Form Ct-601 - Claim For Ez Wage Tax Credit - 2012

ADVERTISEMENT

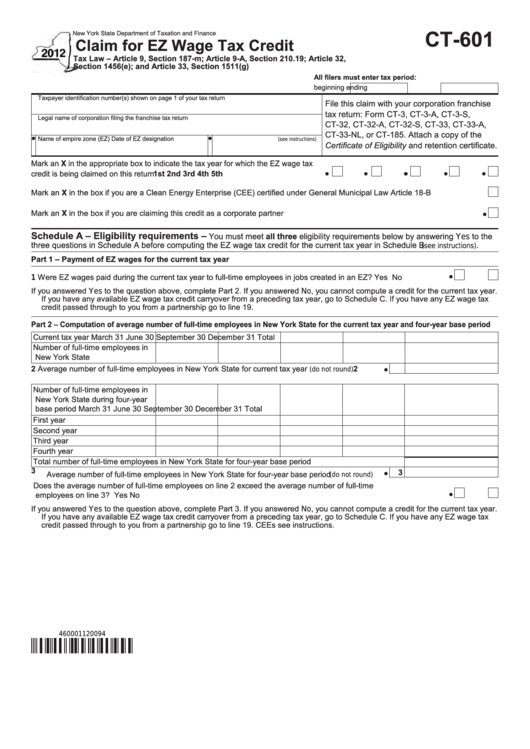

CT-601

New York State Department of Taxation and Finance

Claim for EZ Wage Tax Credit

Tax Law – Article 9, Section 187-m; Article 9-A, Section 210.19; Article 32,

Section 1456(e); and Article 33, Section 1511(g)

All filers must enter tax period:

beginning

ending

Taxpayer identification number(s) shown on page 1 of your tax return

File this claim with your corporation franchise

tax return: Form CT-3, CT-3-A, CT-3-S,

Legal name of corporation filing the franchise tax return

CT-32, CT-32-A, CT-32-S, CT-33, CT-33-A,

CT-33-NL, or CT-185. Attach a copy of the

Name of empire zone (EZ)

Date of EZ designation

(see instructions)

Certificate of Eligibility and retention certificate.

Mark an X in the appropriate box to indicate the tax year for which the EZ wage tax

credit is being claimed on this return ........................................................................ 1st

2nd

3rd

4th

5th

Mark an X in the box if you are a Clean Energy Enterprise (CEE) certified under General Municipal Law Article 18-B .........................

Mark an X in the box if you are claiming this credit as a corporate partner ............................................................................................

Schedule A – Eligibility requirements –

You must meet all three eligibility requirements below by answering Yes to the

three questions in Schedule A before computing the EZ wage tax credit for the current tax year in Schedule B

.

(see instructions)

Part 1 – Payment of EZ wages for the current tax year

Were EZ wages paid during the current tax year to full-time employees in jobs created in an EZ? ........................ Yes

No

1

If you answered Yes to the question above, complete Part 2. If you answered No, you cannot compute a credit for the current tax year.

If you have any available EZ wage tax credit carryover from a preceding tax year, go to Schedule C. If you have any EZ wage tax

credit passed through to you from a partnership go to line 19.

Part 2 – Computation of average number of full-time employees in New York State for the current tax year and four-year base period

Current tax year

March 31

June 30

September 30

December 31

Total

Number of full-time employees in

New York State

2

2

Average number of full-time employees in New York State for current tax year

..........

(do not round)

Number of full-time employees in

New York State during four-year

base period

March 31

June 30

September 30

December 31

Total

First year

Second year

Third year

Fourth year

Total number of full-time employees in New York State for four-year base period ...........................................

3

3

Average number of full-time employees in New York State for four-year base period

....

(do not round)

Does the average number of full-time employees on line 2 exceed the average number of full-time

employees on line 3? ........................................................................................................................................... Yes

No

If you answered Yes to the question above, complete Part 3. If you answered No, you cannot compute a credit for the current tax year.

If you have any available EZ wage tax credit carryover from a preceding tax year, go to Schedule C. If you have any EZ wage tax

credit passed through to you from a partnership go to line 19. CEEs see instructions.

460001120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4