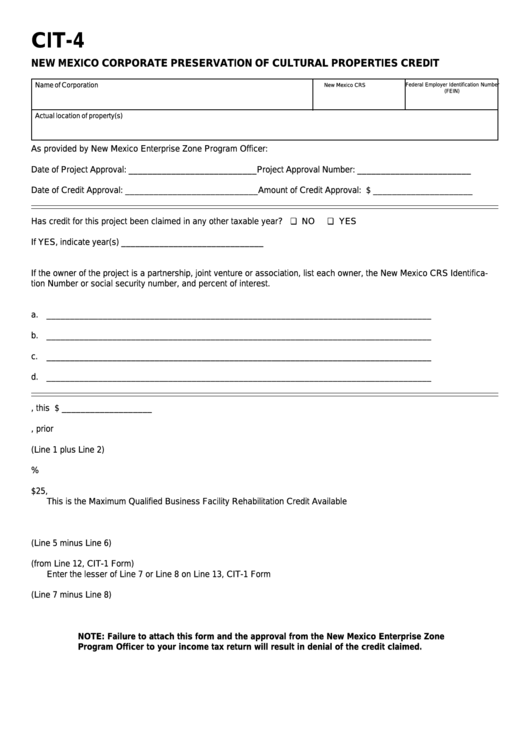

CIT-4

NEW MEXICO CORPORATE PRESERVATION OF CULTURAL PROPERTIES CREDIT

Name of Corporation

New Mexico CRS I.D. Number

Federal Employer Identification Number

(FEIN)

Actual location of property(s)

As provided by New Mexico Enterprise Zone Program Officer:

Date of Project Approval: ___________________________

Project Approval Number: ________________________

Date of Credit Approval: ____________________________

Amount of Credit Approval: $ _____________________

Has credit for this project been claimed in any other taxable year?

NO

YES

If YES, indicate year(s) ______________________________

If the owner of the project is a partnership, joint venture or association, list each owner, the New Mexico CRS Identifica-

tion Number or social security number, and percent of interest.

Name

I.D. Number

Percentage Interest

a. _______________________________________

___________________________

________________

b. _______________________________________

___________________________

________________

c. _______________________________________

___________________________

________________

d. _______________________________________

___________________________

________________

1. Amount approved for credit, this year ..................................................................................... $ ___________________

2. Amount approved for credit, prior year ...................................................................................... ___________________

3. Total credit approved for this project (Line 1 plus Line 2) .......................................................... ___________________

4. Multiply by .................................................................................................................................

50%

5. Enter less of line 3 x line 4 OR $25,000..................................................................................... ___________________

This is the Maximum Qualified Business Facility Rehabilitation Credit Available

6. Credit claimed in prior years ...................................................................................................... ___________________

7. Credit available this year (Line 5 minus Line 6) ......................................................................... ___________________

8. New Mexico liability (from Line 12, CIT-1 Form) ........................................................................ ___________________

Enter the lesser of Line 7 or Line 8 on Line 13, CIT-1 Form

9. Credit available for carryover (Line 7 minus Line 8) ................................................................... ___________________

NOTE: Failure to attach this form and the approval from the New Mexico Enterprise Zone

Program Officer to your income tax return will result in denial of the credit claimed.

1

1