Instructions For Annual Registration For Registered Limited Liability Partnership

ADVERTISEMENT

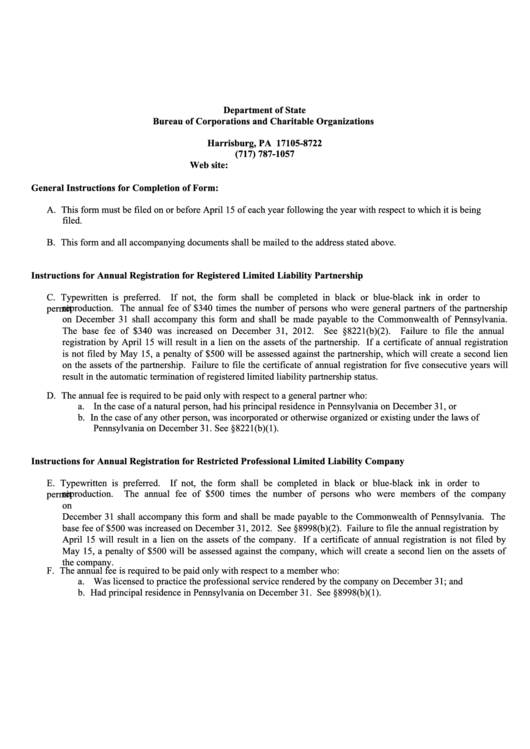

Department of State

Bureau of Corporations and Charitable Organizations

P.O. Box 8722

Harrisburg, PA 17105-8722

(717) 787-1057

Web site:

General Instructions for Completion of Form:

A. This form must be filed on or before April 15 of each year following the year with respect to which it is being

filed.

B. This form and all accompanying documents shall be mailed to the address stated above.

Instructions for Annual Registration for Registered Limited Liability Partnership

C. Typewritten is preferred. If not, the form shall be completed in black or blue-black ink in order to

permit reproduction. The annual fee of $340 times the number of persons who were general partners of the partnership

on December 31 shall accompany this form and shall be made payable to the Commonwealth of Pennsylvania.

The base fee of $340 was increased on December 31, 2012. See §8221(b)(2). Failure to file the annual

registration by April 15 will result in a lien on the assets of the partnership. If a certificate of annual registration

is not filed by May 15, a penalty of $500 will be assessed against the partnership, which will create a second lien

on the assets of the partnership. Failure to file the certificate of annual registration for five consecutive years will

result in the automatic termination of registered limited liability partnership status.

D. The annual fee is required to be paid only with respect to a general partner who:

a. In the case of a natural person, had his principal residence in Pennsylvania on December 31, or

b. In the case of any other person, was incorporated or otherwise organized or existing under the laws of

Pennsylvania on December 31. See §8221(b)(1).

Instructions for Annual Registration for Restricted Professional Limited Liability Company

E. Typewritten is preferred. If not, the form shall be completed in black or blue-black ink in order to

permit reproduction.

The annual fee of $500 times the number of persons who were members of the company

on

December 31 shall accompany this form and shall be made payable to the Commonwealth of Pennsylvania. The

base fee of $500 was increased on December 31, 2012. See §8998(b)(2). Failure to file the annual registration by

April 15 will result in a lien on the assets of the company. If a certificate of annual registration is not filed by

May 15, a penalty of $500 will be assessed against the company, which will create a second lien on the assets of

the company.

F. The annual fee is required to be paid only with respect to a member who:

a. Was licensed to practice the professional service rendered by the company on December 31; and

b. Had principal residence in Pennsylvania on December 31. See §8998(b)(1).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1