Form Ct-259 - Claim For Fuel Cell Electric Generating Equipment Credit - 2012

ADVERTISEMENT

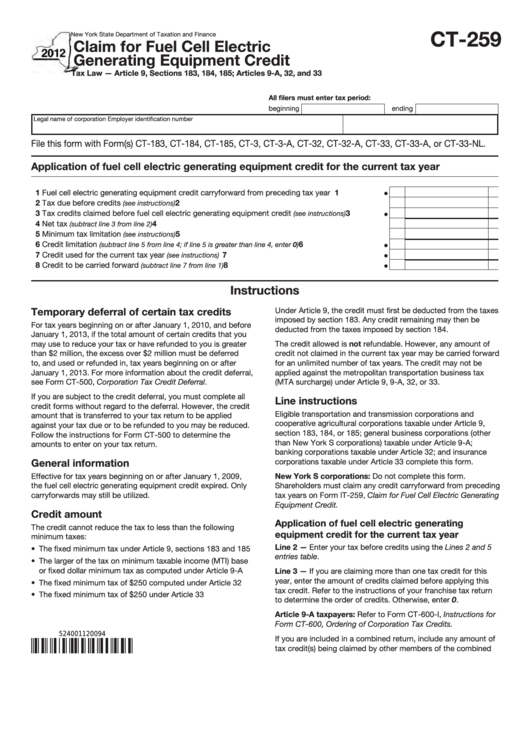

CT-259

New York State Department of Taxation and Finance

Claim for Fuel Cell Electric

Generating Equipment Credit

Tax Law — Article 9, Sections 183, 184, 185; Articles 9-A, 32, and 33

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number

File this form with Form(s) CT-183, CT-184, CT-185, CT-3, CT-3-A, CT-32, CT-32-A, CT-33, CT-33-A, or CT-33-NL.

Application of fuel cell electric generating equipment credit for the current tax year

1 Fuel cell electric generating equipment credit carryforward from preceding tax year ......................

1

2 Tax due before credits

...............................................................................................

2

(see instructions)

3 Tax credits claimed before fuel cell electric generating equipment credit

...............

3

(see instructions)

4 Net tax

4

..........................................................................................................

(subtract line 3 from line 2)

5 Minimum tax limitation

...............................................................................................

5

(see instructions)

6 Credit limitation

.....................................

6

(subtract line 5 from line 4; if line 5 is greater than line 4, enter 0)

7 Credit used for the current tax year

7

.........................................................................

(see instructions)

8 Credit to be carried forward

.......................................................................

8

(subtract line 7 from line 1)

Instructions

Temporary deferral of certain tax credits

Under Article 9, the credit must first be deducted from the taxes

imposed by section 183. Any credit remaining may then be

For tax years beginning on or after January 1, 2010, and before

deducted from the taxes imposed by section 184.

January 1, 2013, if the total amount of certain credits that you

may use to reduce your tax or have refunded to you is greater

The credit allowed is not refundable. However, any amount of

than $2 million, the excess over $2 million must be deferred

credit not claimed in the current tax year may be carried forward

to, and used or refunded in, tax years beginning on or after

for an unlimited number of tax years. The credit may not be

January 1, 2013. For more information about the credit deferral,

applied against the metropolitan transportation business tax

see Form CT-500, Corporation Tax Credit Deferral.

(MTA surcharge) under Article 9, 9-A, 32, or 33.

If you are subject to the credit deferral, you must complete all

Line instructions

credit forms without regard to the deferral. However, the credit

Eligible transportation and transmission corporations and

amount that is transferred to your tax return to be applied

cooperative agricultural corporations taxable under Article 9,

against your tax due or to be refunded to you may be reduced.

section 183, 184, or 185; general business corporations (other

Follow the instructions for Form CT-500 to determine the

than New York S corporations) taxable under Article 9-A;

amounts to enter on your tax return.

banking corporations taxable under Article 32; and insurance

General information

corporations taxable under Article 33 complete this form.

Effective for tax years beginning on or after January 1, 2009,

New York S corporations: Do not complete this form.

the fuel cell electric generating equipment credit expired. Only

Shareholders must claim any credit carryforward from preceding

carryforwards may still be utilized.

tax years on Form IT-259, Claim for Fuel Cell Electric Generating

Equipment Credit.

Credit amount

Application of fuel cell electric generating

The credit cannot reduce the tax to less than the following

equipment credit for the current tax year

minimum taxes:

Line 2 — Enter your tax before credits using the Lines 2 and 5

• The fixed minimum tax under Article 9, sections 183 and 185

entries table.

• The larger of the tax on minimum taxable income (MTI) base

or fixed dollar minimum tax as computed under Article 9-A

Line 3 — If you are claiming more than one tax credit for this

year, enter the amount of credits claimed before applying this

• The fixed minimum tax of $250 computed under Article 32

tax credit. Refer to the instructions of your franchise tax return

• The fixed minimum tax of $250 under Article 33

to determine the order of credits. Otherwise, enter 0.

Article 9-A taxpayers: Refer to Form CT-600-I, Instructions for

Form CT-600, Ordering of Corporation Tax Credits.

524001120094

If you are included in a combined return, include any amount of

tax credit(s) being claimed by other members of the combined

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2