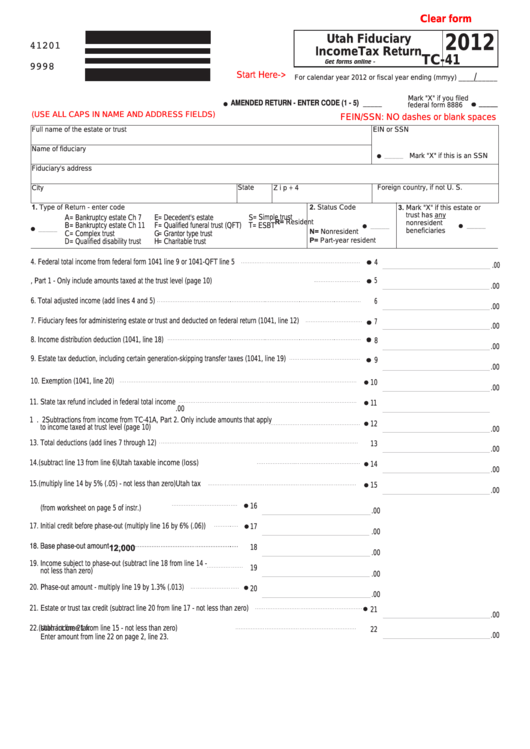

Clear form

Utah Fiduciary

2012

41201

Income Tax Return

TC-41

Get forms online - tax.utah.gov

9998

Start Here->

/

For calendar year 2012 or fiscal year ending (mmyy) __________

Mark "X" if you filed

AMENDED RETURN - ENTER CODE (1 - 5)

_____

_____

federal form 8886

(USE ALL CAPS IN NAME AND ADDRESS FIELDS)

FEIN/SSN: NO dashes or blank spaces

Full name of the estate or trust

EIN or SSN

Name of fiduciary

_____

Mark "X" if this is an SSN

Fiduciary's address

State

City

Zip + 4

Foreign country, if not U. S.

2. Status Code

1. Type of Return - enter code

3. Mark "X" if this estate or

trust has

any

A

= Bankruptcy estate Ch 7

E

= Decedent's estate

S

= Simple trust

R= Resident

nonresident

B

= Bankruptcy estate Ch 11

F

= Qualified funeral trust (QFT)

T

= ESBT

_____

_____

_____

beneficiaries

N= Nonresident

C

= Complex trust

G

= Grantor type trust

P= Part-year resident

D

= Qualified disability trust

H

= Charitable trust

4. Federal total income from federal form 1041 line 9 or 1041-QFT line 5

4

.00

5

5. Additions to income from TC-41A, Part 1 - Only include amounts taxed at the trust level (page 10)

.00

6. Total adjusted income (add lines 4 and 5)

6

.00

7. Fiduciary fees for administering estate or trust and deducted on federal return (1041, line 12)

7

.00

8. Income distribution deduction (1041, line 18)

8

.00

9. Estate tax deduction, including certain generation-skipping transfer taxes (1041, line 19)

9

.00

10. Exemption (1041, line 20)

10

.00

11. State tax refund included in federal total income

11

.00

1 . 2 Subtractions from income from TC-41A, Part 2. Only include amounts that apply

12

to income taxed at trust level (page 10)

.00

13. Total deductions (add lines 7 through 12)

13

.00

14.

Utah taxable income (loss)

(subtract line 13 from line 6)

14

.00

15.

Utah tax

(multiply line 14 by 5% (.05) - not less than zero)

15

.00

16. Allowable deductions for estate or trust credit

16

(from worksheet on page 5 of instr.)

.00

17. Initial credit before phase-out (multiply line 16 by 6% (.06))

17

.00

18. Base phase-out amount

18

12,000

.00

19. Income subject to phase-out (subtract line 18 from line 14 -

19

not less than zero)

.00

20. Phase-out amount - multiply line 19 by 1.3% (.013)

20

.00

21. Estate or trust tax credit (subtract line 20 from line 17 - not less than zero)

21

.00

22.

Utah income tax

(subtract line 21 from line 15 - not less than zero)

22

.00

Enter amount from line 22 on page 2, line 23.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12