Form 805 Instructions For Statement Regarding Delayed Effective Condition

ADVERTISEMENT

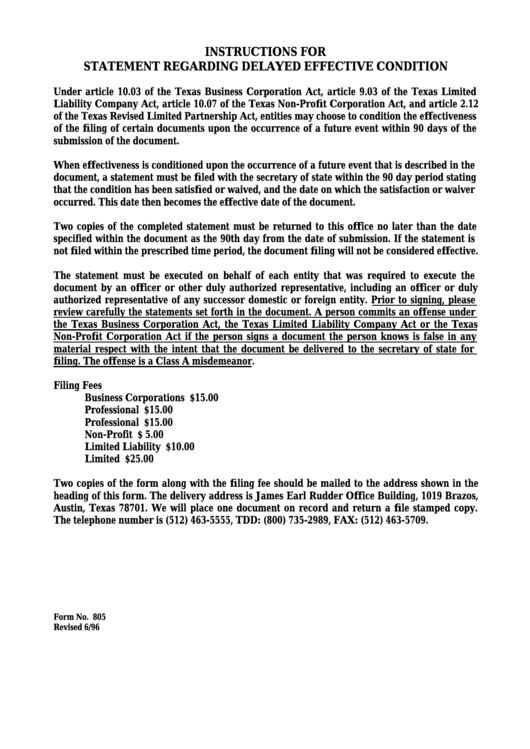

INSTRUCTIONS FOR

STATEMENT REGARDING DELAYED EFFECTIVE CONDITION

Under article 10.03 of the Texas Business Corporation Act, article 9.03 of the Texas Limited

Liability Company Act, article 10.07 of the Texas Non-Profit Corporation Act, and article 2.12

of the Texas Revised Limited Partnership Act, entities may choose to condition the effectiveness

of the filing of certain documents upon the occurrence of a future event within 90 days of the

submission of the document.

When effectiveness is conditioned upon the occurrence of a future event that is described in the

document, a statement must be filed with the secretary of state within the 90 day period stating

that the condition has been satisfied or waived, and the date on which the satisfaction or waiver

occurred. This date then becomes the effective date of the document.

Two copies of the completed statement must be returned to this office no later than the date

specified within the document as the 90th day from the date of submission. If the statement is

not filed within the prescribed time period, the document filing will not be considered effective.

The statement must be executed on behalf of each entity that was required to execute the

document by an officer or other duly authorized representative, including an officer or duly

authorized representative of any successor domestic or foreign entity. Prior to signing, please

review carefully the statements set forth in the document. A person commits an offense under

the Texas Business Corporation Act, the Texas Limited Liability Company Act or the Texas

Non-Profit Corporation Act if the person signs a document the person knows is false in any

material respect with the intent that the document be delivered to the secretary of state for

filing. The offense is a Class A misdemeanor.

Filing Fees

Business Corporations .................... $15.00

Professional Corporations .............. $15.00

Professional Associations ................ $15.00

Non-Profit Corporations ..................$ 5.00

Limited Liability Companies.......... $10.00

Limited Partnerships....................... $25.00

Two copies of the form along with the filing fee should be mailed to the address shown in the

heading of this form. The delivery address is James Earl Rudder Office Building, 1019 Brazos,

Austin, Texas 78701. We will place one document on record and return a file stamped copy.

The telephone number is (512) 463-5555, TDD: (800) 735-2989, FAX: (512) 463-5709.

Form No. 805

Revised 6/96

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1