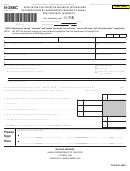

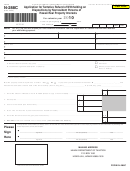

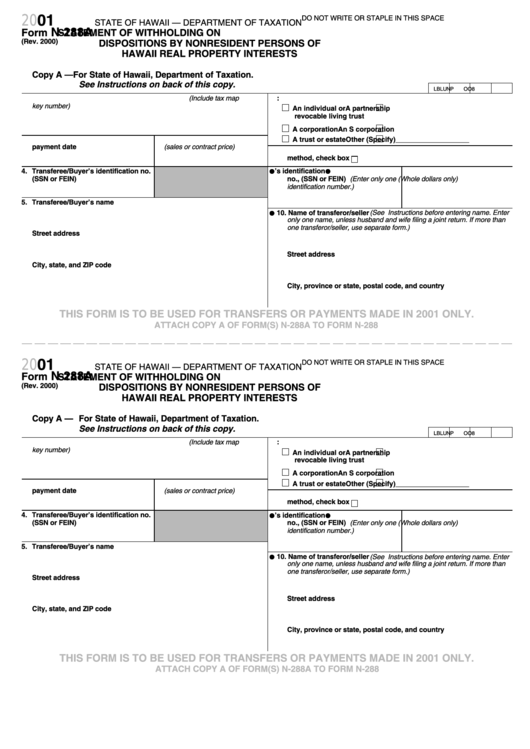

Form N-288a - Statement Of Withholding On Dispositions By Nonresident Persons Of Hawaii Real Property Interests - 2001

ADVERTISEMENT

2001

DO NOT WRITE OR STAPLE IN THIS SPACE

STATE OF HAWAII — DEPARTMENT OF TAXATION

N-288A

Form

STATEMENT OF WITHHOLDING ON

(Rev. 2000)

DISPOSITIONS BY NONRESIDENT PERSONS OF

HAWAII REAL PROPERTY INTERESTS

Copy A — For State of Hawaii, Department of Taxation.

See Instructions on back of this copy.

LBL

UNP

OO8

1. Description and location of property transferred (Include tax map

6. Transferor/Seller is:

key number)

An individual or

A partnership

revocable living trust

A corporation

An S corporation

2. Date of transfer or installment

3. Amount realized

A trust or estate

Other (Specify) ___________________

payment date

(sales or contract price)

7. If the transferor/seller is reporting the gain under the installment

method, check box

•

•

4. Transferee/Buyer’s identification no.

8. Transferor/Seller’s identification

9. Hawaii income tax withheld

(SSN or FEIN)

no., (SSN or FEIN) (Enter only one

(Whole dollars only)

identification number.)

5. Transferee/Buyer’s name

•

10. Name of transferor/seller (See Instructions before entering name. Enter

only one name, unless husband and wife filing a joint return. If more than

one transferor/seller, use separate form.)

Street address

Street address

City, state, and ZIP code

City, province or state, postal code, and country

THIS FORM IS TO BE USED FOR TRANSFERS OR PAYMENTS MADE IN 2001 ONLY.

ATTACH COPY A OF FORM(S) N-288A TO FORM N-288

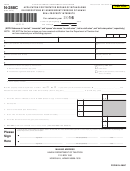

2001

DO NOT WRITE OR STAPLE IN THIS SPACE

STATE OF HAWAII — DEPARTMENT OF TAXATION

N-288A

Form

STATEMENT OF WITHHOLDING ON

(Rev. 2000)

DISPOSITIONS BY NONRESIDENT PERSONS OF

HAWAII REAL PROPERTY INTERESTS

Copy A — For State of Hawaii, Department of Taxation.

See Instructions on back of this copy.

LBL

UNP

OO8

1. Description and location of property transferred (Include tax map

6. Transferor/Seller is:

key number)

An individual or

A partnership

revocable living trust

A corporation

An S corporation

2. Date of transfer or installment

3. Amount realized

A trust or estate

Other (Specify) ___________________

payment date

(sales or contract price)

7. If the transferor/seller is reporting the gain under the installment

method, check box

•

•

4. Transferee/Buyer’s identification no.

8. Transferor/Seller’s identification

9. Hawaii income tax withheld

(SSN or FEIN)

no., (SSN or FEIN) (Enter only one

(Whole dollars only)

identification number.)

5. Transferee/Buyer’s name

•

10. Name of transferor/seller (See Instructions before entering name. Enter

only one name, unless husband and wife filing a joint return. If more than

one transferor/seller, use separate form.)

Street address

Street address

City, state, and ZIP code

City, province or state, postal code, and country

THIS FORM IS TO BE USED FOR TRANSFERS OR PAYMENTS MADE IN 2001 ONLY.

ATTACH COPY A OF FORM(S) N-288A TO FORM N-288

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3