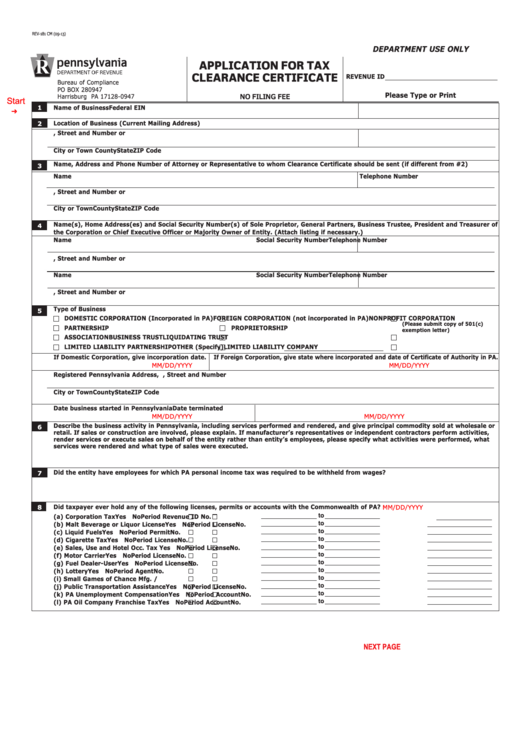

REV-181 CM (09-13)

DEPARTMENT USE ONLY

APPLICATION FOR TAX

CLEARANCE CERTIFICATE

REVENUE ID

Bureau of Compliance

PO BOX 280947

NO FILING FEE

Please Type or Print

Harrisburg PA 17128-0947

Start

Name of Business

Federal EIN

1

Location of Business (Current Mailing Address)

2

P.O. Box, Street and Number or R.D. Number and Box Number

Telephone Number

City or Town

County

State

ZIP Code

Name, Address and Phone Number of Attorney or Representative to whom Clearance Certificate should be sent (if different from #2)

3

Name

Telephone Number

P.O. Box, Street and Number or R.D. Number and Box Number

City or Town

County

State

ZIP Code

Name ( s), Home Address(es) and Social Security Number(s) of Sole Proprietor, General Partners, Business Trustee, President and Treasurer of

4

the Corporation or Chief Executive Officer or Majority Owner of Entity. (Attach listing if necessary.)

Name

Social Security Number

Telephone Number

P.O. Box, Street and Number or R.D. Number and Box Number

City

State

ZIP Code

Name

Social Security Number

Telephone Number

P.O. Box, Street and Number or R.D. Number and Box Number

City

State

ZIP Code

Type of Business

5

DOMESTIC CORPORATION (Incorporated in PA)

FOREIGN CORPORATION (not incorporated in PA)

NONPROFIT CORPORATION

(Please submit copy of 501(c)

PARTNERSHIP

PROPRIETORSHIP

exemption letter)

ASSOCIATION

BUSINESS TRUST

LIQUIDATING TRUST

LIMITED LIABILITY PARTNERSHIP

OTHER (Specify)

LIMITED LIABILITY COMPANY

If Domestic Corporation, give incorporation date.

If Foreign Corporation, give state where incorporated and date of Certificate of Authority in PA.

MM/DD/YYYY

MM/DD/YYYY

Registered Pennsylvania Address, P.O. Box, Street and Number

City or Town

County

State

ZIP Code

Date business started in Pennsylvania

Date terminated

MM/DD/YYYY

MM/DD/YYYY

Describe the business activity in Pennsylvania, including services performed and rendered, and give principal commodity sold at wholesale or

6

retail. If sales or construction are involved, please explain. If manufacturer’s representatives or independent contractors perform activities,

render services or execute sales on behalf of the entity rather than entity’s employees, please specify what activities were performed, what

services were rendered and what type of sales were executed.

Did the entity have employees for which PA personal income tax was required to be withheld from wages?

7

MM/DD/YYYY

Did taxpayer ever hold any of the following licenses, permits or accounts with the Commonwealth of PA?

8

to

(a) Corporation Tax

Yes

No

Period

Revenue ID No.

to

(b) Malt Beverage or Liquor License

Yes

No

Period

License No.

to

(c)

Liquid Fuels

Yes

No

Period

Permit No.

to

(d) Cigarette Tax

Yes

No

Period

License No.

to

(e) Sales, Use and Hotel Occ. Tax

Yes

No

Period

License No.

to

(f)

Motor Carrier

Yes

No

Period

License No.

to

(g) Fuel Dealer-User

Yes

No

Period

License No.

to

(h) Lottery

Yes

No

Period

Agent

No.

to

(i)

Small Games of Chance Mfg. / Distr.

Yes

No

Period

License No.

to

(j)

Public Transportation Assistance

Yes

No

Period

License No.

to

(k) PA Unemployment Compensation

Yes

No

Period

Account No.

to

(l)

PA Oil Company Franchise Tax

Yes

No

Period

Account No.

PRINT FORM

NEXT PAGE

Reset Entire Form

1

1 2

2 3

3 4

4