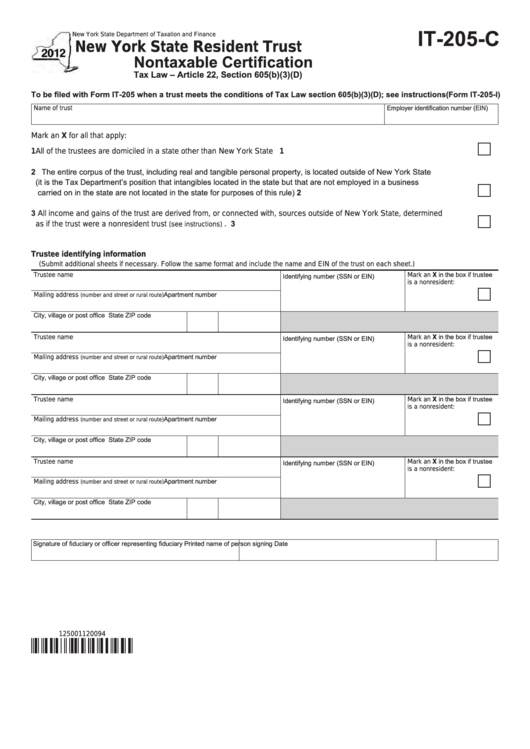

IT-205-C

New York State Department of Taxation and Finance

New York State Resident Trust

Nontaxable Certification

Tax Law – Article 22, Section 605(b)(3)(D)

To be filed with Form IT-205 when a trust meets the conditions of Tax Law section 605(b)(3)(D); see instructions (Form IT-205-I)

Name of trust

Employer identification number (EIN)

Mark an X for all that apply:

1 All of the trustees are domiciled in a state other than New York State ...................................................................................

1

2 The entire corpus of the trust, including real and tangible personal property, is located outside of New York State

(it is the Tax Department’s position that intangibles located in the state but that are not employed in a business

carried on in the state are not located in the state for purposes of this rule) ......................................................................

2

3 All income and gains of the trust are derived from, or connected with, sources outside of New York State, determined

as if the trust were a nonresident trust

. ......................................................................................................

3

(see instructions)

Trustee identifying information

(Submit additional sheets if necessary. Follow the same format and include the name and EIN of the trust on each sheet.)

Trustee name

Mark an X in the box if trustee

Identifying number (SSN or EIN)

is a nonresident:

Mailing address

Apartment number

(number and street or rural route)

City, village or post office

State

ZIP code

Trustee name

Mark an X in the box if trustee

Identifying number (SSN or EIN)

is a nonresident:

Mailing address

Apartment number

(number and street or rural route)

City, village or post office

State

ZIP code

Trustee name

Mark an X in the box if trustee

Identifying number (SSN or EIN)

is a nonresident:

Mailing address

Apartment number

(number and street or rural route)

City, village or post office

State

ZIP code

Trustee name

Mark an X in the box if trustee

Identifying number (SSN or EIN)

is a nonresident:

Mailing address

Apartment number

(number and street or rural route)

City, village or post office

State

ZIP code

Signature of fiduciary or officer representing fiduciary

Printed name of person signing

Date

125001120094

1

1