Instructions For Completing The Agency Declaration Of Verification Results (Advr) Worksheet, Eta Form 9065

ADVERTISEMENT

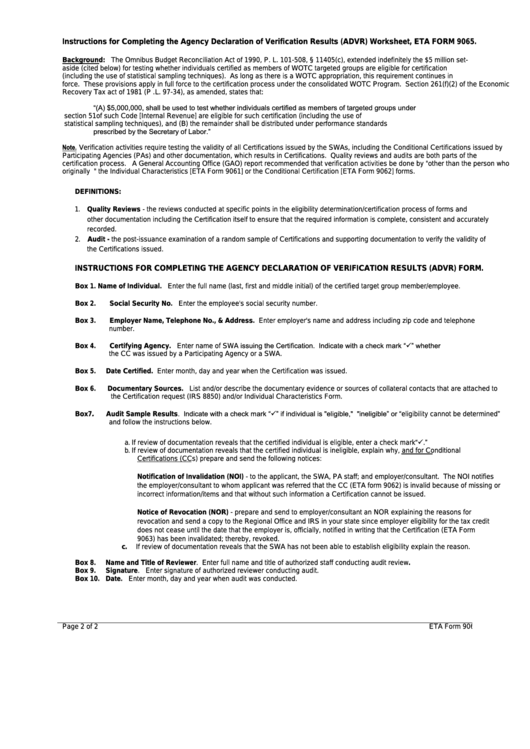

Instructions for Completing the Agency Declaration of Verification Results (ADVR) Worksheet, ETA FORM 9065.

Background: The Omnibus Budget Reconciliation Act of 1990, P. L. 101-508, § 11405(c), extended indefinitely the $5 million set-

aside (cited below) for testing whether individuals certified as members of WOTC targeted groups are eligible for certification

(including the use of statistical sampling techniques). As long as there is a WOTC appropriation, this requirement continues in

force. These provisions apply in full force to the certification process under the consolidated WOTC Program. Section 261(f)(2) of the Economic

Recovery Tax act of 1981 (P .L. 97-34), as amended, states that:

“(A) $5,000,000, shall be used to test whether individuals certified as members of targeted groups under

section 51of such Code [Internal Revenue] are eligible for such certification (including the use of

statistical sampling techniques), and (B) the remainder shall be distributed under performance standards

prescribed by the Secretary of Labor.”

Note. Verification activities require testing the validity of all Certifications issued by the SWAs, including the Conditional Certifications issued by

Participating Agencies (PAs) and other documentation, which results in Certifications. Quality reviews and audits are both parts of the

certification process. A General Accounting Office (GAO) report recommended that verification activities be done by "other than the person who

originally processed..." the Individual Characteristics [ETA Form 9061] or the Conditional Certification [ETA Form 9062] forms.

DEFINITIONS:

1. Quality Reviews - the reviews conducted at specific points in the eligibility determination/certification process of forms and

other documentation including the Certification itself to ensure that the required information is complete, consistent and accurately

recorded.

2. Audit - the post-issuance examination of a random sample of Certifications and supporting documentation to verify the validity of

the Certifications issued.

INSTRUCTIONS FOR COMPLETING THE AGENCY DECLARATION OF VERIFICATION RESULTS (ADVR) FORM.

Box 1.

Name of Individual. Enter the full name (last, first and middle initial) of the certified target group member/employee.

Box 2.

Social Security No. Enter the employee's social security number.

Box 3.

Employer Name, Telephone No., & Address. Enter employer's name and address including zip code and telephone

number.

Certifying Agency. Enter name of SWA issuing the Certification. Indicate with a check mark “” whether

Box 4.

the CC was issued by a Participating Agency or a SWA.

Box 5.

Date Certified. Enter month, day and year when the Certification was issued.

Box 6.

Documentary Sources. List and/or describe the documentary evidence or sources of collateral contacts that are attached to

the Certification request (IRS 8850) and/or Individual Characteristics Form.

Audit Sample Results. Indicate with a check mark “” if individual is "eligible," "ineligible” or “eligibility cannot be determined”

Box7.

and follow the instructions below.

a. If review of documentation reveals that the certified individual is eligible, enter a check mark“.”

b. If review of documentation reveals that the certified individual is ineligible, explain why, and for Conditional

Certifications (CCs) prepare and send the following notices:

Notification of Invalidation (NOI) - to the applicant, the SWA, PA staff; and employer/consultant. The NOI notifies

the employer/consultant to whom applicant was referred that the CC (ETA form 9062) is invalid because of missing or

incorrect information/items and that without such information a Certification cannot be issued.

Notice of Revocation (NOR) - prepare and send to employer/consultant an NOR explaining the reasons for

revocation and send a copy to the Regional Office and IRS in your state since employer eligibility for the tax credit

does not cease until the date that the employer is, officially, notified in writing that the Certification (ETA Form

9063) has been invalidated; thereby, revoked.

c.

If review of documentation reveals that the SWA has not been able to establish eligibility explain the reason.

Box 8.

Name and Title of Reviewer. Enter full name and title of authorized staff conducting audit review.

Box 9.

Signature. Enter signature of authorized reviewer conducting audit.

Box 10. Date. Enter month, day and year when audit was conducted.

Page 2 of 2

ETA Form 9065 (Rev. June 2012)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1