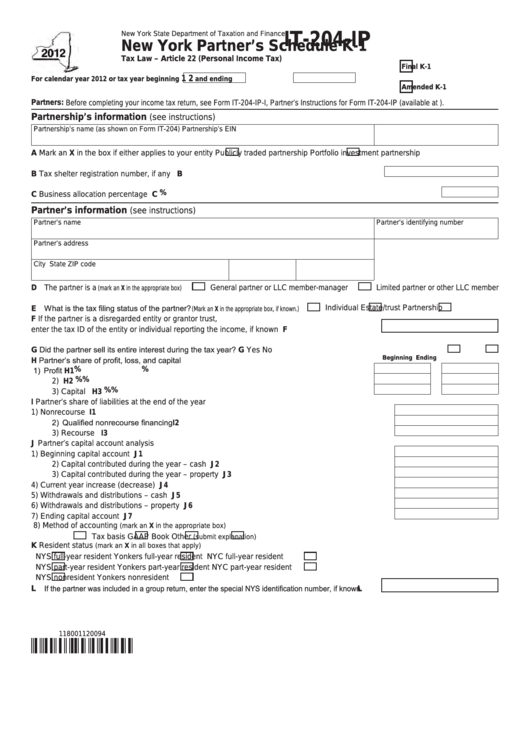

New York State Department of Taxation and Finance

IT-204-IP

New York Partner’s Schedule K-1

Tax Law – Article 22 (Personal Income Tax)

Final K-1

1 2

For calendar year 2012 or tax year beginning

and ending

Amended K-1

Partners: Before completing your income tax return, see Form IT-204-IP-I, Partner’s Instructions for Form IT-204-IP (available at ).

Partnership’s information

(see instructions)

Partnership’s name (as shown on Form IT-204)

Partnership’s EIN

A Mark an X in the box if either applies to your entity

Publicly traded partnership

Portfolio investment partnership

B Tax shelter registration number, if any .......................................................................................... B

%

C Business allocation percentage ............................................................................................................................... C

Partner’s information

(see instructions)

Partner’s name

Partner’s identifying number

Partner’s address

City

State

ZIP code

D The partner is a

General partner or LLC member-manager

Limited partner or other LLC member

(mark an X in the appropriate box)

E What is the tax filing status of the partner?

Individual

Estate/trust

Partnership

(Mark an X in the appropriate box, if known.)

F

If the partner is a disregarded entity or grantor trust,

enter the tax ID of the entity or individual reporting the income, if known ................................ F

G Did the partner sell its entire interest during the tax year? ................................................................................ G Yes

No

H Partner’s share of profit, loss, and capital

Beginning

Ending

1) Profit .............................................................................................................................. H1

%

%

%

%

2) Loss................................................................................................................................ H2

%

%

3) Capital ........................................................................................................................... H3

I

Partner’s share of liabilities at the end of the year

1) Nonrecourse ............................................................................................................................. I1

2) Qualified nonrecourse financing................................................................................................ I2

3) Recourse .................................................................................................................................. I3

J

Partner’s capital account analysis

1) Beginning capital account ........................................................................................................ J1

2) Capital contributed during the year – cash .............................................................................. J2

3) Capital contributed during the year – property ......................................................................... J3

4) Current year increase (decrease) ............................................................................................ J4

5) Withdrawals and distributions – cash ....................................................................................... J5

6) Withdrawals and distributions – property ................................................................................. J6

7) Ending capital account ............................................................................................................. J7

8) Method of accounting

(mark an X in the appropriate box)

Tax basis

GAAP

Book

Other

(submit explanation)

K Resident status

(mark an X in all boxes that apply)

NYS full-year resident

Yonkers full-year resident

NYC full-year resident

NYS part-year resident

Yonkers part-year resident

NYC part-year resident

NYS nonresident

Yonkers nonresident

If the partner was included in a group return, enter the special NYS identification number, if known ..... L

L

118001120094

1

1 2

2 3

3 4

4