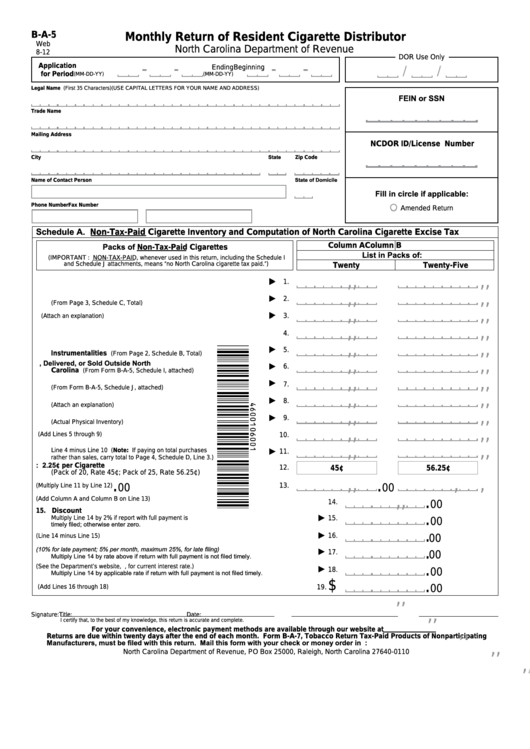

B-A-5

Monthly Return of Resident Cigarette Distributor

Web

North Carolina Department of Revenue

8-12

DOR Use Only

Application

Beginning

Ending

for Period

(mm-DD-YY)

(mm-DD-YY)

Legal Name (First 35 Characters) (USE CAPITAL LETTERS FoR YoUR nAmE AnD ADDRESS)

FEIN or SSN

Trade Name

Mailing Address

NCDOR ID/License Number

State

City

Zip Code

State of Domicile

Name of Contact Person

Fill in circle if applicable:

Phone Number

Fax Number

Amended Return

Schedule A. Non-Tax-Paid Cigarette Inventory and Computation of North Carolina Cigarette Excise Tax

Packs of Non-Tax-Paid Cigarettes

Column A

Column B

List in Packs of:

(ImPoRTAnT : non-TAx-PAID, whenever used in this return, including the Schedule I

and Schedule J attachments, means “no north Carolina cigarette tax paid.”)

Twenty

Twenty-Five

,

,

,

,

1. Non-Tax-Paid Packs Beginning Inventory

1.

,

,

,

,

2. Purchased and Received From Manufacturer

2.

(From Page 3, Schedule C, Total)

,

,

,

,

3. Other Increases in Inventory

3.

(Attach an explanation)

,

,

,

,

4. Add Lines 1 through 3

4.

5. Sold to Federal Government and Its

,

,

,

,

5.

Instrumentalities

(From Page 2, Schedule B, Total)

6. Shipped, Delivered, or Sold Outside North

,

,

,

,

6.

Carolina

(From Form B-A-5, Schedule I, attached)

7. Non-Tax-Paid Packs Returned to Manufacturer

,

,

,

,

7.

(From Form B-A-5, Schedule J, attached)

,

,

,

,

8. Other Decreases in Inventory

8.

(Attach an explanation)

,

,

,

,

9. Non-Tax-Paid Packs Ending Inventory

9.

(Actual Physical Inventory)

,

,

,

,

10. Total Deductions

(Add Lines 5 through 9)

10.

11. Total Packs Subject to North Carolina Tax

,

,

,

,

Line 4 minus Line 10 (Note: If paying on total purchases

11.

rather than sales, carry total to Page 4, Schedule D, Line 3.)

12. Tax Rate: 2.25¢ per Cigarette

12.

45¢

56.25¢

(Pack of 20, Rate 45¢; Pack of 25, Rate 56.25¢)

,

,

,

,

.

.

13. Total Excise Tax Due

13.

(Multiply Line 11 by Line 12)

00

00

,

,

.

14. Total Tax

(Add Column A and Column B on Line 13)

14.

00

15. Discount

,

,

.

Multiply Line 14 by 2% if report with full payment is

15.

00

timely filed; otherwise enter zero.

,

,

.

16. Net Excise Tax Due

16.

(Line 14 minus Line 15)

00

,

,

.

(10% for late payment; 5% per month, maximum 25%, for late filing)

17. Penalty

17.

00

Multiply Line 14 by rate above if return with full payment is not filed timely.

,

,

.

18. Interest

(See the Department’s website, , for current interest rate.)

18.

00

Multiply Line 14 by applicable rate if return with full payment is not filed timely.

,

,

.

$

19. Total Payment Due

19.

(Add Lines 16 through 18)

00

Signature:

Title:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

For your convenience, electronic payment methods are available through our website at .

Returns are due within twenty days after the end of each month. Form B-A-7, Tobacco Return Tax-Paid Products of Nonparticipating

Manufacturers, must be filed with this return. Mail this form with your check or money order in U.S. currency from a domestic bank to:

North Carolina Department of Revenue, PO Box 25000, Raleigh, North Carolina 27640-0110

1

1 2

2 3

3 4

4