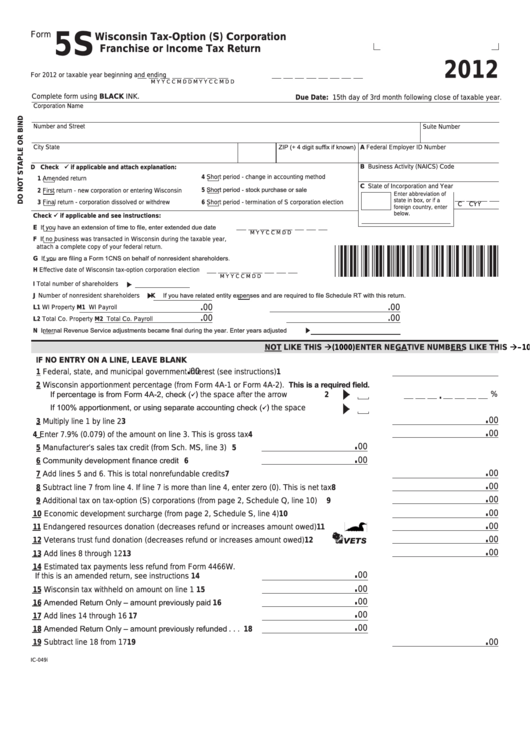

Form

5S

Wisconsin Tax-Option (S) Corporation

Franchise or Income Tax Return

2012

For 2012 or taxable year beginning

and ending

M

M

D

D

C

C

Y

Y

M

M

D

D

C

C

Y

Y

Complete form using BLACK INK.

Due Date: 15th day of 3rd month following close of taxable year.

Corporation Name

Number and Street

Suite Number

ZIP (+ 4 digit suffix if known)

City

State

A Federal Employer ID Number

B Business Activity (NAICS) Code

D Check

if applicable and attach explanation:

4

Short period - change in accounting method

1

Amended return

C State of Incorporation

and

Year

Short period - stock purchase or sale

5

2

First return - new corporation or entering Wisconsin

Enter abbreviation of

state in box, or if a

3

Final return - corporation dissolved or withdrew

6

Short period - termination of S corporation election

C

C

Y

Y

foreign country, enter

below.

Check

if applicable and see instructions:

If you have an extension of time to file, enter extended due date

E

M

M

D

D

C

C

Y

Y

F

If no business was transacted in Wisconsin during the taxable year,

attach a complete copy of your federal return.

If you are filing a Form 1CNS on behalf of nonresident shareholders.

G

H

Effective date of Wisconsin tax-option corporation election

M

M

D

D

C

C

Y

Y

I

Total number of shareholders

If you have related entity expenses and are required to file Schedule RT with this return.

J

Number of nonresident shareholders

K

.00

.00

L1 WI Property

M1 WI Payroll

.00

.00

L2 Total Co. Property

M2 Total Co. Payroll

Internal Revenue Service adjustments became final during the year. Enter years adjusted

N

–1000

(1000)

NO COMMAS; NO CENTS

ENTER NEGATIVE NUMBERS LIKE THIS

NOT LIKE THIS

IF NO ENTRY ON A LINE, LEAVE BLANK

.

00

1 Federal, state, and municipal government interest (see instructions) . . . . . . . . . . . . . . . . . . . .

1

2 Wisconsin apportionment percentage (from Form 4A-1 or Form 4A-2). This is a required field.

If percentage is from Form 4A-2, check (

.

%

)

the space after the arrow . . . . . . . . . . . . . .

2

If 100% apportionment, or using separate accounting check (

)

the space . . . . . . . . .

.

00

3 Multiply line 1 by line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

.

00

4 Enter 7.9% (0.079) of the amount on line 3. This is gross tax . . . . . . . . . . . . . . . . . . . . . . . . . .

4

.

00

5 Manufacturer’s sales tax credit (from Sch. MS, line 3) . . . . 5

.

6 Community development finance credit . . . . . . . . . . . . . . . 6

00

.

00

7 Add lines 5 and 6. This is total nonrefundable credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

.

00

8 Subtract line 7 from line 4. If line 7 is more than line 4, enter zero (0). This is net tax . . . . . . . .

8

.

00

9 Additional tax on tax-option (S) corporations (from page 2, Schedule Q, line 10) . . . . . . . . . . .

9

.

00

10 Economic development surcharge (from page 2, Schedule S, line 4) . . . . . . . . . . . . . . . . . . . .

10

.

00

11 Endangered resources donation (decreases refund or increases amount owed) . . . . . .

11

.

00

12 Veterans trust fund donation (decreases refund or increases amount owed) . . . . . . . . . . . . . .

12

.

00

13 Add lines 8 through 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

14 Estimated tax payments less refund from Form 4466W.

.

00

If this is an amended return, see instructions . . . . . . . . . . 14

.

00

15 Wisconsin tax withheld on amount on line 1 . . . . . . . . . . . 15

.

16 Amended Return Only – amount previously paid . . . . . . . 16

00

.

00

17 Add lines 14 through 16 . . . . . . . . . . . . . . . . . . . . . . . . . . 17

.

18 Amended Return Only – amount previously refunded . . . 18

00

.

00

19 Subtract line 18 from 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

IC-049i

1

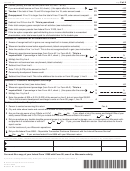

1 2

2 3

3 4

4