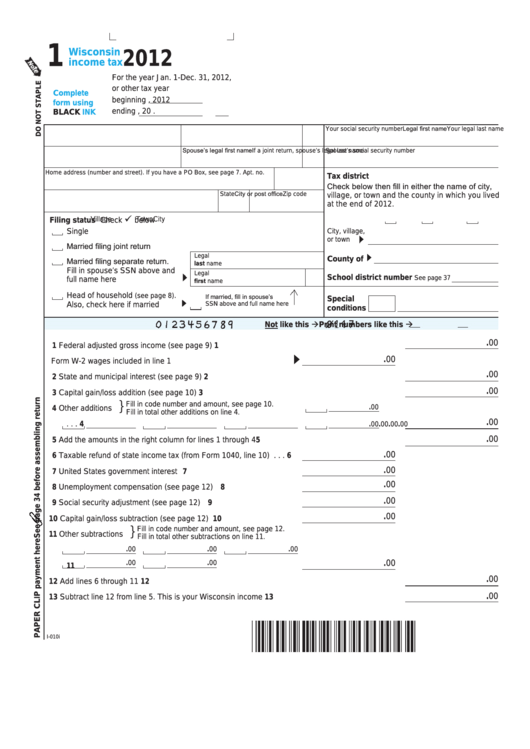

1

Wisconsin

2012

income tax

For the year Jan . 1‑Dec . 31, 2012,

or other tax year

Complete

beginning

, 2012

form using

ending

, 20

.

BLACK

INK

Legal first name

Your legal last name

M .I .

Your social security number

Spouse’s legal first name

If a joint return, spouse’s legal last name

M .I .

Spouse’s social security number

Home address (number and street) . If you have a PO Box, see page 7 .

Apt . no .

Tax district

Check below then fill in either the name of city,

City or post office

State

Zip code

village, or town and the county in which you lived

at the end of 2012 .

City

Village

Town

Filing status Check

below

City, village,

Single

or town

Married filing joint return

Legal

Married filing separate return.

County of

last name

Fill in spouse’s SSN above and

Legal

M .I .

School district number

See page 37

full name here . . . . . . . . . . . . . . . . . . . . . . . . . . . .

first name

Head of household

.

If married, fill in spouse’s

(see page 8)

Special

SSN above and full name here

Also, check here if married . . . . . . . . .

conditions

Print numbers like this

Not like this

NO COMMAS; NO CENTS

.00

1 Federal adjusted gross income (see page 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

.00

Form W‑2 wages included in line 1 . . . . . . . . . . . . . . . . . . . . . . . .

.00

2 State and municipal interest (see page 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

.00

3 Capital gain/loss addition (see page 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

}

Fill in code number and amount, see page 10 .

.00

4 Other additions

Fill in total other additions on line 4

.

.00

. . . 4

.00

.00

.00

.00

.00

5 Add the amounts in the right column for lines 1 through 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

.00

6 Taxable refund of state income tax (from Form 1040, line 10) . . .

6

.00

7 United States government interest . . . . . . . . . . . . . . . . . . . . . . . . .

7

.00

8 Unemployment compensation (see page 12) . . . . . . . . . . . . . . . .

8

.00

9 Social security adjustment (see page 12) . . . . . . . . . . . . . . . . . . .

9

.00

10 Capital gain/loss subtraction (see page 12) . . . . . . . . . . . . . . . . . 10

Fill in code number and amount, see page 12 .

}

11 Other subtractions

Fill in total other subtractions on line 11

.

.00

.00

.00

.00

.00

.00

. . . . . . . . . . . . . . . . 11

.00

12 Add lines 6 through 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

.00

13 Subtract line 12 from line 5 . This is your Wisconsin income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

I‑010i

1

1 2

2 3

3 4

4