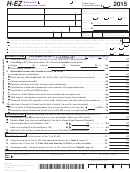

Schedule H Instructions - 2015

ADVERTISEMENT

2015 Schedule H Instructions

Investment Tax Credit and Carryovers

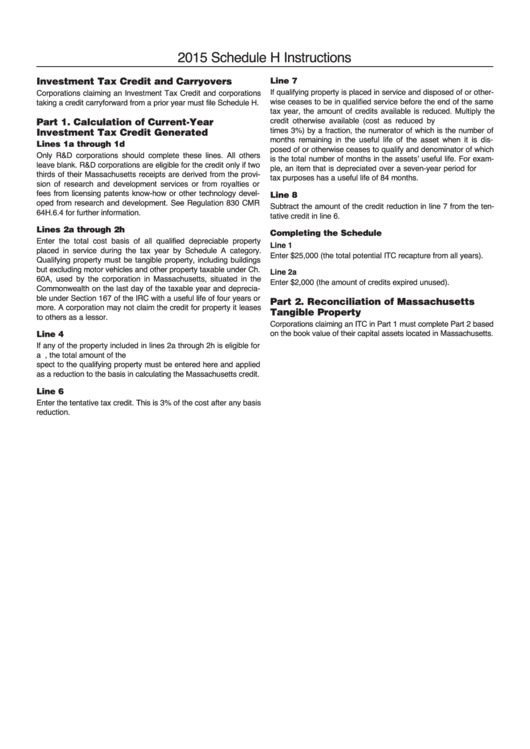

Line 7

If qualifying property is placed in service and disposed of or other-

Corporations claiming an Investment Tax Credit and corporations

wise ceases to be in qualified service before the end of the same

taking a credit carryforward from a prior year must file Schedule H.

tax year, the amount of credits available is reduced. Multiply the

credit otherwise available (cost as reduced by U.S. tax credits

Part 1. Calculation of Current-Year

times 3%) by a fraction, the numerator of which is the number of

Investment Tax Credit Generated

months remaining in the useful life of the asset when it is dis-

Lines 1a through 1d

posed of or otherwise ceases to qualify and denominator of which

Only R&D corporations should complete these lines. All others

is the total number of months in the assets’ useful life. For exam-

leave blank. R&D corporations are eligible for the credit only if two

ple, an item that is depreciated over a seven-year period for U.S.

thirds of their Massachusetts receipts are derived from the provi-

tax purposes has a useful life of 84 months.

sion of research and development services or from royalties or

fees from licensing patents know-how or other technology devel-

Line 8

oped from research and development. See Regulation 830 CMR

Subtract the amount of the credit reduction in line 7 from the ten-

64H.6.4 for further information.

tative credit in line 6.

Lines 2a through 2h

Completing the Schedule

Enter the total cost basis of all qualified depreciable property

Line 1

placed in service during the tax year by Schedule A category.

Enter $25,000 (the total potential ITC recapture from all years).

Qualifying property must be tangible property, including buildings

but excluding motor vehicles and other property taxable under Ch.

Line 2a

60A, used by the corporation in Massachusetts, situated in the

Enter $2,000 (the amount of credits expired unused).

Commonwealth on the last day of the taxable year and deprecia-

ble under Section 167 of the IRC with a useful life of four years or

Part 2. Reconciliation of Massachusetts

more. A corporation may not claim the credit for property it leases

Tangible Property

to others as a lessor.

Corporations claiming an ITC in Part 1 must complete Part 2 based

on the book value of their capital assets located in Massachusetts.

Line 4

If any of the property included in lines 2a through 2h is eligible for

a U.S. Tax Credit, the total amount of the U.S. credit taken with re-

spect to the qualifying property must be entered here and applied

as a reduction to the basis in calculating the Massachusetts credit.

Line 6

Enter the tentative tax credit. This is 3% of the cost after any basis

reduction.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1