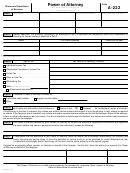

Form A-222 - Power Of Attorney

Download a blank fillable Form A-222 - Power Of Attorney in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form A-222 - Power Of Attorney with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

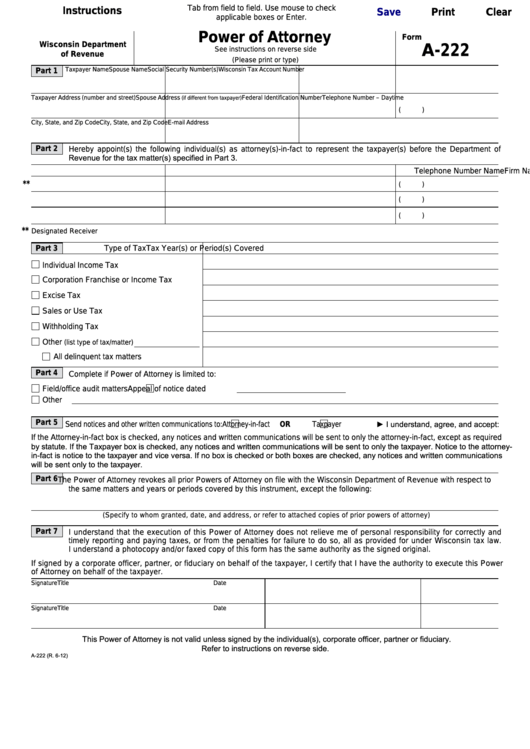

Tab from field to field. Use mouse to check

Instructions

Save

Print

Clear

applicable boxes or Enter.

Power of Attorney

Form

Wisconsin Department

A-222

See instructions on reverse side

of Revenue

(Please print or type)

Taxpayer Name

Spouse Name

Social Security Number(s)

Wisconsin Tax Account Number

Part 1

Taxpayer Address (number and street)

Spouse Address

Federal Identification Number

Telephone Number – Daytime

(if different from taxpayer)

(

)

City, State, and Zip Code

City, State, and Zip Code

E-mail Address

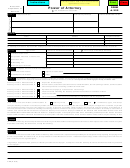

Part 2

Hereby appoint(s) the following individual(s) as attorney(s)-in-fact to represent the taxpayer(s) before the Department of

Revenue for the tax matter(s) specified in Part 3.

Name

Firm Name/Address

Telephone Number

**

(

)

(

)

(

)

**

Designated Receiver

Part 3

Type of Tax

Tax Year(s) or Period(s) Covered

Individual Income Tax . . . . . . . . . . . . . . . . . . .

Corporation Franchise or Income Tax . . . . . .

Excise Tax . . . . . . . . . . . . . . . . . . . . . . . . . . .

Sales or Use Tax . . . . . . . . . . . . . . . . . . . . . .

Withholding Tax . . . . . . . . . . . . . . . . . . . . . . .

Other

(list type of tax/matter)

All delinquent tax matters . . . . . . . . . . . . .

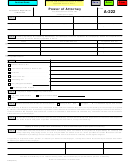

Part 4

Complete if Power of Attorney is limited to:

Field/office audit matters

Appeal of notice dated

Other

Send notices and other written communications to:

Attorney-in-fact

OR

Taxpayer

► I understand, agree, and accept:

Part 5

If the Attorney-in-fact box is checked, any notices and written communications will be sent to only the attorney-in-fact, except as required

by statute. If the Taxpayer box is checked, any notices and written communications will be sent to only the taxpayer. Notice to the attorney-

in-fact is notice to the taxpayer and vice versa. If no box is checked or both boxes are checked, any notices and written communications

will be sent only to the taxpayer.

Part 6

The Power of Attorney revokes all prior Powers of Attorney on file with the Wisconsin Department of Revenue with respect to

the same matters and years or periods covered by this instrument, except the following:

(Specify to whom granted, date, and address, or refer to attached copies of prior powers of attorney)

Part 7

I understand that the execution of this Power of Attorney does not relieve me of personal responsibility for correctly and

timely reporting and paying taxes, or from the penalties for failure to do so, all as provided for under Wisconsin tax law.

I understand a photocopy and/or faxed copy of this form has the same authority as the signed original.

If signed by a corporate officer, partner, or fiduciary on behalf of the taxpayer, I certify that I have the authority to execute this Power

of Attorney on behalf of the taxpayer.

Signature

Title

Date

Signature

Title

Date

This Power of Attorney is not valid unless signed by the individual(s), corporate officer, partner or fiduciary.

Refer to instructions on reverse side.

A-222 (R. 6-12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2