Form 3595 - Itemized Listing Of Daily Rental Property - 2002

ADVERTISEMENT

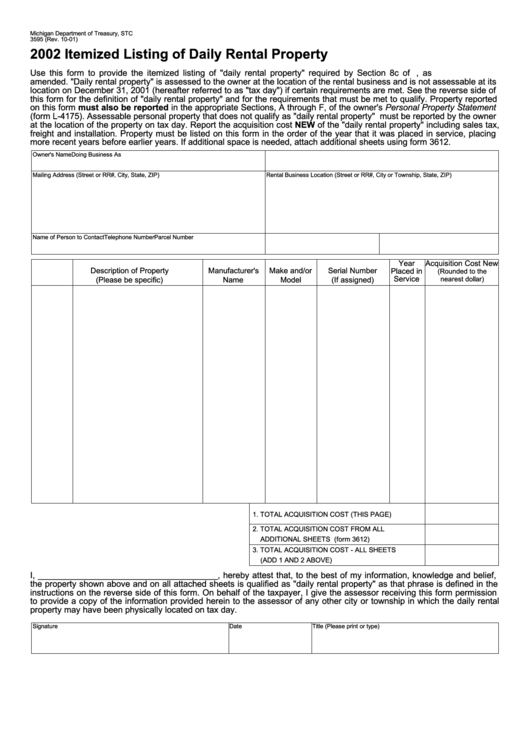

Michigan Department of Treasury, STC

3595 (Rev. 10-01)

2002 Itemized Listing of Daily Rental Property

Use this form to provide the itemized listing of "daily rental property" required by Section 8c of P.A. 206 of 1893, as

amended. "Daily rental property" is assessed to the owner at the location of the rental business and is not assessable at its

location on December 31, 2001 (hereafter referred to as "tax day") if certain requirements are met. See the reverse side of

this form for the definition of "daily rental property" and for the requirements that must be met to qualify. Property reported

on this form must also be reported in the appropriate Sections, A through F, of the owner's Personal Property Statement

(form L-4175). Assessable personal property that does not qualify as "daily rental property" must be reported by the owner

at the location of the property on tax day. Report the acquisition cost NEW of the "daily rental property" including sales tax,

freight and installation. Property must be listed on this form in the order of the year that it was placed in service, placing

more recent years before earlier years. If additional space is needed, attach additional sheets using form 3612.

Owner's Name

Doing Business As

Mailing Address (Street or RR#, City, State, ZIP)

Rental Business Location (Street or RR#, City or Township, State, ZIP)

Name of Person to Contact

Telephone Number

Parcel Number

Year

Acquisition Cost New

Description of Property

Manufacturer's

Make and/or

Serial Number

Placed in

(Rounded to the

I.D. No.

Service

(Please be specific)

Name

Model

(If assigned)

nearest dollar)

1. TOTAL ACQUISITION COST (THIS PAGE)

2. TOTAL ACQUISITION COST FROM ALL

ADDITIONAL SHEETS (form 3612)

3. TOTAL ACQUISITION COST - ALL SHEETS

(ADD 1 AND 2 ABOVE)

I, ______________________________________, hereby attest that, to the best of my information, knowledge and belief,

the property shown above and on all attached sheets is qualified as "daily rental property" as that phrase is defined in the

instructions on the reverse side of this form. On behalf of the taxpayer, I give the assessor receiving this form permission

to provide a copy of the information provided herein to the assessor of any other city or township in which the daily rental

property may have been physically located on tax day.

Signature

Date

Title (Please print or type)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1