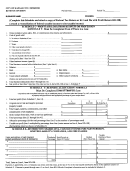

PA Schedule C

Profit or Loss from Business or

Profession (Sole Proprietorship)

PA-40 C (09–12) (FI)

PA DEPARTMENT OF REVENUE

Other Pennsylvania and Federal Income Tax

Line Instructions

Differences -

Identification Information.

Complete each line.

PA income from the operation of business generally differs

Owner's Name.

Enter the name of the business owner. If you

from the income determined for federal income tax purposes.

are married and you jointly owned the business with your spouse,

enter both names. If you and your spouse have separate

Further, Pennsylvania will no longer accept a PA Schedule C-F

business activities, complete separate PA Schedule(s) C.

Reconciliation for the purpose of adjusting the federal business

income to PA business income. Therefore, the items which

Federal NAICS Code.

Provide your Federal NAICS Code as

were previously included as additions to PA income or expense

identified on your Federal Schedule C.

on the PA Schedule C-F Reconciliation should be included with

Social Security Number (SSN).

Enter the SSN of the

the specific line of income or expense on the PA Schedule C.

business owner. If you are married and you jointly owned the

In addition, those items which Pennsylvania does not require be

business, enter the SSN that you entered first on your PA tax

reported as income or does not allow as expense in determining

return.

net business income, which are allowed in the determination

A. Main Business Activity.

Describe the business or

of net federal business income, should not be included in the

professional activity that provided your principal source of

specific business income or expenses on PA Schedule C.

income for Line 1. Use the same description you use for

your Federal Schedule C. Enter the principal business or

Examples of items that Pennsylvania requires as additions to

professional code you use on your Federal Schedule C.

income include: any advance receipts for goods or services;

B. Business Name.

Enter the name of the business as you

working capital interest or dividend income including federal-

registered with the IRS.

exempt interest and dividend income from obligations of other

C. Taxpayer Identification Numbers.

Enter the

states; gains from the sale of business assets where the prop-

Federal Employer Identification Number (FEIN) assigned to

erty is replaced by similar property; gains from like-kind

the business. If you do not have an FEIN for your Federal

exchanges; gains from involuntary conversions (such as those

Schedule C, leave this space blank. Enter the Sales Tax

from IRC Section 1033); and gains from the sale of property

License number if you have one, or leave this space blank.

where PA basis is different than federal basis.

D. Business Address.

Enter the complete address of the

business.

Examples of items that Pennsylvania allows as additions to

E. Closing Inventory Valuation.

Fill in the appropriate

expenses that required a reduction for federal tax purposes

oval. Submit an explanation if necessary.

include: a meals, travel and entertainment expense deduction

F. Accounting Method.

Fill in the oval for the accounting

of 100 percent by Pennsylvania for the expenses incurred; any

method you use for this business. Submit an explanation

differences in depreciation related to differences in basis of

if necessary.

assets, amount of allowable Section 179 expense, or method

G. Inventory Changes.

Check “Yes” or “No” for this

of depreciation for federal or PA purposes; and any other

question. Submit an explanation if necessary.

reductions in federal expenses allowed at 100 percent for PA

H. Office In-Home.

Check “Yes” if you deduct expenses

personal income tax purposes.

for an office in-home. Check “No” if you do not deduct

Examples of items that Pennsylvania requires as reductions in

expenses for an office in-home.

federal income or expenses include: income taxes based upon

Out of Business.

I.

If the business is out-of-existence at

gross or net income; any differences in depreciation related to

the end of the tax year for which you are filing, fill in the

differences in basis of assets, amount of allowable Section 179

oval.

expense, or method of depreciation for federal or PA purposes;

Part I. Income

recognition of cancellation of debt income; recognition of income

Use generally accepted accounting principles and practices to

from IRC Section 481(a) spread adjustments; payments for

maintain your books and records, and report your income

owner pension, profit-sharing plans, deferred, or welfare benefit

from your business or professional activity.

plans; percentage depletion; direct expensing of organizational

Line 1a.

Gross receipts or sales. Include all amounts you

expenses, start-up costs, intangible drilling costs or syndication

received in operating your business or profession. PA law does

fees; losses from the sale of property where PA basis is

not contain provisions for statutory employees. A statutory

different than federal basis; and any other income or expenses

employee reports his or her PA taxable income on Line 1a,

where there is a specialized federal treatment that is not

PA-40, and uses PA Schedule UE to deduct his or her allowable

employee business expenses.

specifically addressed or allowed by PA personal income tax law

that might involve additional expensing, expensing verses

Installment Sales.

You may use the installment method

capitalization, carry back or carry forward of losses, income

for sales of inventory. Include interest on such sales in gross

recognition, or other special treatments.

receipts.

PAGE 2

NEXT PAGE

1

1 2

2 3

3 4

4 5

5 6

6