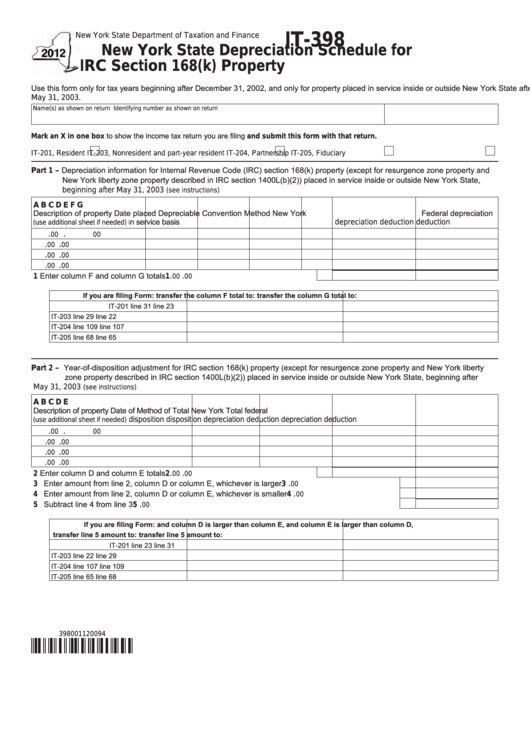

IT-398

New York State Department of Taxation and Finance

New York State Depreciation Schedule for

IRC Section 168(k) Property

Use this form only for tax years beginning after December 31, 2002, and only for property placed in service inside or outside New York State after

May 31, 2003.

Name(s) as shown on return

Identifying number as shown on return

Mark an X in one box to show the income tax return you are filing and submit this form with that return.

IT-201, Resident

IT-203, Nonresident and part-year resident

IT-204, Partnership

IT-205, Fiduciary

Part 1 – Depreciation information for Internal Revenue Code (IRC) section 168(k) property (except for resurgence zone property and

New York liberty zone property described in IRC section 1400L(b)(2)) placed in service inside or outside New York State,

beginning after May 31, 2003

(see instructions)

A

B

C

D

E

F

G

Description of property

Date placed

Depreciable

Convention

Method

New York

Federal depreciation

n service

basis

depreciation deduction

deduction

(use additional sheet if needed)

i

.

.

00

00

.

.

00

00

.

.

00

00

.

.

00

00

1 Enter column F and column G totals ................................................................

.

.

1

00

00

If you are filing Form:

transfer the column F total to:

transfer the column G total to:

IT-201

line 31

line 23

IT-203

line 29

line 22

IT-204

line 109

line 107

IT-205

line 68

line 65

Part 2 – Year-of-disposition adjustment for IRC section 168(k) property (except for resurgence zone property and New York liberty

zone property described in IRC section 1400L(b)(2)) placed in service inside or outside New York State, beginning after

May 31, 2003

(see instructions)

A

B

C

D

E

Description of property

Date of

Method of

Total New York

Total federal

disposition

disposition

depreciation deduction depreciation deduction

(use additional sheet if needed)

.

.

00

00

.

.

00

00

.

.

00

00

.

.

00

00

2 Enter column D and column E totals ................................................................

.

.

2

00

00

3 Enter amount from line 2, column D or column E, whichever is larger ...................................................

.

3

00

4 Enter amount from line 2, column D or column E, whichever is smaller .................................................

.

4

00

5 Subtract line 4 from line 3 .......................................................................................................................

.

5

00

If you are filing Form:

and column D is larger than column E,

and column E is larger than column D,

transfer line 5 amount to:

transfer line 5 amount to:

IT-201

line 23

line 31

IT-203

line 22

line 29

IT-204

line 107

line 109

IT-205

line 65

line 68

398001120094

1

1 2

2