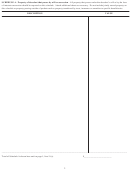

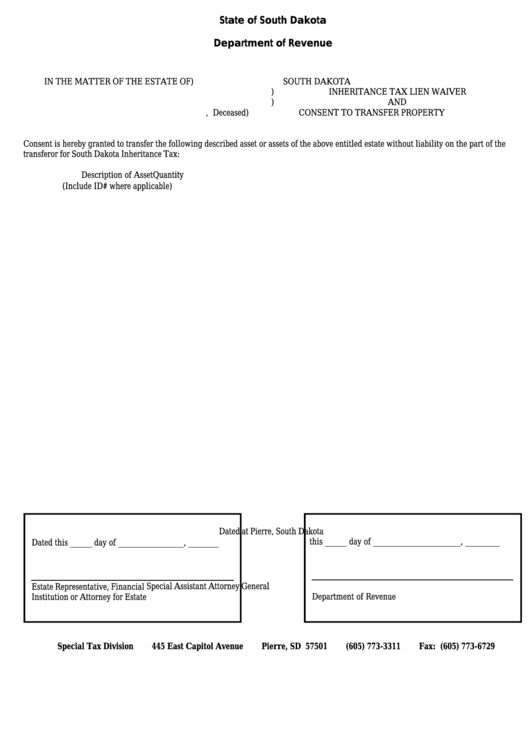

South Dakota Inheritance Tax Lien Waiver And Consent To Transfer Property

ADVERTISEMENT

State of South Dakota

Department of Revenue

IN THE MATTER OF THE ESTATE OF

)

SOUTH DAKOTA

)

INHERITANCE TAX LIEN WAIVER

)

AND

, Deceased

)

CONSENT TO TRANSFER PROPERTY

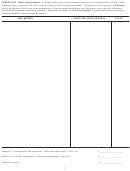

Consent is hereby granted to transfer the following described asset or assets of the above entitled estate without liability on the part of the

transferor for South Dakota Inheritance Tax:

Description of Asset

Quantity

(Include ID# where applicable)

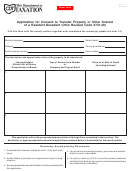

Dated at Pierre, South Dakota

this _____ day of ____________________, ________

Dated this _____ day of _______________, _______

Special Assistant Attorney General

Estate Representative, Financial

Department of Revenue

Institution or Attorney for Estate

Special Tax Division

445 East Capitol Avenue

Pierre, SD 57501

(605) 773-3311

Fax: (605) 773-6729

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1