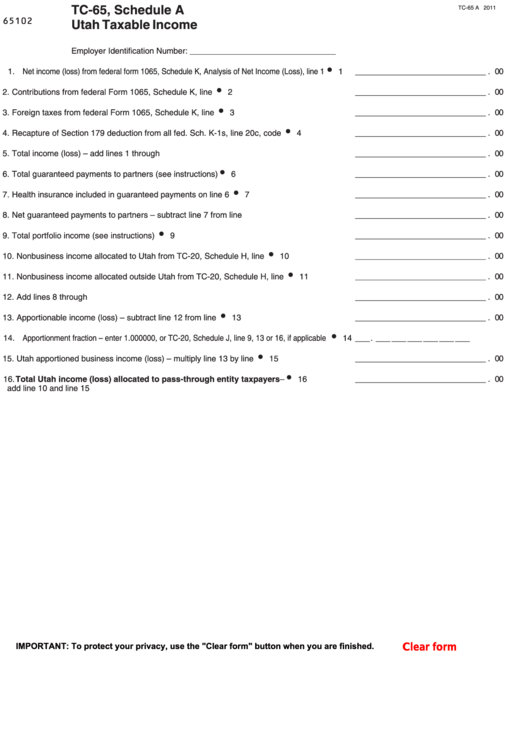

TC-65, Schedule A

TC-65 A 2011

65102

Utah Taxable Income

Employer Identification Number: __ ___________ ___ ___

1. Net income (loss) from federal form 1065, Schedule K, Analysis of Net Income (Loss), line 1

1 ___ ____ ____ _ _ _ _ _ _ . 00

2. Contributions from federal Form 1065, Schedule K, line 13a .....................................

2 __ ____ ___ ____ _ _ _ _ . 00

3. Foreign taxes from federal Form 1065, Schedule K, line 16l ......................................

3 __ ____ ___ ____ _ _ _ _ . 00

4. Recapture of Section 179 deduction from all fed. Sch. K-1s, line 20c, code M...........

4 __ ____ ___ ____ _ _ _ _ . 00

5. Total income (loss) – add lines 1 through 4 ................................................................

5 __ ____ ____ __ _ _ _ _ _ . 00

6. Total guaranteed payments to partners (see instructions) ..........................................

6 __ ____ ___ ____ _ _ _ _ . 00

7. Health insurance included in guaranteed payments on line 6 ....................................

7 __ ____ ___ ____ _ _ _ _ . 00

8. Net guaranteed payments to partners – subtract line 7 from line 6 ............................

8 __ ____ ___ ____ _ _ _ _ . 00

9. Total portfolio income (see instructions) .....................................................................

9 __ ____ ___ ____ _ _ _ _ . 00

10. Nonbusiness income allocated to Utah from TC-20, Schedule H, line 14 ..................

10 __ ____ ___ ____ _ _ _ _ . 00

11. Nonbusiness income allocated outside Utah from TC-20, Schedule H, line 28..........

11 __ ____ ___ ____ _ _ _ _ . 00

12. Add lines 8 through 11 ................................................................................................

12 __ ____ ____ __ _ _ _ _ _ . 00

13. Apportionable income (loss) – subtract line 12 from line 5 .........................................

13 __ ____ ___ ____ _ _ _ _ . 00

14. Apportionment fraction – enter 1.000000, or TC-20, Schedule J, line 9, 13 or 16, if applicable

14 __ . __ __ __ __ __ __

15. Utah apportioned business income (loss) – multiply line 13 by line 14.......................

15 __ ____ ___ ____ _ _ _ _ . 00

16. Total Utah income (loss) allocated to pass-through entity taxpayers – ..............

16 _ ____ ____ ___ _ _ _ _ _ . 00

add line 10 and line 15

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1