Employer Report Of Employee Earnings - Ohio

ADVERTISEMENT

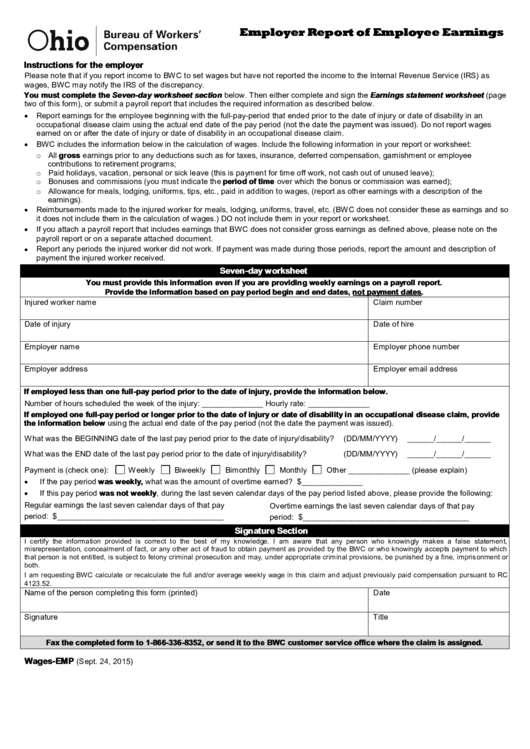

Employer Report of Employee Earnings

Instructions for the employer

Please note that if you report income to BWC to set wages but have not reported the income to the Internal Revenue Service (IRS) as

wages, BWC may notify the IRS of the discrepancy.

You must complete the Seven-day worksheet section below. Then either complete and sign the Earnings statement worksheet (page

two of this form), or submit a payroll report that includes the required information as described below.

Report earnings for the employee beginning with the full-pay-period that ended prior to the date of injury or date of disability in an

occupational disease claim using the actual end date of the pay period (not the date the payment was issued). Do not report wages

earned on or after the date of injury or date of disability in an occupational disease claim.

BWC includes the information below in the calculation of wages. Include the following information in your report or worksheet:

o All gross earnings prior to any deductions such as for taxes, insurance, deferred compensation, garnishment or employee

contributions to retirement programs;

o Paid holidays, vacation, personal or sick leave (this is payment for time off work, not cash out of unused leave);

o Bonuses and commissions (you must indicate the period of time over which the bonus or commission was earned);

o Allowance for meals, lodging, uniforms, tips, etc., paid in addition to wages, (report as other earnings with a description of the

earnings).

Reimbursements made to the injured worker for meals, lodging, uniforms, travel, etc. (BWC does not consider these as earnings and so

it does not include them in the calculation of wages.) DO not include them in your report or worksheet.

If you attach a payroll report that includes earnings that BWC does not consider gross earnings as defined above, please note on the

payroll report or on a separate attached document.

Report any periods the injured worker did not work. If payment was made during those periods, report the amount and description of

payment the injured worker received.

Seven-day worksheet

You must provide this information even if you are providing weekly earnings on a payroll report.

Provide the information based on pay period begin and end dates, not payment dates.

Injured worker name

Claim number

Date of injury

Date of hire

Employer name

Employer phone number

Employer address

Employer email address

If employed less than one full-pay period prior to the date of injury, provide the information below.

Number of hours scheduled the week of the injury: ______________ Hourly rate: ______________

If employed one full-pay period or longer prior to the date of injury or date of disability in an occupational disease claim, provide

the information below using the actual end date of the pay period (not the date the payment was issued).

What was the BEGINNING date of the last pay period prior to the date of injury/disability?

(DD/MM/YYYY)

______/______/______

What was the END date of the last pay period prior to the date of injury/disability?

(DD/MM/YYYY)

______/______/______

Payment is (check one):

Weekly

Biweekly

Bimonthly

Monthly

Other ______________ (please explain)

If the pay period was weekly, what was the amount of overtime earned? $______________

If this pay period was not weekly, during the last seven calendar days of the pay period listed above, please provide the following:

Regular earnings the last seven calendar days of that pay

Overtime earnings the last seven calendar days of that pay

period: $______________________________________

period: $______________________________________

Signature Section

I certify the information provided is correct to the best of my knowledge. I am aware that any person who knowingly makes a false statement,

misrepresentation, concealment of fact, or any other act of fraud to obtain payment as provided by the BWC or who knowingly accepts payment to which

that person is not entitled, is subject to felony criminal prosecution and may, under appropriate criminal provisions, be punished by a fine, imprisonment or

both.

I am requesting BWC calculate or recalculate the full and/or average weekly wage in this claim and adjust previously paid compensation pursuant to RC

4123.52.

Name of the person completing this form (printed)

Date

Signature

Title

Fax the completed form to 1-866-336-8352, or send it to the BWC customer service office where the claim is assigned.

Wages-EMP

(Sept. 24, 2015)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3