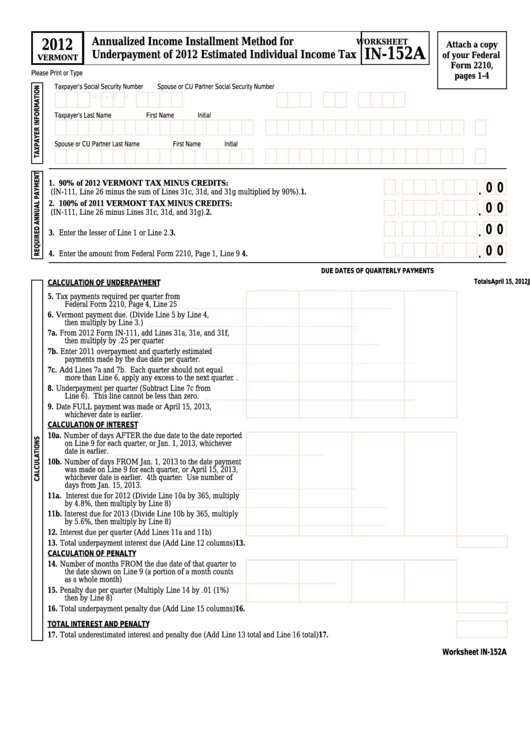

Worksheet In-152a - Vermont Annualized Income Installment Method For Underpayment Of 2012 Estimated Individual Income Tax - 2012

ADVERTISEMENT

Annualized Income Installment Method for

2012

WORKSHEET

Attach a copy

152A

IN-

Underpayment of 2012 Estimated Individual Income Tax

of your Federal

VERMONT

Form 2210,

Please Print or Type

pages 1-4

Taxpayer’s Social Security Number

Spouse or CU Partner Social Security Number

-

-

-

-

Taxpayer’s Last Name

First Name

Initial

Spouse or CU Partner Last Name

First Name

Initial

0 0

1. 90% of 2012 VERMONT TAX MINUS CREDITS:

,

,

.

(IN-111, Line 26 minus the sum of Lines 31c, 31d, and 31g multiplied by 90%). . . . . . . . . . . . . . . . . . 1.

0 0

2. 100% of 2011 VERMONT TAX MINUS CREDITS:

,

,

.

(IN-111, Line 26 minus Lines 31c, 31d, and 31g). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

0 0

,

,

.

3. Enter the lesser of Line 1 or Line 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3.

0 0

,

,

.

4. Enter the amount from Federal Form 2210, Page 1, Line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4.

DUE DATES OF QUARTERLY PAYMENTS

April 15, 2012

June 15, 2012

Sept. 15, 2012

Jan. 15, 2013

Totals

CALCULATION OF UNDERPAYMENT

5.

Tax payments required per quarter from

Federal Form 2210, Page 4, Line 25 . . . . . . . . . . . . . . . .

______________________________________________________

6.

Vermont payment due. (Divide Line 5 by Line 4,

then multiply by Line 3.) . . . . . . . . . . . . . . . . . . . . . . . . .

______________________________________________________

7a. From 2012 Form IN-111, add Lines 31a, 31e, and 31f,

then multiply by .25 per quarter . . . . . . . . . . . . . . . . . . . .

______________________________________________________

7b. Enter 2011 overpayment and quarterly estimated

payments made by the due date per quarter. . . . . . . . . . .

______________________________________________________

7c. Add Lines 7a and 7b. Each quarter should not equal

more than Line 6, apply any excess to the next quarter . .

______________________________________________________

8.

Underpayment per quarter (Subtract Line 7c from

Line 6). This line cannot be less than zero. . . . . . . . . . . .

______________________________________________________

9.

Date FULL payment was made or April 15, 2013,

whichever date is earlier. . . . . . . . . . . . . . . . . . . . . . . . . .

CALCULATION OF INTEREST

10a. Number of days AFTER the due date to the date reported

on Line 9 for each quarter, or Jan. 1, 2013, whichever

date is earlier. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

______________________________________________________

10b. Number of days FROM Jan. 1, 2013 to the date payment

was made on Line 9 for each quarter, or April 15, 2013,

whichever date is earlier. 4th quarter: Use number of

days from Jan. 15, 2013. . . . . . . . . . . . . . . . . . . . . . . . . .

______________________________________________________

11a. Interest due for 2012 (Divide Line 10a by 365, multiply

by 4.8%, then multiply by Line 8) . . . . . . . . . . . . . . . . . .

______________________________________________________

11b. Interest due for 2013 (Divide Line 10b by 365, multiply

by 5.6%, then multiply by Line 8) . . . . . . . . . . . . . . . . . .

______________________________________________________

12. Interest due per quarter (Add Lines 11a and 11b) . . . . . .

13. Total underpayment interest due (Add Line 12 columns) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .13.

CALCULATION OF PENALTY

14. Number of months FROM the due date of that quarter to

the date shown on Line 9 (a portion of a month counts

as a whole month) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

______________________________________________________

15. Penalty due per quarter (Multiply Line 14 by .01 (1%)

then by Line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

______________________________________________________

16. Total underpayment penalty due (Add Line 15 columns) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .16.

TOTAL INTEREST AND PENALTY

17. Total underestimated interest and penalty due (Add Line 13 total and Line 16 total) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .17.

Worksheet IN-152A

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1