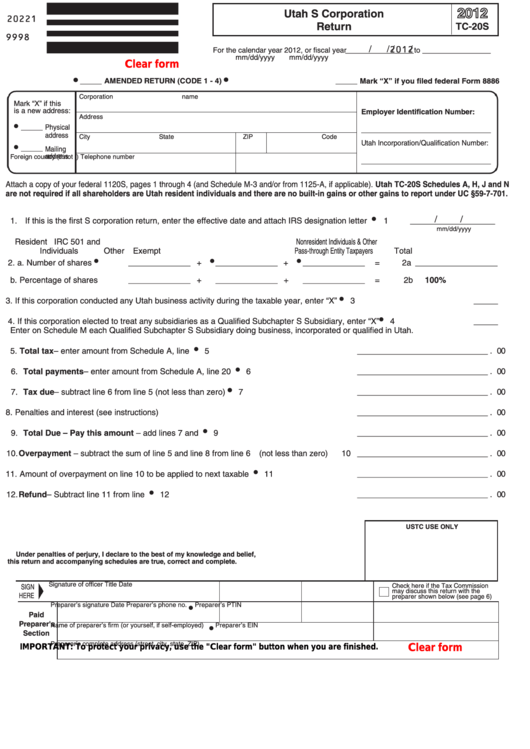

Utah S Corporation

Return

TC-20S

/

/

/

/

For the calendar year 2012, or fiscal year________________ to ________________

mm/dd/yyyy

mm/dd/yyyy

Clear form

___ AMENDED RETURN (CODE 1 - 4)

___ Mark “X” if you filed federal Form 8886

Corporation name

Mark “X” if this

is a new address:

Employer Identification Number:

Address

___ Physical

___________________

address

City

State

ZIP Code

Utah Incorporation/Qualification Number:

___ Mailing

address

Foreign country (if not U.S.)

Telephone number

___________________

Attach a copy of your federal 1120S, pages 1 through 4 (and Schedule M-3 and/or from 1125-A, if applicable). Utah TC-20S Schedules A, H, J and N

are not required if all shareholders are Utah resident individuals and there are no built-in gains or other gains to report under UC §59-7-701.

/

/

1. If this is the first S corporation return, enter the effective date and attach IRS designation letter .......

1 ___________

mm/dd/yyyy

Resident

IRC 501 and

Nonresident Individuals & Other

Individuals

Other Exempt

Pass-through Entity Taxpayers

Total

2. a. Number of shares

+

+

=

2a

_________

_________

_________

____________

b. Percentage of shares

+

+

=

2b

100%

_________

_________

_________

3. If this corporation conducted any Utah business activity during the taxable year, enter “X” .........................................

3 ___

4. If this corporation elected to treat any subsidiaries as a Qualified Subchapter S Subsidiary, enter “X” .........................

4 ___

Enter on Schedule M each Qualified Subchapter S Subsidiary doing business, incorporated or qualified in Utah.

5. Total tax – enter amount from Schedule A, line 17 ....................................................

5 _________________ . 00

6. Total payments – enter amount from Schedule A, line 20 ........................................

6 _________________ . 00

7. Tax due – subtract line 6 from line 5 (not less than zero)...........................................

7 _________________ . 00

8. Penalties and interest (see instructions) .....................................................................

8 _________________ . 00

9. Total Due – Pay this amount – add lines 7 and 8.....................................................

9 _________________ . 00

10. Overpayment – subtract the sum of line 5 and line 8 from line 6 (not less than zero)

10 _________________ . 00

11. Amount of overpayment on line 10 to be applied to next taxable year .......................

11 _________________ . 00

12. Refund – Subtract line 11 from line 10.......................................................................

12 _________________ . 00

USTC USE ONLY

Under penalties of perjury, I declare to the best of my knowledge and belief,

this return and accompanying schedules are true, correct and complete.

Signature of officer

Title

Date

Check here if the Tax Commission

SIGN

may discuss this return with the

HERE

preparer shown below (see page 6)

Preparer’s signature

Date

Preparer’s phone no.

Preparer’s PTIN

Paid

Preparer's

Name of preparer’s firm (or yourself, if self-employed)

Preparer’s EIN

Section

Preparer’s complete address (street, city, state, ZIP)

Clear form

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13