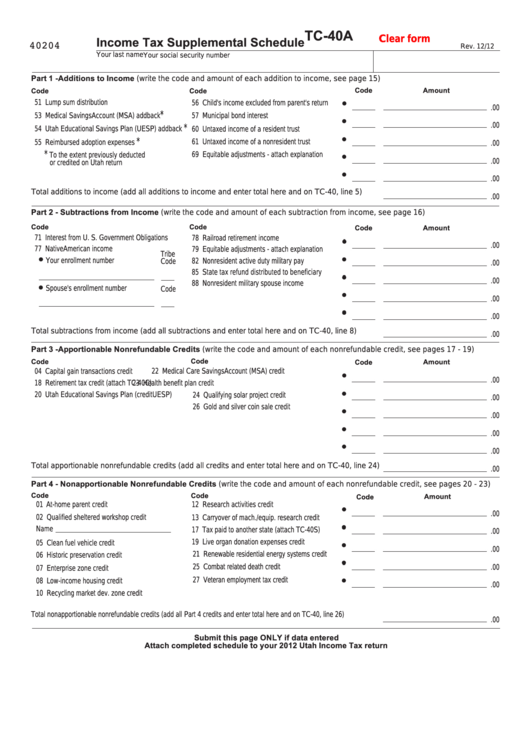

TC-40A

Clear form

Income Tax Supplemental Schedule

40204

Rev. 12/12

Your last name

Your social security number

Part 1 - Additions to Income (write the code and amount of each addition to income, see page 15)

Code

Amount

Code

Code

51 Lump sum distribution

56 Child's income excluded from parent's return

.00

*

53 Medical Savings Account (MSA) addback

57 Municipal bond interest

.00

*

54 Utah Educational Savings Plan (UESP) addback

60 Untaxed income of a resident trust

*

61 Untaxed income of a nonresident trust

55 Reimbursed adoption expenses

.00

*

69 Equitable adjustments - attach explanation

To the extent previously deducted

.00

or credited on Utah return

.00

Total additions to income (add all additions to income and enter total here and on TC-40, line 5)

.00

Part 2 - Subtractions from Income (write the code and amount of each subtraction from income, see page 16)

Code

Code

Code

Amount

71 Interest from U. S. Government Obligations

78 Railroad retirement income

.00

77 Native American income

79 Equitable adjustments - attach explanation

Tribe

82 Nonresident active duty military pay

Your enrollment number

Code

.00

85 State tax refund distributed to beneficiary

.00

88 Nonresident military spouse income

Spouse's enrollment number

Code

.00

.00

Total subtractions from income (add all subtractions and enter total here and on TC-40, line 8)

.00

Part 3 - Apportionable Nonrefundable Credits (write the code and amount of each nonrefundable credit, see pages 17 - 19)

Code

Code

Amount

Code

04 Capital gain transactions credit

22 Medical Care Savings Account (MSA) credit

.00

23 Health benefit plan credit

18 Retirement tax credit (attach TC-40C)

20 Utah Educational Savings Plan (

24 Qualifying solar project credit

UESP)

credit

.00

26 Gold and silver coin sale credit

.00

.00

.00

Total apportionable nonrefundable credits (add all credits and enter total here and on TC-40, line 24)

.00

Part 4 - Nonapportionable Nonrefundable Credits (write the code and amount of each nonrefundable credit, see pages 20 - 23)

Code

Code

Amount

Code

12 Research activities credit

01 At-home parent credit

.00

02 Qualified sheltered workshop credit

13 Carryover of mach./equip. research credit

17 Tax paid to another state (attach TC-40S)

Name

.00

19 Live organ donation expenses credit

05 Clean fuel vehicle credit

.00

21 Renewable residential energy systems credit

06 Historic preservation credit

25 Combat related death credit

.00

07 Enterprise zone credit

27 Veteran employment tax credit

08 Low-income housing credit

.00

10 Recycling market dev. zone credit

Total nonapportionable nonrefundable credits (add all Part 4 credits and enter total here and on TC-40, line 26)

.00

Submit this page ONLY if data entered

Attach completed schedule to your 2012 Utah Income Tax return

1

1 2

2