4

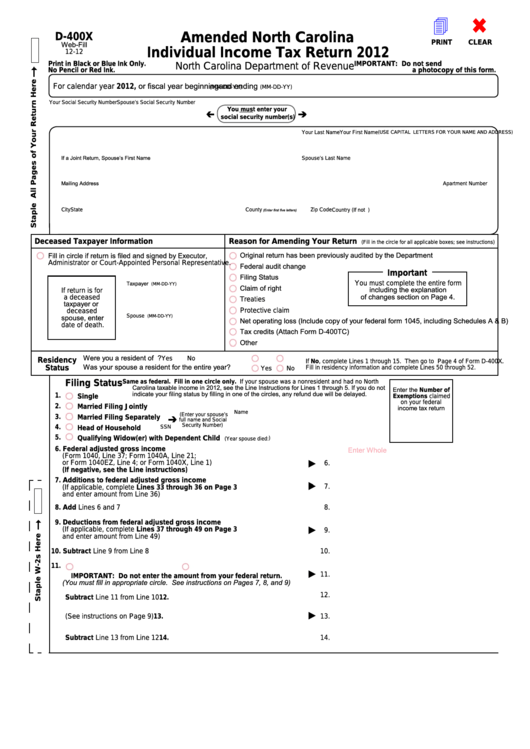

Amended North Carolina

D-400X

PRINT

CLEAR

Web-Fill

Individual Income Tax Return 2012

12-12

Print in Black or Blue Ink Only.

IMPORTANT: Do not send

North Carolina Department of Revenue

No Pencil or Red Ink.

a photocopy of this form.

For calendar year 2012, or fiscal year beginning

and ending

(MM-DD-YY)

(MM-DD-YY)

Your Social Security Number

Spouse’s Social Security Number

You must enter your

social security number(s)

Your First Name

(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

M.I.

Your Last Name

If a Joint Return, Spouse’s First Name

M.I.

Spouse’s Last Name

Mailing Address

Apartment Number

City

State

Zip Code

Country (If not U.S.)

County

(Enter first five letters)

Deceased Taxpayer Information

Reason for Amending Your Return

(Fill in the circle for all applicable boxes; see instructions)

Original return has been previously audited by the Department

Fill in circle if return is filed and signed by Executor,

Administrator or Court-Appointed Personal Representative.

Federal audit change

Important

Filing Status

Taxpayer

You must complete the entire form

(MM-DD-YY)

Claim of right

including the explanation

If return is for

of changes section on Page 4.

a deceased

Treaties

taxpayer or

Protective claim

deceased

spouse, enter

Spouse

(MM-DD-YY)

Net operating loss (Include copy of your federal form 1045, including Schedules A & B)

date of death.

Tax credits (Attach Form D-400TC)

Other

Were you a resident of N.C. for the entire year of 2012?

Yes

No

Residency

If No, complete Lines 1 through 15. Then go to Page 4 of Form D-400X.

Was your spouse a resident for the entire year?

Status

Fill in residency information and complete Lines 50 through 52.

Yes

No

Filing Status

Same as federal. Fill in one circle only. If your spouse was a nonresident and had no North

Carolina taxable income in 2012, see the Line Instructions for Lines 1 through 5. If you do not

Enter the Number of

indicate your filing status by filling in one of the circles, any refund due will be delayed.

1.

Single

Exemptions claimed

on your federal

2.

Married Filing Jointly

income tax return

Name

(Enter your spouse’s

3.

Married Filing Separately

full name and Social

Security Number)

4.

SSN

Head of Household

5.

Qualifying Widow(er) with Dependent Child

)

(Year spouse died:

Enter Whole U.S. Dollars Only

6. Federal adjusted gross income

(Form 1040, Line 37; Form 1040A, Line 21;

or Form 1040EZ, Line 4; or Form 1040X, Line 1)

6.

(If negative, see the Line instructions)

7. Additions to federal adjusted gross income

7.

(If applicable, complete Lines 33 through 36 on Page 3

and enter amount from Line 36)

8. Add Lines 6 and 7

8.

9. Deductions from federal adjusted gross income

(If applicable, complete Lines 37 through 49 on Page 3

9.

and enter amount from Line 49)

10. Subtract Line 9 from Line 8

10.

11.

N.C. standard deduction

OR

N.C. itemized deductions

11.

ImPORtaNt: Do not enter the amount from your federal return.

(You must fill in appropriate circle. See instructions on Pages 7, 8, and 9)

12.

12.

Subtract Line 11 from Line 10

13.

N.C. personal exemption allowance (See instructions on Page 9)

13.

14.

Subtract Line 13 from Line 12

14.

1

1 2

2 3

3 4

4