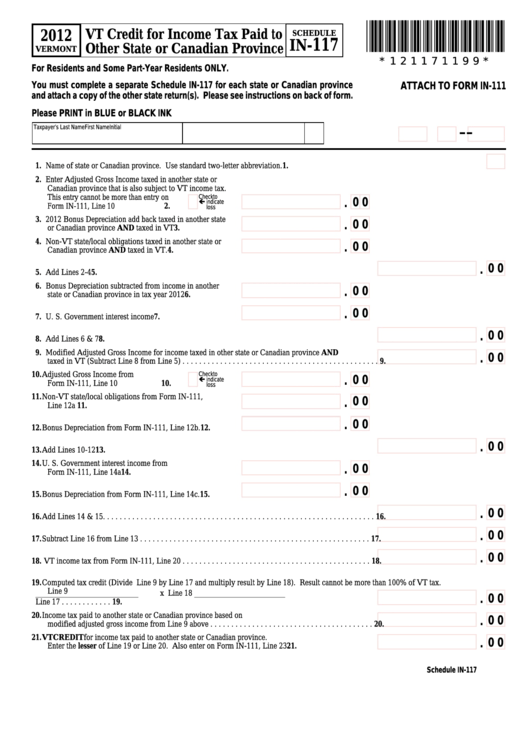

Schedule In-117 - Vt Credit For Income Tax Paid To Other State Or Canadian Province - 2012

ADVERTISEMENT

*121171199*

VT Credit for Income Tax Paid to

2012

SCHEDULE

117

IN-

Other State or Canadian Province

VERMONT

* 1 2 1 1 7 1 1 9 9 *

For Residents and Some Part-Year Residents ONLY.

You must complete a separate Schedule IN-117 for each state or Canadian province

ATTACH TO FORM IN-111

and attach a copy of the other state return(s). Please see instructions on back of form.

Please PRINT in BLUE or BLACK INK

Taxpayer’s Last Name

First Name

Initial

-

-

1. Name of state or Canadian province. Use standard two-letter abbreviation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. Enter Adjusted Gross Income taxed in another state or

Canadian province that is also subject to VT income tax.

Check to

This entry cannot be more than entry on

.

ç indicate

0 0

loss

Form IN-111, Line 10 . . . . . . . . . . . . . . . . .

2.

3. 2012 Bonus Depreciation add back taxed in another state

.

0 0

or Canadian province AND taxed in VT . . . . . . . . . . . . . . 3.

4. Non-VT state/local obligations taxed in another state or

.

0 0

Canadian province AND taxed in VT. . . . . . . . . . . . . . . . . 4.

.

0 0

5. Add Lines 2-4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

6. Bonus Depreciation subtracted from income in another

.

0 0

state or Canadian province in tax year 2012 . . . . . . . . . . . . 6.

.

0 0

7. U. S. Government interest income . . . . . . . . . . . . . . . . . . . 7.

.

0 0

8. Add Lines 6 & 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

9. Modified Adjusted Gross Income for income taxed in other state or Canadian province AND

.

0 0

taxed in VT (Subtract Line 8 from Line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

Check to

10. Adjusted Gross Income from

.

ç indicate

0 0

loss

Form IN-111, Line 10 . . . . . . . . . . . . . . . . .

10.

11. Non-VT state/local obligations from Form IN-111,

.

0 0

Line 12a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

.

0 0

12. Bonus Depreciation from Form IN-111, Line 12b. . . . . . 12.

.

0 0

13. Add Lines 10-12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

14. U. S. Government interest income from

.

0 0

Form IN-111, Line 14a . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

.

0 0

15. Bonus Depreciation from Form IN-111, Line 14c. . . . . . . 15.

.

0 0

16. Add Lines 14 & 15. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16.

.

0 0

17. Subtract Line 16 from Line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17.

.

0 0

18. VT income tax from Form IN-111, Line 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.

19. Computed tax credit (Divide Line 9 by Line 17 and multiply result by Line 18). Result cannot be more than 100% of VT tax.

Line 9

__________________________

x Line 18 _______________________

.

0 0

Line 17

. . . . . . . . . . . . 19.

20. Income tax paid to another state or Canadian province based on

.

0 0

modified adjusted gross income from Line 9 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20.

21. VT CREDIT for income tax paid to another state or Canadian province.

.

0 0

Enter the lesser of Line 19 or Line 20. Also enter on Form IN-111, Line 23 . . . . . . . . . . . . . . . . . . . 21.

Schedule IN-117

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2