Form Ia 1040 - Iowa Individual Income Tax Form - 2011

ADVERTISEMENT

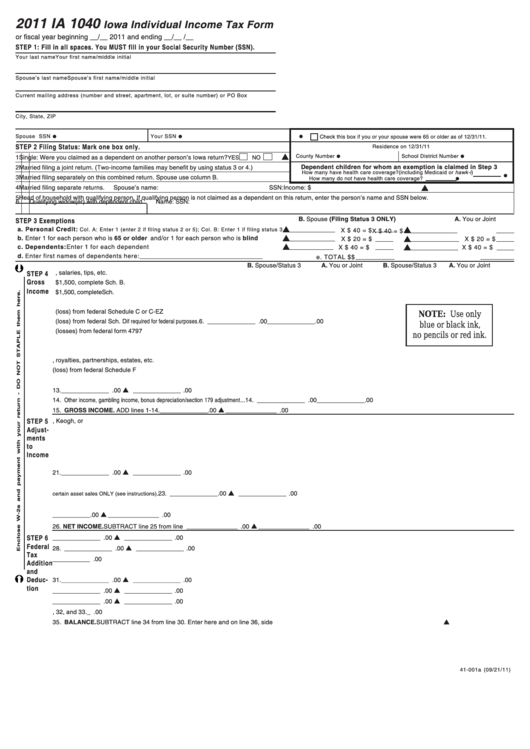

2011 IA 1040

Iowa Individual Income Tax Form

or fiscal year beginning __/__ 2011 and ending __/__ /__

STEP 1: Fill in all spaces. You MUST fill in your Social Security Number (SSN).

Your last name

Your first name/middle initial

Spouse’s last name

Spouse’s first name/middle initial

Current mailing address (number and street, apartment, lot, or suite number) or PO Box

City, State, ZIP

•

•

•

Spouse SSN

Your SSN

Check this box if you or your spouse were 65 or older as of 12/31/11.

STEP 2 Filing Status: Mark one box only.

Residence on 12/31/11

•

•

County Number

School District Number

1

Single: Were you claimed as a dependent on another person’s Iowa return?

YES

NO

Dependent children for whom an exemption is claimed in Step 3

2

Married filing a joint return. (Two-income families may benefit by using status 3 or 4.)

•

How many have health care coverage?(including Medicaid or hawk-i)

•

3

Married filing separately on this combined return. Spouse use column B.

How many do not have health care coverage?

4

Married filing separate returns.

Spouse’s name:

SSN:

Income: $

5

Head of household with qualifying person. If qualifying person is not claimed as a dependent on this return, enter the person’s name and SSN below.

6

Qualifying widow(er) with dependent child.

Name:

SSN:

B. Spouse (Filing Status 3 ONLY)

A. You or Joint

STEP 3 Exemptions

a. Personal Credit:

Col. A: Enter 1 (enter 2 if filing status 2 or 5); Col. B: Enter 1 if filing status 3

X $ 40 = $

X $ 40 = $

b. Enter 1 for each person who is 65 or older and/or 1 for each person who is blind..............

X $ 20 = $

X $ 20 = $

c. Dependents: Enter 1 for each dependent ...................................................................

X $ 40 = $

X $ 40 = $

d. Enter first names of dependents here: ____________________________________

e. TOTAL $

$

B. Spouse/Status 3

A. You or Joint

B. Spouse/Status 3

A. You or Joint

1. Wages, salaries, tips, etc. ................................................................. 1. ______________ .00

______________ .00

STEP 4

Gross

2. Taxable interest income. If more than $1,500, complete Sch. B. ...... 2. ______________ .00

______________ .00

Income

3. Ordinary dividend income. If more than $1,500, complete Sch. B. ...... 3. ______________ .00

______________ .00

4. Alimony received .............................................................................. 4. ______________ .00

______________ .00

5. Business income/(loss) from federal Schedule C or C-EZ .............. 5. ______________ .00

______________ .00

NOTE: Use only

6. Capital gain/(loss) from federal Sch. D if required for federal purposes . 6. ______________ .00

______________ .00

blue or black ink,

7. Other gains/(losses) from federal form 4797 .................................... 7. ______________ .00

______________ .00

no pencils or red ink.

8. Taxable IRA distributions .................................................................. 8. ______________ .00

______________ .00

9. Taxable pensions and annuities ....................................................... 9. ______________ .00

______________ .00

10. Rents, royalties, partnerships, estates, etc. ..................................... 10. ______________ .00

______________ .00

11. Farm income/(loss) from federal Schedule F ................................... 11. ______________ .00

______________ .00

12. Unemployment compensation. See instructions. ............................. 12. ______________ .00

______________ .00

13. Taxable Social Security benefits ...................................................... 13. ______________ .00

______________ .00

14. Other income, gambling income, bonus depreciation/section 179 adjustment ... 14. ______________ .00

______________ .00

15. GROSS INCOME. ADD lines 1-14. ........................................................................................................................... 15. _______________ .00

_______________ .00

STEP 5

16. Payments to an IRA, Keogh, or SEP ............................................... 16. ______________ .00

______________ .00

Adjust-

17. Deductible part of self-employment tax ............................................ 17. ______________ .00

______________ .00

ments

18. Health insurance deduction .............................................................. 18. ______________ .00

______________ .00

to

19. Penalty on early withdrawal of savings ............................................ 19. ______________ .00

______________ .00

Income

20. Alimony paid ..................................................................................... 20. ______________ .00

______________ .00

21. Pension/retirement income exclusion .............................................. 21. ______________ .00

______________ .00

22. Moving expense deduction from federal form 3903 ......................... 22. ______________ .00

______________ .00

23. Iowa capital gain deduction

23. ______________ .00

______________ .00

certain asset sales ONLY (see instructions).

24. Other adjustments ............................................................................ 24. ______________ .00

______________ .00

25. Total adjustments. ADD lines 16-24. ........................................................................................................................ 25. _______________ .00

_______________ .00

26. NET INCOME. SUBTRACT line 25 from line 15. .................................................................................................... 26. _______________ .00

_______________ .00

STEP 6

27. Federal income tax refund / overpayment received in 2011 ............ 27. ______________ .00

______________ .00

Federal

28. Self-employment/household employment taxes .............................. 28. ______________ .00

______________ .00

Tax

29. Addition for federal taxes. ADD lines 27 and 28. ...................................................................................................... 29. _______________ .00

_______________ .00

Addition

30. Total. ADD lines 26 and 29. ...................................................................................................................................... 30. _______________ .00

_______________ .00

and

Deduc-

31. Federal tax withheld ......................................................................... 31. ______________ .00

______________ .00

tion

32. Federal estimated tax payments made in 2011 ............................... 32. ______________ .00

______________ .00

33. Additional federal tax paid in 2011 for 2010 and prior years ........... 33. ______________ .00

______________ .00

34. Deduction for federal taxes. ADD lines 31, 32, and 33. ............................................................................................ 34. _______________ .00

_______________ .00

35. BALANCE. SUBTRACT line 34 from line 30. Enter here and on line 36, side 2. .................................................... 35. _______________ .00

_______________ .00

41-001a (09/21/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2