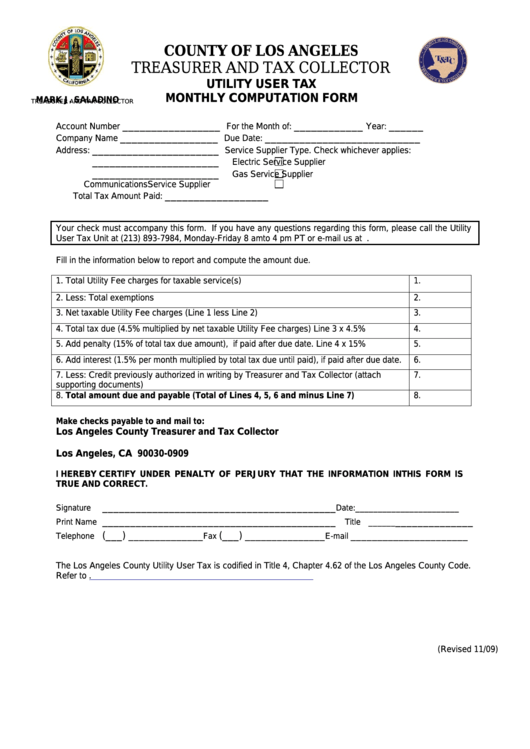

COUNTY OF LOS ANGELES

TREASURER AND TAX COLLECTOR

UTILITY USER TAX

MONTHLY COMPUTATION FORM

MARK J. SALADINO

TREASURER AND TAX COLLECTOR

_________________

____________

______

Account Number

For the Month of:

Year:

_________________

___________________________

Company Name

Due Date:

______________________

Address:

Service Supplier Type. Check whichever applies:

______________________

Electric Service Supplier

______________________

Gas Service Supplier

Communications Service Supplier

__________________

Total Tax Amount Paid:

Your check must accompany this form. If you have any questions regarding this form, please call the Utility

User Tax Unit at (213) 893-7984, Monday-Friday 8 am to 4 pm PT or e-mail us at uut@ttc.lacounty.gov.

Fill in the information below to report and compute the amount due.

1. Total Utility Fee charges for taxable service(s)

1.

2. Less: Total exemptions

2.

3. Net taxable Utility Fee charges (Line 1 less Line 2)

3.

4. Total tax due (4.5% multiplied by net taxable Utility Fee charges) Line 3 x 4.5%

4.

5. Add penalty (15% of total tax due amount), if paid after due date. Line 4 x 15%

5.

6. Add interest (1.5% per month multiplied by total tax due until paid), if paid after due date.

6.

7. Less: Credit previously authorized in writing by Treasurer and Tax Collector (attach

7.

supporting documents)

8. Total amount due and payable (Total of Lines 4, 5, 6 and minus Line 7)

8.

Make checks payable to and mail to:

Los Angeles County Treasurer and Tax Collector

P.O. Box 30909

Los Angeles, CA 90030-0909

I HEREBY CERTIFY UNDER PENALTY OF PERJURY THAT THE INFORMATION IN THIS FORM IS

TRUE AND CORRECT.

__________________________________________

Signature

Date: _______________________

__________________________________________

______________

Print Name

Title ______

(___) ______________

(___) _______________

______________________

Telephone

Fax

E-mail

The Los Angeles County Utility User Tax is codified in Title 4, Chapter 4.62 of the Los Angeles County Code.

Refer to

(Revised 11/09)

1

1