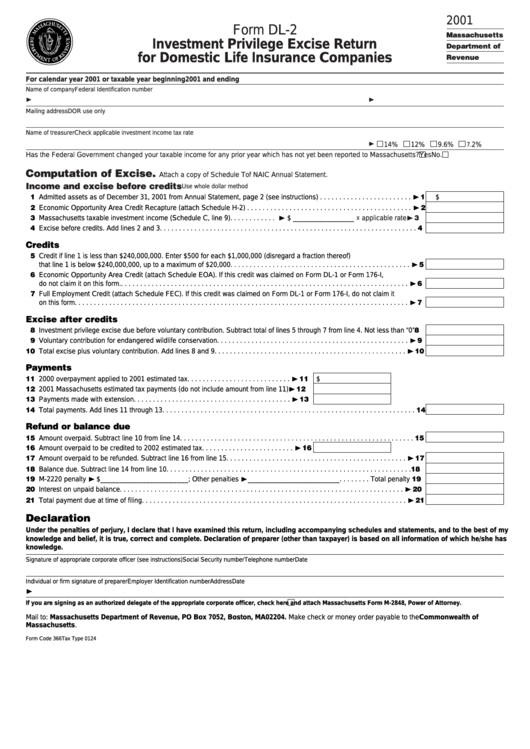

Form Dl-2 - Investment Privilege Excise Return For Domestic Life Insurance Companies - 2001

ADVERTISEMENT

2001

Form DL-2

Massachusetts

Investment Privilege Excise Return

Department of

for Domestic Life Insurance Companies

Revenue

For calendar year 2001 or taxable year beginning

2001 and ending

Name of company

Federal Identification number

❿

❿

Mailing address

DOR use only

Name of treasurer

Check applicable investment income tax rate

❿

14%

12%

9.6%

2%

7.

Has the Federal Government changed your taxable income for any prior year which has not yet been reported to Massachusetts?

Yes

No.

Computation of Excise.

Attach a copy of Schedule T of NAIC Annual Statement.

Income and excise before credits

Use whole dollar method

11 Admitted assets as of December 31, 2001 from Annual Statement, page 2 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . ❿ 1

$

12 Economic Opportunity Area Credit Recapture (attach Schedule H-2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 2

× applicable rate ❿ 3

13 Massachusetts taxable investment income (Schedule C, line 9) . . . . . . . . . . . . ❿ $ ________________

14 Excise before credits. Add lines 2 and 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

Credits

15 Credit if line 1 is less than $240,000,000. Enter $500 for each $1,000,000 (disregard a fraction thereof)

that line 1 is below $240,000,000, up to a maximum of $20,000. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 5

16 Economic Opportunity Area Credit (attach Schedule EOA). If this credit was claimed on Form DL-1 or Form 176-I,

do not claim it on this form. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 6

17 Full Employment Credit (attach Schedule FEC). If this credit was claimed on Form DL-1 or Form 176-I, do not claim it

on this form . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 7

Excise after credits

18 Investment privilege excise due before voluntary contribution. Subtract total of lines 5 through 7 from line 4. Not less than “0” 8

19 Voluntary contribution for endangered wildlife conservation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 9

10 Total excise plus voluntary contribution. Add lines 8 and 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 10

Payments

11 2000 overpayment applied to 2001 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 11

$

12 2001 Massachusetts estimated tax payments (do not include amount from line 11) ❿ 12

13 Payments made with extension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 13

14 Total payments. Add lines 11 through 13. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

Refund or balance due

15 Amount overpaid. Subtract line 10 from line 14. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Amount overpaid to be credited to 2002 estimated tax. . . . . . . . . . . . . . . . . . . . . . . . ❿ 16

17 Amount overpaid to be refunded. Subtract line 16 from line 15. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 17

18 Balance due. Subtract line 14 from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 M-2220 penalty ❿!$_______________________ ; Other penalties ❿________________________ . . . . . . . . Total penalty 19

20 Interest on unpaid balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 20

21 Total payment due at time of filing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ❿ 21

Declaration

Under the penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct and complete. Declaration of preparer (other than taxpayer) is based on all information of which he/she has

knowledge.

Signature of appropriate corporate officer (see instructions)

Social Security number

Telephone number

Date

Individual or firm signature of preparer

Employer Identification number

Address

Date

❿

If you are signing as an authorized delegate of the appropriate corporate officer, check here

and attach Massachusetts Form M-2848, Power of Attorney.

Mail to: Massachusetts Department of Revenue, PO Box 7052, Boston, MA 02204. Make check or money order payable to the Commonwealth of

Massachusetts.

Form Code 366 Tax Type 0124

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2