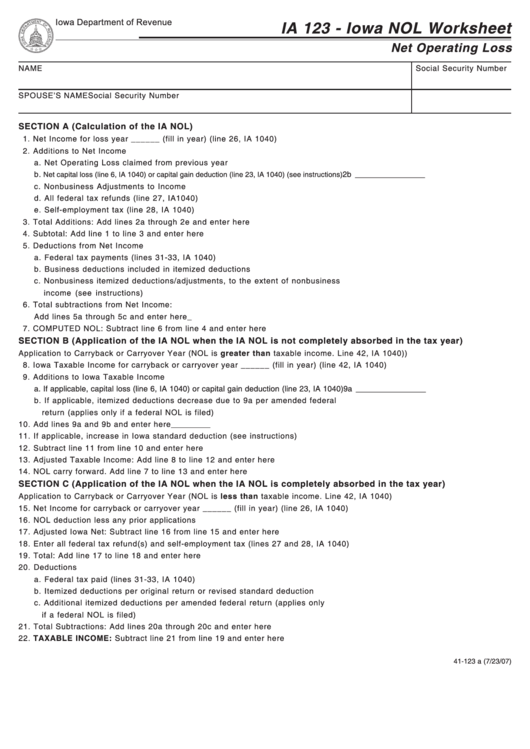

Form Ia 123 - Iowa Nol Worksheet Net Operating Loss

ADVERTISEMENT

Iowa Department of Revenue

IA 123 - Iowa NOL Worksheet

Net Operating Loss

NAME

Social Security Number

SPOUSE’S NAME

Social Security Number

SECTION A (Calculation of the IA NOL)

1. Net Income for loss year ______ (fill in year) (line 26, IA 1040) ....................................................................... 1 _______________

2. Additions to Net Income

a. Net Operating Loss claimed from previous year ...................................................... 2a ________________

b.

2b ________________

Net capital loss (line 6, IA 1040) or capital gain deduction (line 23, IA 1040) (see instructions)

c. Nonbusiness Adjustments to Income ......................................................................... 2c ________________

d. All federal tax refunds (line 27, IA1040) .................................................................... 2d ________________

e. Self-employment tax (line 28, IA 1040) ..................................................................... 2e ________________

3. Total Additions: Add lines 2a through 2e and enter here ................................................................................... 3 ______________

4. Subtotal: Add line 1 to line 3 and enter here ........................................................................................................ 4 ______________

5. Deductions from Net Income

a. Federal tax payments (lines 31-33, IA 1040) ........................................................... 5a ________________

b. Business deductions included in itemized deductions ............................................ 5b ________________

c. Nonbusiness itemized deductions/adjustments, to the extent of nonbusiness

income (see instructions) ............................................................................................. 5c ________________

6. Total subtractions from Net Income:

Add lines 5a through 5c and enter here ................................................................................................................ 6 _______________

7. COMPUTED NOL: Subtract line 6 from line 4 and enter here ........................................................................... 7 _______________

SECTION B (Application of the IA NOL when the IA NOL is not completely absorbed in the tax year)

Application to Carryback or Carryover Year (NOL is greater than taxable income. Line 42, IA 1040))

8. Iowa Taxable Income for carryback or carryover year ______ (fill in year) (line 42, IA 1040) .................... 8 _______________

9. Additions to Iowa Taxable Income

a. If applicable, capital loss (line 6, IA 1040) or capital gain deduction (line 23, IA 1040) 9a ________________

b. If applicable, itemized deductions decrease due to 9a per amended federal

return (applies only if a federal NOL is filed) ............................................................ 9b ________________

10. Add lines 9a and 9b and enter here ....................................................................................................................... 10 _______________

11. If applicable, increase in Iowa standard deduction (see instructions) ............................................................. 11 _______________

12. Subtract line 11 from line 10 and enter here ........................................................................................................ 12 _______________

13. Adjusted Taxable Income: Add line 8 to line 12 and enter here ....................................................................... 13 _______________

14. NOL carry forward. Add line 7 to line 13 and enter here .................................................................................... 14 _______________

SECTION C (Application of the IA NOL when the IA NOL is completely absorbed in the tax year)

Application to Carryback or Carryover Year (NOL is less than taxable income. Line 42, IA 1040)

15. Net Income for carryback or carryover year ______ (fill in year) (line 26, IA 1040) ..................................... 15 _______________

16. NOL deduction less any prior applications ............................................................................................................ 16 _______________

17. Adjusted Iowa Net: Subtract line 16 from line 15 and enter here ..................................................................... 17 _______________

18. Enter all federal tax refund(s) and self-employment tax (lines 27 and 28, IA 1040) ..................................... 18 _______________

19. Total: Add line 17 to line 18 and enter here .......................................................................................................... 19 _______________

20. Deductions

a. Federal tax paid (lines 31-33, IA 1040) ..................................................................... 20a _______________

b. Itemized deductions per original return or revised standard deduction .............. 20b _______________

c. Additional itemized deductions per amended federal return (applies only

if a federal NOL is filed) ................................................................................................ 20c _______________

21. Total Subtractions: Add lines 20a through 20c and enter here ......................................................................... 21 _______________

22. TAXABLE INCOME: Subtract line 21 from line 19 and enter here ................................................................... 22 _______________

41-123 a (7/23/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2