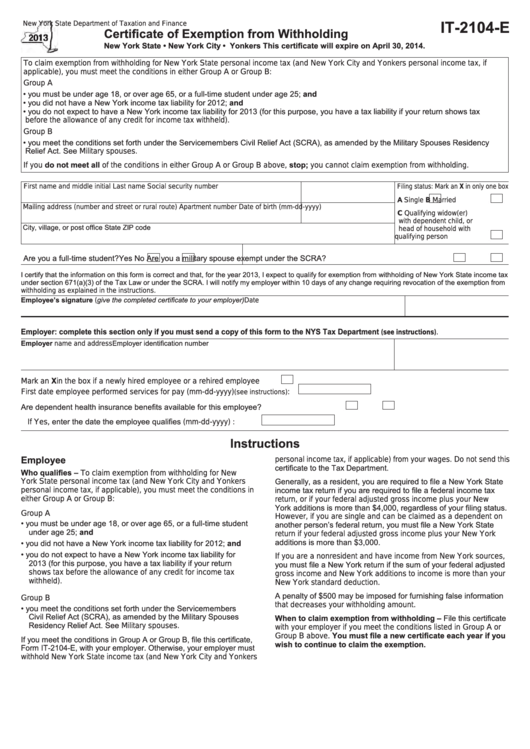

IT-2104-E

New York State Department of Taxation and Finance

Certificate of Exemption from Withholding

New York State • New York City •

Yonkers

This certificate will expire on April 30, 2014.

To claim exemption from withholding for New York State personal income tax (and New York City and Yonkers personal income tax, if

applicable), you must meet the conditions in either Group A or Group B:

Group A

• you must be under age 18, or over age 65, or a full‑time student under age 25; and

• you did not have a New York income tax liability for 2012; and

• you do not expect to have a New York income tax liability for 2013 (for this purpose, you have a tax liability if your return shows tax

before the allowance of any credit for income tax withheld).

Group B

• you meet the conditions set forth under the Servicemembers Civil Relief Act (SCRA), as amended by the Military Spouses Residency

Relief Act. See Military spouses.

If you do not meet all of the conditions in either Group A or Group B above, stop; you cannot claim exemption from withholding.

First name and middle initial

Last name

Social security number

Filing status: Mark an X in only one box

A Single

B Married

Mailing address (number and street or rural route)

Apartment number

Date of birth (mm-dd-yyyy)

C Qualifying widow(er)

with dependent child, or

City, village, or post office

State

ZIP code

head of household with

qualifying person ..............

Are you a full‑time student?...... Yes

No

Are you a military spouse exempt under the SCRA? ..... Yes

No

I certify that the information on this form is correct and that, for the year 2013, I expect to qualify for exemption from withholding of New York State income tax

under section 671(a)(3) of the Tax Law or under the SCRA. I will notify my employer within 10 days of any change requiring revocation of the exemption from

withholding as explained in the instructions.

Employee’s signature (give the completed certificate to your employer)

Date

Employer: complete this section only if you must send a copy of this form to the NYS Tax Department

.

(see instructions)

Employer name and address

Employer identification number

Mark an X in the box if a newly hired employee or a rehired employee .......

First date employee performed services for pay (mm-dd-yyyy)

:

(see instructions)

Are dependent health insurance benefits available for this employee? .............................. Yes

No

If Yes, enter the date the employee qualifies (mm-dd-yyyy) : ......

Instructions

Employee

personal income tax, if applicable) from your wages. Do not send this

certificate to the Tax Department.

Who qualifies – To claim exemption from withholding for New

Generally, as a resident, you are required to file a New York State

York State personal income tax (and New York City and Yonkers

income tax return if you are required to file a federal income tax

personal income tax, if applicable), you must meet the conditions in

either Group A or Group B:

return, or if your federal adjusted gross income plus your New

York additions is more than $4,000, regardless of your filing status.

Group A

However, if you are single and can be claimed as a dependent on

• you must be under age 18, or over age 65, or a full‑time student

another person’s federal return, you must file a New York State

under age 25; and

return if your federal adjusted gross income plus your New York

additions is more than $3,000.

• you did not have a New York income tax liability for 2012; and

• you do not expect to have a New York income tax liability for

If you are a nonresident and have income from New York sources,

2013 (for this purpose, you have a tax liability if your return

you must file a New York return if the sum of your federal adjusted

shows tax before the allowance of any credit for income tax

gross income and New York additions to income is more than your

withheld).

New York standard deduction.

A penalty of $500 may be imposed for furnishing false information

Group B

that decreases your withholding amount.

• you meet the conditions set forth under the Servicemembers

Civil Relief Act (SCRA), as amended by the Military Spouses

When to claim exemption from withholding – File this certificate

Residency Relief Act. See Military spouses.

with your employer if you meet the conditions listed in Group A or

Group B above. You must file a new certificate each year if you

If you meet the conditions in Group A or Group B, file this certificate,

wish to continue to claim the exemption.

Form IT‑2104‑E, with your employer. Otherwise, your employer must

withhold New York State income tax (and New York City and Yonkers

1

1 2

2