Annual Reconciliation Of Payroll License Fees Withheld - Campbell County & Cities - 2011

ADVERTISEMENT

CC-AR REV 1111

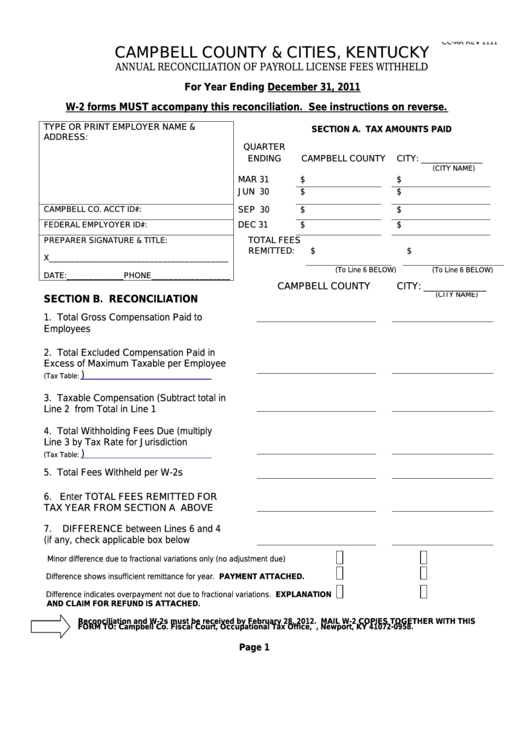

CAMPBELL COUNTY & CITIES, KENTUCKY

ANNUAL RECONCILIATION OF PAYROLL LICENSE FEES WITHHELD

For Year Ending December 31, 2011

W-2 forms MUST accompany this reconciliation. See instructions on reverse.

TYPE OR PRINT EMPLOYER NAME &

SECTION A. TAX AMOUNTS PAID

ADDRESS:

QUARTER

ENDING

CAMPBELL COUNTY

CITY: _____________

(CITY NAME)

MAR 31

$

$

JUN 30

$

$

CAMPBELL CO. ACCT ID#:

SEP 30

$

$

FEDERAL EMPLYOYER ID#:

DEC 31

$

$

PREPARER SIGNATURE & TITLE:

TOTAL FEES

REMITTED:

$

$

X_________________________________________

(To Line 6 BELOW)

(To Line 6 BELOW)

DATE:_____________PHONE__________________

CAMPBELL COUNTY

CITY: ____________

(CITY NAME)

SECTION B. RECONCILIATION

1. Total Gross Compensation Paid to

Employees

2. Total Excluded Compensation Paid in

Excess of Maximum Taxable per Employee

)

(Tax Table:

3. Taxable Compensation (Subtract total in

Line 2 from Total in Line 1

4. Total Withholding Fees Due (multiply

Line 3 by Tax Rate for Jurisdiction

)

(Tax Table:

5. Total Fees Withheld per W-2s

6. Enter TOTAL FEES REMITTED FOR

TAX YEAR FROM SECTION A ABOVE

7.

DIFFERENCE between Lines 6 and 4

(if any, check applicable box below

Minor difference due to fractional variations only (no adjustment due)

Difference shows insufficient remittance for year. PAYMENT ATTACHED.

Difference indicates overpayment not due to fractional variations. EXPLANATION

AND CLAIM FOR REFUND IS ATTACHED.

Reconciliation and W-2s must be received by February 28, 2012. MAIL W-2 COPIES TOGETHER WITH THIS

FORM TO: Campbell Co. Fiscal Court, Occupational Tax Office, P.O. Box 72958, Newport, KY 41072-0958.

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2