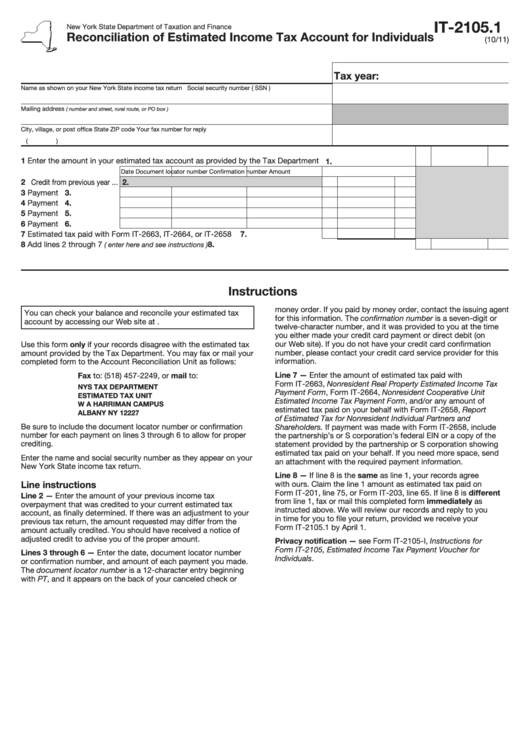

IT-2105.1

New York State Department of Taxation and Finance

Reconciliation of Estimated Income Tax Account for Individuals

(10/11)

Tax year:

Name as shown on your New York State income tax return

Social security number ( SSN )

Mailing address

( number and street, rural route, or PO box )

City, village, or post office

State

ZIP code

Your fax number for reply

(

)

1 Enter the amount in your estimated tax account as provided by the Tax Department ......................................... 1.

Date

Document locator number

Confirmation number

Amount

2 Credit from previous year ...

2.

3 Payment ........................

3.

4 Payment ........................

4.

5 Payment ........................

5.

6 Payment ........................

6.

7 Estimated tax paid with Form IT-2663, IT-2664, or IT-2658 .......................................

7.

8 Add lines 2 through 7

.............................................................................................. 8.

( enter here and see instructions )

Instructions

money order. If you paid by money order, contact the issuing agent

You can check your balance and reconcile your estimated tax

for this information. The confirmation number is a seven-digit or

account by accessing our Web site at

twelve-character number, and it was provided to you at the time

you either made your credit card payment or direct debit (on

Use this form only if your records disagree with the estimated tax

our Web site). If you do not have your credit card confirmation

number, please contact your credit card service provider for this

amount provided by the Tax Department. You may fax or mail your

completed form to the Account Reconciliation Unit as follows:

information.

Fax to: (518) 457-2249, or mail to:

Line 7 — Enter the amount of estimated tax paid with

Form IT-2663, Nonresident Real Property Estimated Income Tax

NYS TAX DEPARTMENT

Payment Form, Form IT-2664, Nonresident Cooperative Unit

ESTIMATED TAX UNIT

Estimated Income Tax Payment Form, and/or any amount of

W A HARRIMAN CAMPUS

estimated tax paid on your behalf with Form IT-2658, Report

ALBANY NY 12227

of Estimated Tax for Nonresident Individual Partners and

Be sure to include the document locator number or confirmation

Shareholders. If payment was made with Form IT-2658, include

number for each payment on lines 3 through 6 to allow for proper

the partnership’s or S corporation’s federal EIN or a copy of the

crediting.

statement provided by the partnership or S corporation showing

estimated tax paid on your behalf. If you need more space, send

Enter the name and social security number as they appear on your

an attachment with the required payment information.

New York State income tax return.

Line 8 — If line 8 is the same as line 1, your records agree

Line instructions

with ours. Claim the line 1 amount as estimated tax paid on

Form IT-201, line 75, or Form IT-203, line 65. If line 8 is different

Line 2 — Enter the amount of your previous income tax

from line 1, fax or mail this completed form immediately as

overpayment that was credited to your current estimated tax

instructed above. We will review our records and reply to you

account, as finally determined. If there was an adjustment to your

in time for you to file your return, provided we receive your

previous tax return, the amount requested may differ from the

Form IT-2105.1 by April 1.

amount actually credited. You should have received a notice of

adjusted credit to advise you of the proper amount.

Privacy notification — see Form IT-2105-I, Instructions for

Form IT‑2105, Estimated Income Tax Payment Voucher for

Lines 3 through 6 — Enter the date, document locator number

Individuals.

or confirmation number, and amount of each payment you made.

The document locator number is a 12-character entry beginning

with PT, and it appears on the back of your canceled check or

1

1