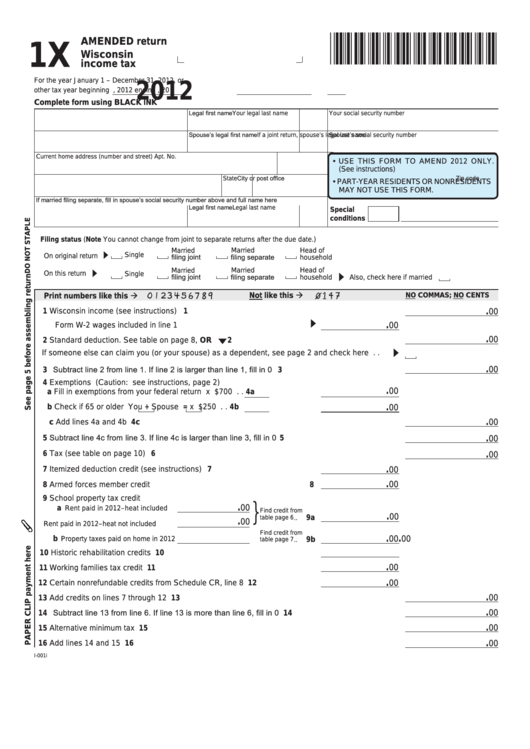

AMENDED return

1X

Wisconsin

income tax

For the year January 1 – December 31, 2012, or

2012

other tax year beginning

, 2012 ending

, 20

Complete form using BLACK INK

Legal first name

Your legal last name

M .I .

Your social security number

Spouse’s legal first name

If a joint return, spouse’s legal last name

M .I .

Spouse’s social security number

Current home address (number and street)

Apt . No .

• USE THIS FORM TO AMEND 2012 ONLY .

(See instructions)

City or post office

State

Zip code

• PART‑YEAR RESIDENTS OR NONRESIDENTS

MAY NOT USE THIS FORM .

If married filing separate, fill in spouse’s social security number above and full name here

Legal first name

Legal last name

M .I .

Special

conditions

Filing status

(Note You cannot change from joint to separate returns after the due date .)

Married

Married

Head of

Single

filing joint

filing separate

On original return

household

Married

Married

Head of

On this return

Single

filing joint

filing separate

Also, check here if married

household

Not like this

Print numbers like this

NO COMMAS; NO CENTS

.

1 Wisconsin income (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

00

.

Form W‑2 wages included in line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

.

00

2 Standard deduction . See table on page 8, OR

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

If someone else can claim you (or your spouse) as a dependent, see page 2 and check here . .

3 Subtract line 2 from line 1. If line 2 is larger than line 1, fill in 0 . . . . . . . . . . . . . . . . . . . . . . . . . . 3

.

00

4 Exemptions (Caution: see instructions, page 2)

.

00

a Fill in exemptions from your federal return

x $700 . . 4a

.

b Check if 65 or older

You +

Spouse =

x $250 . . 4b

00

.

00

c Add lines 4a and 4b . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4c

5 Subtract line 4c from line 3. If line 4c is larger than line 3, fill in 0 . . . . . . . . . . . . . . . . . . . . . . . . 5

.

00

.

6 Tax (see table on page 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

00

.

7 Itemized deduction credit (see instructions) . . . . . . . . . . . . . . . . . . . . . . 7

00

.

8 Armed forces member credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

00

9 School property tax credit

.

}

00

a

Rent paid in 2012–heat included

Find credit from

.

00

9a

table page 6 . .

.

00

Rent paid in 2012–heat not included

Find credit from

.

.

00

00

b

Property taxes paid on home in 2012

9b

table page 7 . .

.

10 Historic rehabilitation credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

00

.

00

11 Working families tax credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

.

12 Certain nonrefundable credits from Schedule CR, line 8 . . . . . . . . . . . . 12

00

.

00

13 Add credits on lines 7 through 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Subtract line 13 from line 6. If line 13 is more than line 6, fill in 0 . . . . . . . . . . . . . . . . . . . . . . . . . 14

.

00

.

00

15 Alternative minimum tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

.

16 Add lines 14 and 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

00

I‑001i

1

1 2

2 3

3 4

4