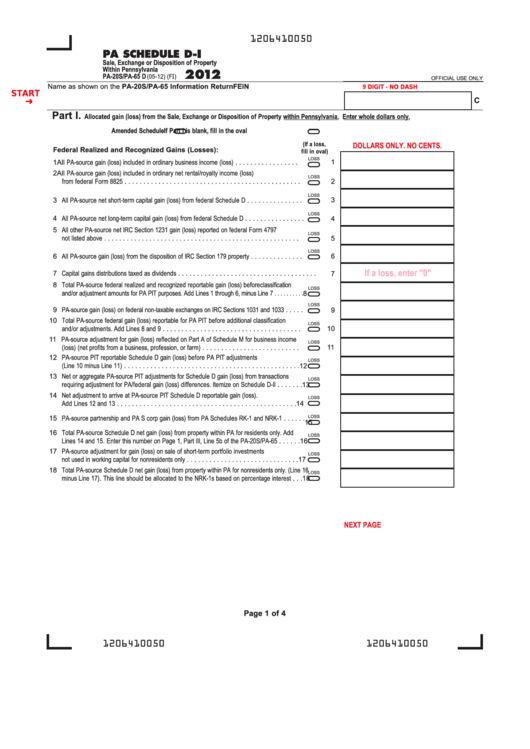

1206410050

PA SCHEDULE D-I

Sale, Exchange or Disposition of Property

Within Pennsylvania

2012

PA-20S/PA-65 D

(05-12) (FI)

OFFICIAL USE ONLY

Name as shown on the PA-20S/PA-65 Information Return

FEIN

9 DIGIT - NO DASH

START

C

Part I.

Allocated gain (loss) from the Sale, Exchange or Disposition of Property within Pennsylvania. Enter whole dollars only.

Amended Schedule

If Part I is blank, fill in the oval

DOLLARS ONLY. NO CENTS.

(If a loss,

Federal Realized and Recognized Gains (Losses):

fill in oval)

LOSS

1 All PA-source gain (loss) included in ordinary business income (loss) . . . . . . . . . . . . . . . . .

1

2 All PA-source gain (loss) included in ordinary net rental/royalty income (loss)

LOSS

from federal Form 8825 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

LOSS

3 All PA-source net short-term capital gain (loss) from federal Schedule D . . . . . . . . . . . . . . .

3

LOSS

4 All PA-source net long-term capital gain (loss) from federal Schedule D . . . . . . . . . . . . . . . .

4

5 All other PA-source net IRC Section 1231 gain (loss) reported on federal Form 4797

LOSS

not listed above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

LOSS

6 All PA-source gain (loss) from the disposition of IRC Section 179 property . . . . . . . . . . . . . .

6

If a loss, enter "0"

7 Capital gains distributions taxed as dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

8 Total PA-source federal realized and recognized reportable gain (loss) before classification

LOSS

and/or adjustment amounts for PA PIT purposes. Add Lines 1 through 6, minus Line 7 . . . . . . . . . .

8

LOSS

9 PA-source gain (loss) on federal non-taxable exchanges on IRC Sections 1031 and 1033 . . . . .

9

10 Total PA-source federal gain (loss) reportable for PA PIT before additional classification

LOSS

and/or adjustments. Add Lines 8 and 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11 PA-source adjustment for gain (loss) reflected on Part A of Schedule M for business income

LOSS

11

(loss) (net profits from a business, profession, or farm) . . . . . . . . . . . . . . . . . . . . . . . . . .

12 PA-source PIT reportable Schedule D gain (loss) before PA PIT adjustments

LOSS

(Line 10 minus Line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13 Net or aggregate PA-source PIT adjustments for Schedule D gain (loss) from transactions

LOSS

requiring adjustment for PA/federal gain (loss) differences. Itemize on Schedule D-II . . . . . . .

13

14 Net adjustment to arrive at PA-source PIT Schedule D reportable gain (loss).

LOSS

Add Lines 12 and 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

LOSS

15 PA-source partnership and PA S corp gain (loss) from PA Schedules RK-1 and NRK-1 . . . . . .

15

16 Total PA-source Schedule D net gain (loss) from property within PA for residents only. Add

LOSS

Lines 14 and 15. Enter this number on Page 1, Part III, Line 5b of the PA-20S/PA-65 . . . . . .

16

17 PA-source adjustment for gain (loss) on sale of short-term portfolio investments

LOSS

17

not used in working capital for nonresidents only . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18 Total PA-source Schedule D net gain (loss) from property within PA for nonresidents only. (Line 16

LOSS

18

minus Line 17). This line should be allocated to the NRK-1s based on percentage interest . . .

PRINT FORM

Reset Entire Form

NEXT PAGE

Page 1 of 4

1206410050

1206410050

1

1 2

2 3

3 4

4