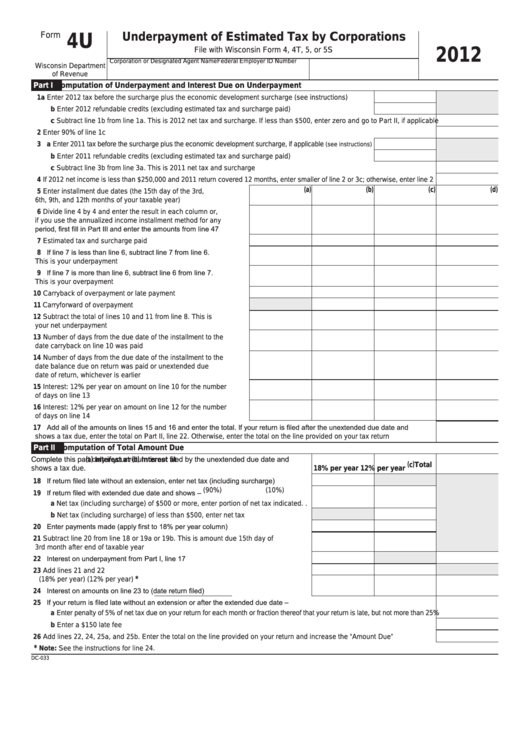

Form

Underpayment of Estimated Tax by Corporations

4U

File with Wisconsin Form 4, 4T, 5, or 5S

2012

Corporation or Designated Agent Name

Federal Employer ID Number

Wisconsin Department

of Revenue

Part I

Computation of Underpayment and Interest Due on Underpayment

1 a Enter 2012 tax before the surcharge plus the economic development surcharge (see instructions) . . . .

b Enter 2012 refundable credits (excluding estimated tax and surcharge paid) . . . . . . . . . . . . . . . . . . . . . .

c Subtract line 1b from line 1a . This is 2012 net tax and surcharge . If less than $500, enter zero and go to Part II, if applicable

2 Enter 90% of line 1c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 a Enter 2011 tax before the surcharge plus the economic development surcharge, if applicable

(see instructions)

b Enter 2011 refundable credits (excluding estimated tax and surcharge paid) . . . . . . . . . . . . . . . . . . . . . .

c Subtract line 3b from line 3a . This is 2011 net tax and surcharge . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4 If 2012 net income is less than $250,000 and 2011 return covered 12 months, enter smaller of line 2 or 3c; otherwise, enter line 2

(a)

(b)

(c)

(d)

5 Enter installment due dates (the 15th day of the 3rd,

6th, 9th, and 12th months of your taxable year) . . . . . . . . . . . . . .

6 Divide line 4 by 4 and enter the result in each column or,

if you use the annualized income installment method for any

period, first fill in Part III and enter the amounts from line 47 . . . .

7 Estimated tax and surcharge paid . . . . . . . . . . . . . . . . . . . . . . . . .

8 If line 7 is less than line 6, subtract line 7 from line 6.

This is your underpayment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 If line 7 is more than line 6, subtract line 6 from line 7.

This is your overpayment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10 Carryback of overpayment or late payment . . . . . . . . . . . . . . . . .

11 Carryforward of overpayment . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 Subtract the total of lines 10 and 11 from line 8 . This is

your net underpayment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13 Number of days from the due date of the installment to the

date carryback on line 10 was paid . . . . . . . . . . . . . . . . . . . . . . . .

14 Number of days from the due date of the installment to the

date balance due on return was paid or unextended due

date of return, whichever is earlier . . . . . . . . . . . . . . . . . . . . . . . .

15 Interest: 12% per year on amount on line 10 for the number

of days on line 13 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16 Interest: 12% per year on amount on line 12 for the number

of days on line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17 Add all of the amounts on lines 15 and 16 and enter the total. If your return is filed after the unextended due date and

shows a tax due, enter the total on Part II, line 22 . Otherwise, enter the total on the line provided on your tax return . . . . . . . . .

Part II

Computation of Total Amount Due

( a ) Interest at

( b ) Interest at

Complete this part only if your return is not filed by the unextended due date and

( c ) Total

shows a tax due .

18% per year

12% per year

18 If return filed late without an extension, enter net tax (including surcharge) . . . . . . . . .

(90%)

(10%)

19 If return filed with extended due date and shows –

a Net tax (including surcharge) of $500 or more, enter portion of net tax indicated . .

b Net tax (including surcharge) of less than $500, enter net tax . . . . . . . . . . . . . . . . .

20 Enter payments made (apply first to 18% per year column) . . . . . . . . . . . . . . . . . . . . .

21 Subtract line 20 from line 18 or 19a or 19b . This is amount due 15th day of

3rd month after end of taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22 Interest on underpayment from Part I, line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23 Add lines 21 and 22 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

*

(18% per year)

(12% per year)

24 Interest on amounts on line 23 to

(date return filed) . . . . .

25 If your return is filed late without an extension or after the extended due date –

a Enter penalty of 5% of net tax due on your return for each month or fraction thereof that your return is late, but not more than 25%

b Enter a $150 late fee . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26 Add lines 22, 24, 25a, and 25b . Enter the total on the line provided on your return and increase the “Amount Due” . . . . . . . . . .

*

Note: See the instructions for line 24 .

DC-033

1

1 2

2