Form Fs-007 - Surplus Line Broker'S Monthly Tax Payment - California Department Of Insurance

ADVERTISEMENT

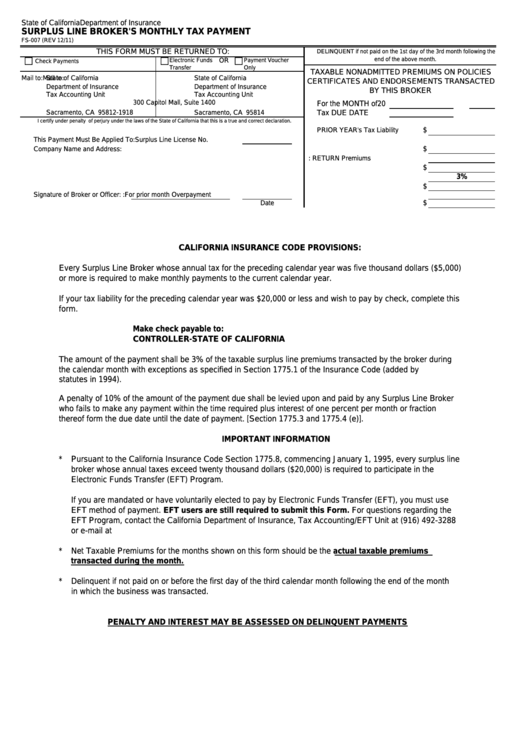

State of California

Department of Insurance

SURPLUS LINE BROKER'S MONTHLY TAX PAYMENT

FS-007 (REV 12/11)

THIS FORM MUST BE RETURNED TO:

DELINQUENT if not paid on the 1st day of the 3rd month following the

end of the above month.

OR

Electronic Funds

Payment Voucher

Check Payments

Transfer

Only

TAXABLE NONADMITTED PREMIUMS ON POLICIES

Mail to:

State of California

Mail to:

State of California

CERTIFICATES AND ENDORSEMENTS TRANSACTED

Department of Insurance

Department of Insurance

BY THIS BROKER

Tax Accounting Unit

Tax Accounting Unit

P.O. Box 1918

300 Capitol Mall, Suite 1400

For the MONTH of

20

Tax DUE DATE

Sacramento, CA 95812-1918

Sacramento, CA 95814

I certify under penalty of perjury under the laws of the State of California that this is a true and correct declaration.

$

PRIOR YEAR's Tax Liability

This Payment Must Be Applied To:

Surplus Line License No.

$

Company Name and Address:

1. GROSS Premiums

2. Deduct: RETURN Premiums

$

3. NET TAXABLE Premiums

3%

4. Tax Rate

$

5. TAX DUE this Month

Signature of Broker or Officer:

6. Credit:For prior month Overpayment

$

Date

7. Net amount DUE

CALIFORNIA INSURANCE CODE PROVISIONS:

Every Surplus Line Broker whose annual tax for the preceding calendar year was five thousand dollars ($5,000)

or more is required to make monthly payments to the current calendar year.

If your tax liability for the preceding calendar year was $20,000 or less and wish to pay by check, complete this

form.

Make check payable to:

CONTROLLER-STATE OF CALIFORNIA

The amount of the payment shall be 3% of the taxable surplus line premiums transacted by the broker during

the calendar month with exceptions as specified in Section 1775.1 of the Insurance Code (added by

statutes in 1994).

A penalty of 10% of the amount of the payment due shall be levied upon and paid by any Surplus Line Broker

who fails to make any payment within the time required plus interest of one percent per month or fraction

thereof form the due date until the date of payment. [Section 1775.3 and 1775.4 (e)].

IMPORTANT INFORMATION

*

Pursuant to the California Insurance Code Section 1775.8, commencing January 1, 1995, every surplus line

broker whose annual taxes exceed twenty thousand dollars ($20,000) is required to participate in the

Electronic Funds Transfer (EFT) Program.

If you are mandated or have voluntarily elected to pay by Electronic Funds Transfer (EFT), you must use

EFT method of payment. EFT users are still required to submit this Form. For questions regarding the

EFT Program, contact the California Department of Insurance, Tax Accounting/EFT Unit at (916) 492-3288

or e-mail at EFT@insurance.ca.gov

*

Net Taxable Premiums for the months shown on this form should be the actual taxable premiums

transacted during the month.

*

Delinquent if not paid on or before the first day of the third calendar month following the end of the month

in which the business was transacted.

PENALTY AND INTEREST MAY BE ASSESSED ON DELINQUENT PAYMENTS

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1