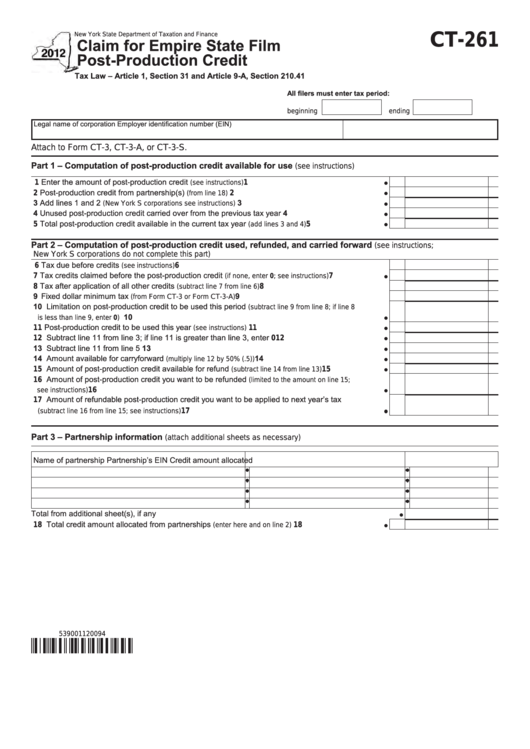

Form Ct-261 - Claim For Empire State Film Post-Production Credit - 2012

ADVERTISEMENT

New York State Department of Taxation and Finance

CT-261

Claim for Empire State Film

Post-Production Credit

Tax Law – Article 1, Section 31 and Article 9-A, Section 210.41

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number (EIN)

Attach to Form CT-3, CT-3-A, or CT-3-S.

Part 1 – Computation of post-production credit available for use

(see instructions)

1 Enter the amount of post-production credit

...............................................................

1

(see instructions)

2 Post-production credit from partnership(s)

....................................................................

2

(from line 18)

3 Add lines 1 and 2

3

.................................................................

(New York S corporations see instructions)

4 Unused post-production credit carried over from the previous tax year ............................................

4

5 Total post-production credit available in the current tax year

.................................

5

(add lines 3 and 4)

Part 2 – Computation of post-production credit used, refunded, and carried forward

(see instructions;

New York S corporations do not complete this part)

6 Tax due before credits

................................................................................................

6

(see instructions)

7 Tax credits claimed before the post-production credit

.......................

7

(if none, enter 0; see instructions)

8 Tax after application of all other credits

.........................................................

8

(subtract line 7 from line 6)

9 Fixed dollar minimum tax

9

.....................................................................

(from Form CT-3 or Form CT-3-A)

10 Limitation on post-production credit to be used this period

(subtract line 9 from line 8; if line 8

10

..................................................................................................................

is less than line 9, enter 0)

11 Post-production credit to be used this year

..............................................................

11

(see instructions)

12 Subtract line 11 from line 3; if line 11 is greater than line 3, enter 0 ...................................................

12

13 Subtract line 11 from line 5 ................................................................................................................

13

14 Amount available for carryforward

14

............................................................

(multiply line 12 by 50% (.5))

15 Amount of post-production credit available for refund

.............................

15

(subtract line 14 from line 13)

16 Amount of post-production credit you want to be refunded

(limited to the amount on line 15;

.................................................................................................................................

16

see instructions)

17 Amount of refundable post-production credit you want to be applied to next year’s tax

......................................................................................

17

(subtract line 16 from line 15; see instructions)

Part 3 – Partnership information

(attach additional sheets as necessary)

Name of partnership

Partnership’s EIN

Credit amount allocated

Total from additional sheet(s), if any ...............................................................................................................

18 Total credit amount allocated from partnerships

...........................................

18

(enter here and on line 2)

539001120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1