Form N-301, Application For Automatic Extension of Time To

2. Use only a black or dark blue ink pen. Do not use red ink,

File Hawaii Return for a Corporation, Partnership, Trust, or REMIC.

pencil, or felt tip pens.

1. Purpose. — Use this form to ask for an automatic 6-month extension

of time to file Form N-20, N-30, N-35, N-40, N-66, N-70NP, or N-310. File

3. Because this form is read by a machine, please print your

this form to request an extension even if you are not making a payment.

numbers inside the boxes like this:

An extension of time to file your income tax return will not extend the time

to pay your income tax. Therefore, you must pay the income tax balance

1 2 3 4 5 6 7 8 . 9 0

due (i.e., total income tax liability reduced by payments and credits) in full

with this form.

Do not request an automatic extension if you are under a court order to

4. Do NOT print outside the boxes.

file your return by the regular due date.

5. Do NOT use dollar signs, slashes, dashes or parenthesis in the boxes.

The extension will be granted if you complete this form properly, file it

on time, pay with it the amount of tax shown on line 5 of the Income Tax

6. Photocopying of this form could cause delays in processing

Balance Due Worksheet and meet the conditions indicated on page 2.

your payment.

INCOME TAX BALANCE DUE WORKSHEET

1 Total properly estimated income tax liability for the taxable year. .........................................1

Note: You must enter an amount on line 1. If you do not expect to owe tax, enter zero (0).

2 Current year’s estimated tax payments (include prior year’s overpayment

allowed as credit) ...................................................................................................................2

3 Other payments and credits ..................................................................................................3

4 Total (add lines 2 and 3) ........................................................................................................4

5 Income tax balance due (line 1 minus line 4). Pay in full with this form .................................5

Pay amount on line 5 in full. Detach the voucher from this form. Attach check or money order to the voucher for full

amount payable to “Hawaii State Tax Collector.” Write your Federal Employer Identification Number and “2012

Form N-301” on the check or money order. Pay in U.S. dollars drawn on U.S. bank. Do not send cash. File with the

Hawaii Department of Taxation, P.O. Box 1530, Honolulu, HI 96806-1530, or file electronically through

gov/efile.

DETACH HERE

Form

Tax Year

(Rev. 2012)

STATE OF HAWAII — DEPARTMENT OF TAXATION

DO NOT WRITE OR STAPLE IN THIS SPACE

N-301

2012

APPLICATION FOR AUTOMATIC EXTENSION OF TIME TO FILE HAWAII

RETURN FOR A CORPORATION, PARTNERSHIP,

TRUST, OR REMIC

DO NOT SUBMIT A PHOTOCOPY OF THIS FORM

CKF121

CORPORATION

PARTNERSHIP

FIDUCIARY

REMIC

Name

Dba or C/O

Federal Employer Identification Number (FEIN)

Address

Suite Number

Calendar or Fiscal Year Ending (MM DD YY)

City, town, or post office

State

Postal/ZIP Code

Country

For office use only

Amount of Payment

MAIL THIS VOUCHER WITH CHECK OR MONEY ORDER

PAYABLE TO “HAWAII STATE TAX COLLECTOR.” Write your

Federal Employer I.D. Number and “2012 Form N-301” on your

ID NO 12

check or money order.

1

1 2

2