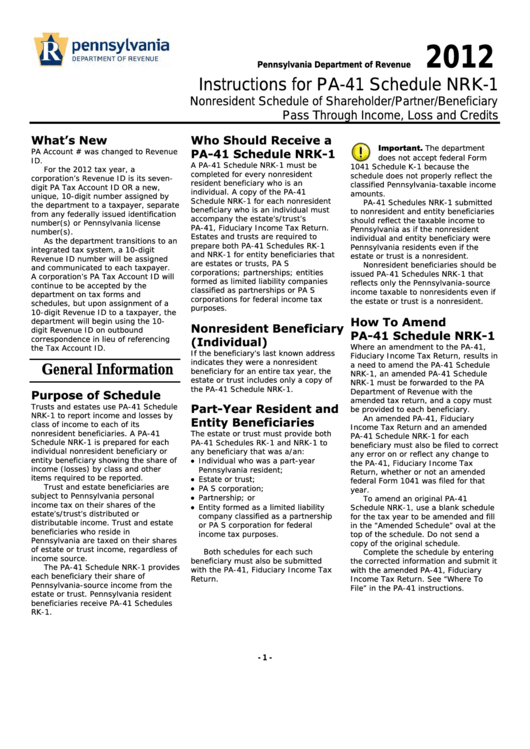

Instructions For Form Pa-41 - Schedule Nrk-1 Nonresident Schedule Of Shareholder/partner/beneficiary Pass Through Income, Loss And Credits - 2012

ADVERTISEMENT

2012

Pennsylvania Department of Revenue

Instructions for PA-41 Schedule NRK-1

Nonresident Schedule of Shareholder/Partner/Beneficiary

Pass Through Income, Loss and Credits

What’s New

Who Should Receive a

Important.

The department

PA Account # was changed to Revenue

PA-41 Schedule NRK-1

does not accept federal Form

ID.

A PA-41 Schedule NRK-1 must be

1041 Schedule K-1 because the

For the 2012 tax year, a

completed for every nonresident

schedule does not properly reflect the

corporation’s Revenue ID is its seven-

resident beneficiary who is an

classified Pennsylvania-taxable income

digit PA Tax Account ID OR a new,

individual. A copy of the PA-41

amounts.

unique, 10-digit number assigned by

Schedule NRK-1 for each nonresident

PA-41 Schedules NRK-1 submitted

the department to a taxpayer, separate

beneficiary who is an individual must

to nonresident and entity beneficiaries

from any federally issued identification

accompany the estate’s/trust’s

should reflect the taxable income to

number(s) or Pennsylvania license

PA-41, Fiduciary Income Tax Return.

Pennsylvania as if the nonresident

number(s).

Estates and trusts are required to

individual and entity beneficiary were

As the department transitions to an

prepare both PA-41 Schedules RK-1

Pennsylvania residents even if the

integrated tax system, a 10-digit

and NRK-1 for entity beneficiaries that

estate or trust is a nonresident.

Revenue ID number will be assigned

are estates or trusts, PA S

Nonresident beneficiaries should be

and communicated to each taxpayer.

corporations; partnerships; entities

issued PA-41 Schedules NRK-1 that

A corporation’s PA Tax Account ID will

formed as limited liability companies

reflects only the Pennsylvania-source

continue to be accepted by the

classified as partnerships or PA S

income taxable to nonresidents even if

department on tax forms and

corporations for federal income tax

the estate or trust is a nonresident

.

schedules, but upon assignment of a

purposes.

10-digit Revenue ID to a taxpayer, the

How To Amend

department will begin using the 10-

Nonresident Beneficiary

digit Revenue ID on outbound

PA-41 Schedule NRK-1

correspondence in lieu of referencing

(Individual)

Where an amendment to the PA-41,

the Tax Account ID.

If the beneficiary’s last known address

Fiduciary Income Tax Return, results in

indicates they were a nonresident

a need to amend the PA-41 Schedule

General Information

beneficiary for an entire tax year, the

NRK-1, an amended PA-41 Schedule

estate or trust includes only a copy of

NRK-1 must be forwarded to the PA

the PA-41 Schedule NRK-1.

Department of Revenue with the

Purpose of Schedule

amended tax return, and a copy must

Trusts and estates use PA-41 Schedule

Part-Year Resident and

be provided to each beneficiary.

NRK-1 to report income and losses by

An amended PA-41, Fiduciary

Entity Beneficiaries

class of income to each of its

Income Tax Return and an amended

nonresident beneficiaries. A PA-41

The estate or trust must provide both

PA-41 Schedule NRK-1 for each

Schedule NRK-1 is prepared for each

PA-41 Schedules RK-1 and NRK-1 to

beneficiary must also be filed to correct

individual nonresident beneficiary or

any beneficiary that was a/an:

any error on or reflect any change to

entity beneficiary showing the share of

Individual who was a part-year

the PA-41, Fiduciary Income Tax

income (losses) by class and other

Pennsylvania resident;

Return, whether or not an amended

items required to be reported.

Estate or trust;

federal Form 1041 was filed for that

Trust and estate beneficiaries are

PA S corporation;

year.

subject to Pennsylvania personal

Partnership; or

To amend an original PA-41

income tax on their shares of the

Entity formed as a limited liability

Schedule NRK-1, use a blank schedule

estate’s/trust’s distributed or

company classified as a partnership

for the tax year to be amended and fill

distributable income. Trust and estate

or PA S corporation for federal

in the “Amended Schedule” oval at the

beneficiaries who reside in

income tax purposes.

top of the schedule. Do not send a

Pennsylvania are taxed on their shares

copy of the original schedule.

of estate or trust income, regardless of

Both schedules for each such

Complete the schedule by entering

income source.

beneficiary must also be submitted

the corrected information and submit it

The PA-41 Schedule NRK-1 provides

with the PA-41, Fiduciary Income Tax

with the amended PA-41, Fiduciary

each beneficiary their share of

Return.

Income Tax Return. See “Where To

Pennsylvania-source income from the

File” in the PA-41 instructions.

estate or trust. Pennsylvania resident

beneficiaries receive PA-41 Schedules

RK-1.

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3