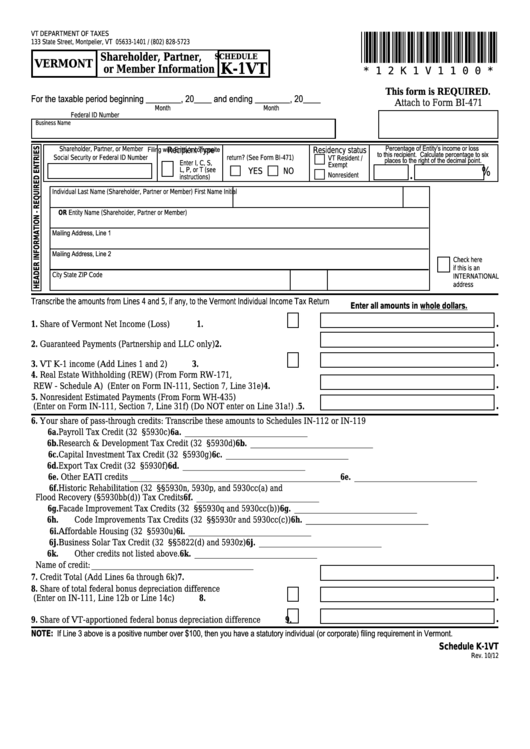

Schedule K-1vt - Vermont Shareholder, Partner, Or Member Information

ADVERTISEMENT

VT DEPARTMENT OF TAXES

*12K1V1100*

133 State Street, Montpelier, VT 05633-1401 / (802) 828-5723

Shareholder, Partner,

SchEDUlE

VERMONT

K-1VT

or Member Information

* 1 2 K 1 V 1 1 0 0 *

This form is REQUIRED.

For the taxable period beginning ________, 20____ and ending ________, 20____

Attach to Form BI-471

Month

Month

Federal ID Number

Business Name

Percentage of Entity’s income or loss

Shareholder, Partner, or Member

Recipient Type

Residency status

Filing with Entity’s composite

to this recipient. Calculate percentage to six

Social Security or Federal ID Number

return? (See Form BI-471)

VT Resident /

places to the right of the decimal point.

Enter I, C, S,

Exempt

%

L, P, or T (see

YES

NO

.

Nonresident

instructions)

Individual Last Name (Shareholder, Partner or Member)

First Name

Initial

OR Entity Name (Shareholder, Partner or Member)

Mailing Address, Line 1

Mailing Address, Line 2

Check here

if this is an

City

State

ZIP Code

INTERNATIONAL

address

Transcribe the amounts from Lines 4 and 5, if any, to the Vermont Individual Income Tax Return

Enter all amounts in whole dollars.

.

1. Share of Vermont Net Income (Loss) . . . . . . . . . . . . . . . . . . . . . . . . .

1.

.

2.

Guaranteed Payments (Partnership and LLC only) . . . . . . . . . . . . . . . . . . . . .2.

.

3.

VT K-1 income (Add Lines 1 and 2) . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4.

Real Estate Withholding (REW) (From Form RW-171,

.

REW - Schedule A) (Enter on Form IN-111, Section 7, Line 31e) . . . . . . . .4.

5.

Nonresident Estimated Payments (From Form WH-435)

.

(Enter on Form IN-111, Section 7, Line 31f) (Do NOT enter on Line 31a!) .5.

6. Your share of pass-through credits:

Transcribe these amounts to Schedules IN-112 or IN-119

6a. Payroll Tax Credit (32 V .S .A . §5930c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6a. ____________________________

6b. Research & Development Tax Credit (32 V .S .A . §5930d) . . . . . . . . . . . . . . . . . . . . . . . .6b. ____________________________

6c. Capital Investment Tax Credit (32 V .S .A . §5930g) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6c. ____________________________

6d. Export Tax Credit (32 V .S .A . §5930f) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6d. ____________________________

6e. Other EATI credits ________________________________________________ . . . . . . 6e. ____________________________

6f. Historic Rehabilitation (32 V .S .A . §§5930n, 5930p, and 5930cc(a) and

Flood Recovery (§5930bb(d)) Tax Credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6f. ____________________________

6g. Facade Improvement Tax Credits (32 V .S .A . §§5930q and 5930cc(b)) . . . . . . . . . . . . . . 6g. ____________________________

6h. Code Improvements Tax Credits (32 V .S .A . §§5930r and 5930cc(c)) . . . . . . . . . . . . . . .6h. ____________________________

6i. Affordable Housing (32 V .S .A . §5930u) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6i. ____________________________

6j. Business Solar Tax Credit (32 V .S .A . §§5822(d) and 5930z) . . . . . . . . . . . . . . . . . . . . . 6j. ____________________________

6k. Other credits not listed above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6k. ____________________________

Name of credit: _____________________________________

.

7. Credit Total (Add Lines 6a through 6k) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7.

8.

Share of total federal bonus depreciation difference

.

(Enter on IN-111, Line 12b or Line 14c) . . . . . . . . . . . . . . . . . . . . . . .

8.

.

9.

Share of VT-apportioned federal bonus depreciation difference . . . . .

9.

NOTE: If Line 3 above is a positive number over $100, then you have a statutory individual (or corporate) filing requirement in Vermont.

Schedule K-1VT

Rev. 10/12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3